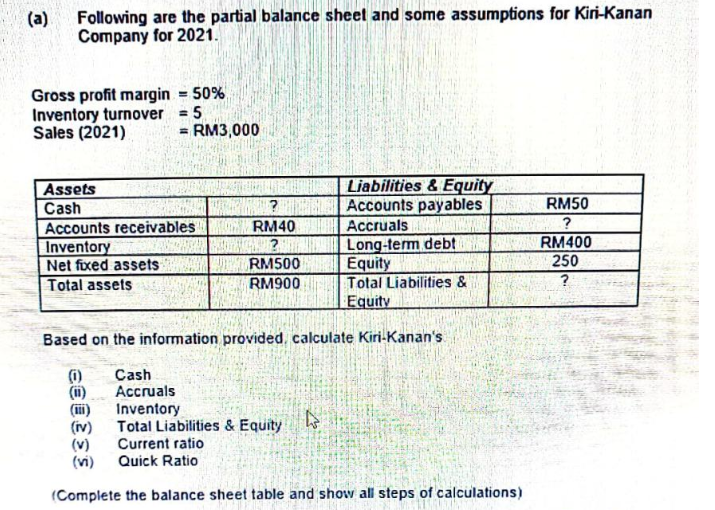

(a) Following are the partial balance sheet and some assumptions for Kiri-Kanan Company for 2021. Gross profit margin = 50% Inventory turnover 5 Sales (2021) = = RM3,000 Assets Cash Accounts receivables Inventory Net fixed assets Total assets ? RM40 2 RM500 RM900 Cash Accruals Inventory Based on the information provided, calculate Kiri-Kanan's (1) (11) Liabilities & Equity Accounts payables Accruals Long-term debt Total Liabilities & Equity Current ratio Equity Total Liabilities & Equity (1) (iv) (v) (vi) Quick Ratio (Complete the balance sheet table and show all steps of calculations) 4 RM50 ? RM400 250 ?

(a) Following are the partial balance sheet and some assumptions for Kiri-Kanan Company for 2021. Gross profit margin = 50% Inventory turnover 5 Sales (2021) = = RM3,000 Assets Cash Accounts receivables Inventory Net fixed assets Total assets ? RM40 2 RM500 RM900 Cash Accruals Inventory Based on the information provided, calculate Kiri-Kanan's (1) (11) Liabilities & Equity Accounts payables Accruals Long-term debt Total Liabilities & Equity Current ratio Equity Total Liabilities & Equity (1) (iv) (v) (vi) Quick Ratio (Complete the balance sheet table and show all steps of calculations) 4 RM50 ? RM400 250 ?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 48CE

Related questions

Question

Transcribed Image Text:(a)

Following are the partial balance sheet and some assumptions for Kiri-Kanan

Company for 2021.

Gross profit margin = 50%

Inventory turnover 5

Sales (2021)

=

= RM3,000

Assets

Cash

Accounts receivables

Inventory

Net fixed assets

Total assets

?

RM40

2

RM500

RM900

Cash

Accruals

Inventory

Based on the information provided, calculate Kiri-Kanan's

(1)

(11)

Liabilities & Equity

Accounts payables

Accruals

Long-term debt

Total Liabilities & Equity

Current ratio

Equity

Total Liabilities &

Equity

(1)

(iv)

(v)

(vi) Quick Ratio

(Complete the balance sheet table and show all steps of calculations)

4

RM50

?

RM400

250

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning