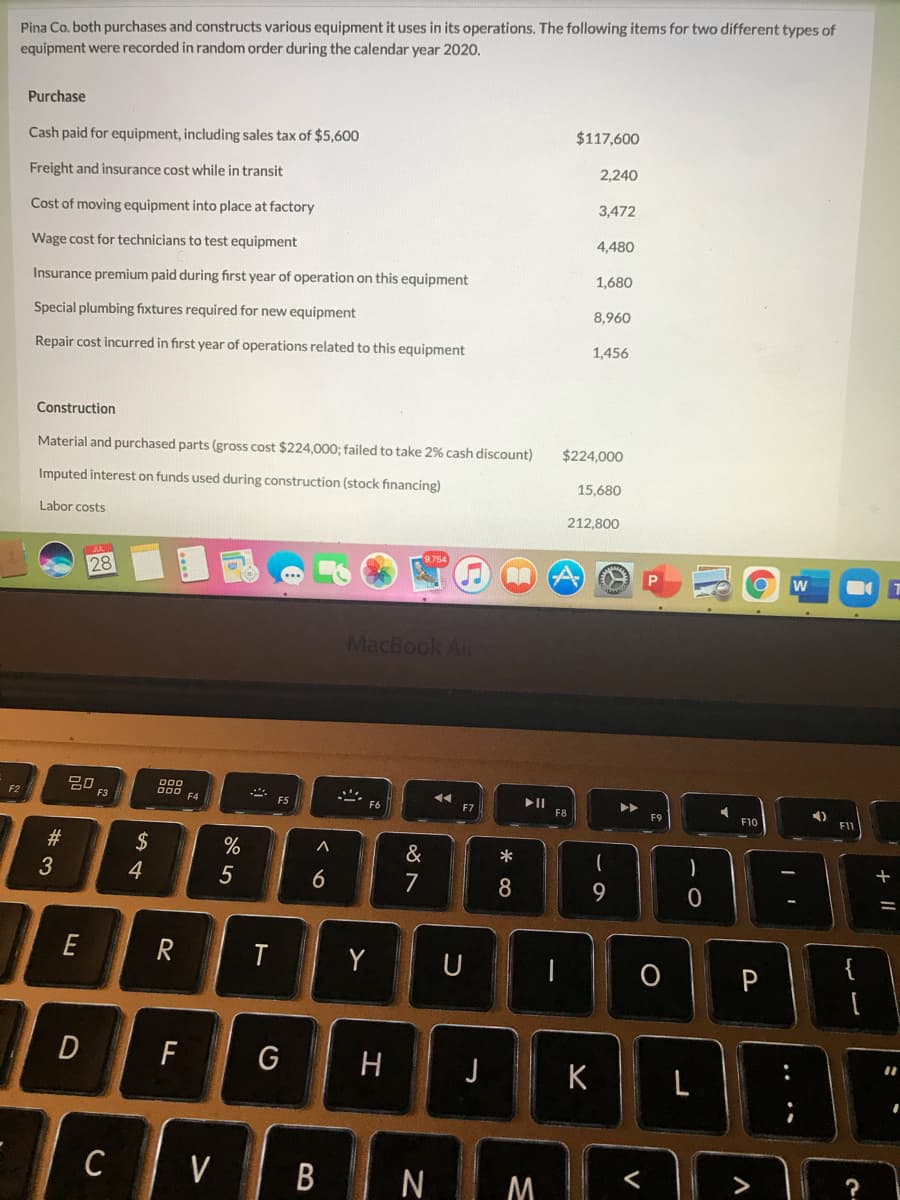

Pina Co. both purchases and constructs various equipment it uses in its operations. The following items for two different types of equipment were recorded in random order during the calendar year 2020. Purchase Cash paid for equipment, including sales tax of $5,600 $117,600 Freight and insurance cost while in transit 2,240 Cost of moving equipment into place at factory 3,472 Wage cost for technicians to test equipment 4,480 Insurance premium paid during first year of operation on this equipment 1,680 Special plumbing fixtures required for new equipment 8,960 Repair cost incurred in first year of operations related to this equipment 1,456 Construction Material and purchased parts (gross cost $224,000; failed to take 2% cash discount) $224,000 Imputed interest on funds used during construction (stock financing) 15,680 Labor costs 212,800

Pina Co. both purchases and constructs various equipment it uses in its operations. The following items for two different types of equipment were recorded in random order during the calendar year 2020. Purchase Cash paid for equipment, including sales tax of $5,600 $117,600 Freight and insurance cost while in transit 2,240 Cost of moving equipment into place at factory 3,472 Wage cost for technicians to test equipment 4,480 Insurance premium paid during first year of operation on this equipment 1,680 Special plumbing fixtures required for new equipment 8,960 Repair cost incurred in first year of operations related to this equipment 1,456 Construction Material and purchased parts (gross cost $224,000; failed to take 2% cash discount) $224,000 Imputed interest on funds used during construction (stock financing) 15,680 Labor costs 212,800

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.1E

Related questions

Question

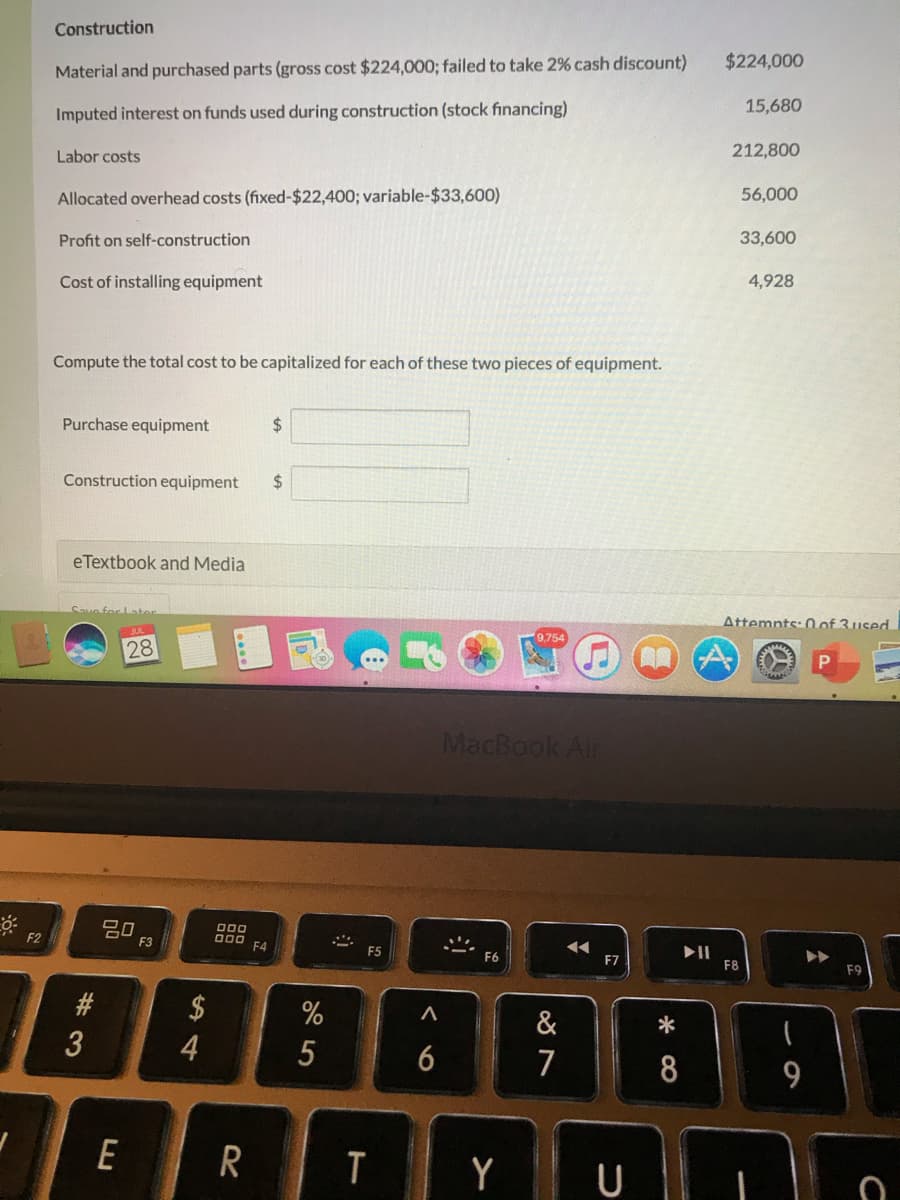

Transcribed Image Text:Construction

$224,000

Material and purchased parts (gross cost $224,000; failed to take 2% cash discount)

15,680

Imputed interest on funds used during construction (stock financing)

Labor costs

212,800

Allocated overhead costs (fixed-$22,400; variable-$33,600)

56,000

Profit on self-construction

33,600

Cost of installing equipment

4,928

Compute the total cost to be capitalized for each of these two pieces of equipment.

Purchase equipment

2$

Construction equipment

24

eTextbook and Media

Save

Attemnts: 0 of 3used

28

MacBook Air

吕0

F3

DO0

000

F4

F2

F5

F7

F8

F9

$

&

5

6

7

8

9

E

Y U

%# 3

Transcribed Image Text:Pina Co. both purchases and constructs various equipment it uses in its operations. The following items for two different types of

equipment were recorded in random order during the calendar year 2020.

Purchase

$117,600

Cash paid for equipment, including sales tax of $5,600

2,240

Freight and insurance cost while in transit

3,472

Cost of moving equipment into place at factory

4,480

Wage cost for technicians to test equipment

1,680

Insurance premium paid during first year of operation on this equipment

8,960

Special plumbing fixtures required for new equipment

1,456

Repair cost incurred in first year of operations related to this equipment

Construction

Material and purchased parts (gross cost $224,000; failed to take 2% cash discount)

$224,000

Imputed interest on funds used during construction (stock financing)

15.680

Labor costs

212,800

28

w

MacBook Air

20.

F2

F3

F5

F8

F9

F10

F1

2$

&

*

4

5

7

9.

E

T

Y

U

O P

{

F

G

H

K

CV

B N

M

..

# 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College