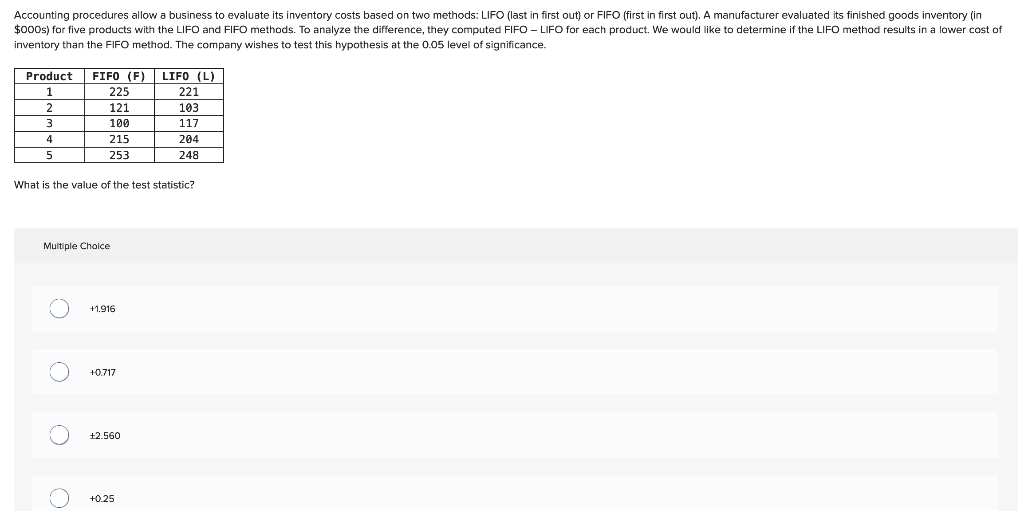

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out). A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIIFO methods. To analyze the difference, they computed FIFO - LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method. The company wishes to test this hypothesis at the 0.05 level of significance. Product FIFO (F) LIFO (L) 1 225 221 121 103 3 100 117 215 253 4 204 5 248 What is the value of the test statistic? Multiple Cholce +1.916 +0.717 +2.560 +0.25

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out). A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIIFO methods. To analyze the difference, they computed FIFO - LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method. The company wishes to test this hypothesis at the 0.05 level of significance. Product FIFO (F) LIFO (L) 1 225 221 121 103 3 100 117 215 253 4 204 5 248 What is the value of the test statistic? Multiple Cholce +1.916 +0.717 +2.560 +0.25

College Algebra (MindTap Course List)

12th Edition

ISBN:9781305652231

Author:R. David Gustafson, Jeff Hughes

Publisher:R. David Gustafson, Jeff Hughes

Chapter6: Linear Systems

Section6.8: Linear Programming

Problem 5SC: If during the following year it is predicted that each comedy skit will generate 30 thousand and...

Related questions

Question

Transcribed Image Text:Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out). A manufacturer evaluated its finished goods inventory (in

$000s) for five products with the LIFO and FIIFO methods. To analyze the difference, they computed FIFO - LIFO for each product. We would like to determine if the LIFO method results in a lower cost of

inventory than the FIFO method. The company wishes to test this hypothesis at the 0.05 level of significance.

Product

FIFO (F) LIFO (L)

1

225

221

121

103

3

100

117

215

253

4

204

5

248

What is the value of the test statistic?

Multiple Cholce

+1.916

+0.717

+2.560

+0.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning