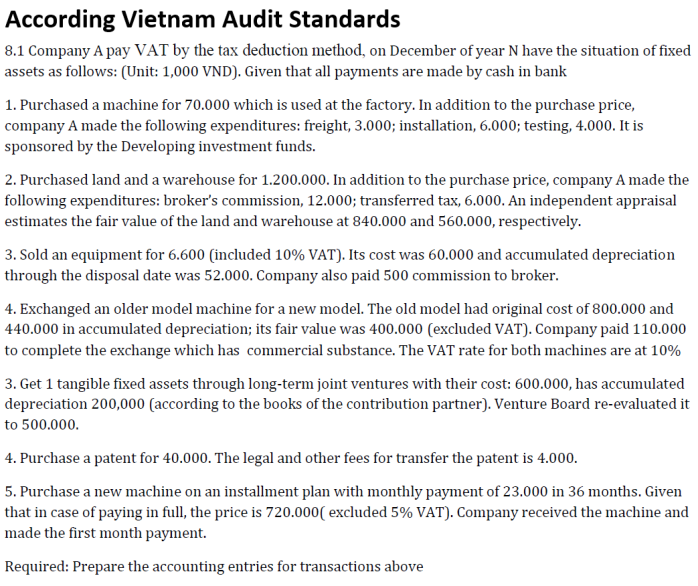

According Vietnam Audit Standards 8.1 Company A pay VAT by the tax deduction method, on December of year N have the situation of fixed assets as follows: (Unit: 1,000 VND). Given that all payments are made by cash in bank 1. Purchased a machine for 70.000 which is used at the factory. In addition to the purchase price, company A made the following expenditures: freight, 3.000; installation, 6.000; testing, 4.000. It is sponsored by the Developing investment funds. 2. Purchased land and a warehouse for 1.200.000. In addition to the purchase price, company A made the following expenditures: broker's commission, 12.000; transferred tax, 6.000. An independent appraisal estimates the fair value of the land and warehouse at 840.000 and 560.000, respectively. 3. Sold an equipment for 6.600 (included 10% VAT). Its cost was 60.000 and accumulated depreciation through the disposal date was 52.000. Company also paid 500 commission to broker. 4. Exchanged an older model machine for a new model. The old model had original cost of 800.000 and 440.000 in accumulated depreciation; its fair value was 400.000 (excluded VAT). Company paid 110.000 to complete the exchange which has commercial substance. The VAT rate for both machines are at 10% 3. Get 1 tangible fixed assets through long-term joint ventures with their cost: 600.000, has accumulated depreciation 200,000 (according to the books of the contribution partner). Venture Board re-evaluated it to 500.000. 4. Purchase a patent for 40.000. The legal and other fees for transfer the patent is 4.000. 5. Purchase a new machine on an installment plan with monthly payment of 23.000 in 36 months. Given that in case of paying in full, the price is 720.000( excluded 5% VAT). Company received the machine and made the first month payment. Required: Prepare the accounting entries for transactions above

According Vietnam Audit Standards 8.1 Company A pay VAT by the tax deduction method, on December of year N have the situation of fixed assets as follows: (Unit: 1,000 VND). Given that all payments are made by cash in bank 1. Purchased a machine for 70.000 which is used at the factory. In addition to the purchase price, company A made the following expenditures: freight, 3.000; installation, 6.000; testing, 4.000. It is sponsored by the Developing investment funds. 2. Purchased land and a warehouse for 1.200.000. In addition to the purchase price, company A made the following expenditures: broker's commission, 12.000; transferred tax, 6.000. An independent appraisal estimates the fair value of the land and warehouse at 840.000 and 560.000, respectively. 3. Sold an equipment for 6.600 (included 10% VAT). Its cost was 60.000 and accumulated depreciation through the disposal date was 52.000. Company also paid 500 commission to broker. 4. Exchanged an older model machine for a new model. The old model had original cost of 800.000 and 440.000 in accumulated depreciation; its fair value was 400.000 (excluded VAT). Company paid 110.000 to complete the exchange which has commercial substance. The VAT rate for both machines are at 10% 3. Get 1 tangible fixed assets through long-term joint ventures with their cost: 600.000, has accumulated depreciation 200,000 (according to the books of the contribution partner). Venture Board re-evaluated it to 500.000. 4. Purchase a patent for 40.000. The legal and other fees for transfer the patent is 4.000. 5. Purchase a new machine on an installment plan with monthly payment of 23.000 in 36 months. Given that in case of paying in full, the price is 720.000( excluded 5% VAT). Company received the machine and made the first month payment. Required: Prepare the accounting entries for transactions above

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter5: Income Statement: Reporting The Results Of Operating Activities

Section: Chapter Questions

Problem 25P

Related questions

Question

Transcribed Image Text:According Vietnam Audit Standards

8.1 Company A pay VAT by the tax deduction method, on December of year N have the situation of fixed

assets as follows: (Unit: 1,000 VND). Given that all payments are made by cash in bank

1. Purchased a machine for 70.000 which is used at the factory. In addition to the purchase price,

company A made the following expenditures: freight, 3.000; installation, 6.000; testing, 4.000. It is

sponsored by the Developing investment funds.

2. Purchased land and a warehouse for 1.200.000. In addition to the purchase price, company A made the

following expenditures: broker's commission, 12.000; transferred tax, 6.000. An independent appraisal

estimates the fair value of the land and warehouse at 840.000 and 560.000, respectively.

3. Sold an equipment for 6.600 (included 10% VAT). Its cost was 60.000 and accumulated depreciation

through the disposal date was 52.000. Company also paid 500 commission to broker.

4. Exchanged an older model machine for a new model. The old model had original cost of 800.000 and

440.000 in accumulated depreciation; its fair value was 400.000 (excluded VAT). Company paid 110.000

to complete the exchange which has commercial substance. The VAT rate for both machines are at 10%

3. Get 1 tangible fixed assets through long-term joint ventures with their cost: 600.000, has accumulated

depreciation 200,000 (according to the books of the contribution partner). Venture Board re-evaluated it

to 500.000.

4. Purchase a patent for 40.000. The legal and other fees for transfer the patent is 4.000.

5. Purchase a new machine on an installment plan with monthly payment of 23.000 in 36 months. Given

that in case of paying in full, the price is 720.000( excluded 5% VAT). Company received the machine and

made the first month payment.

Required: Prepare the accounting entries for transactions above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning