ers 7-9) Saved Westway Company pays Suzie Chan $3,100 per week. Assume Social Security is 6.2% on $128,400 and 1.45% for Medicare. a. By the end of week 52, how much did Westway deduct for Suzie's Social Security and Medicare for the year? (Round your answers to the nearest cent.) Deductions Social Security Medicare b. What state and federal unemployment taxes does Westway pay on Suzie's yearly salary? The state unemployment rate is 5.1% and the federal unemployment tax is 0.6% on the first $7,000. (Enter your answers as whole numbers.) Payment State unemployment taxes Federal unemployment taxes < Prev 15 of 15 Next> hp DII @ %23 24 & 3. 4. 6. e r f * 00 In 35

ers 7-9) Saved Westway Company pays Suzie Chan $3,100 per week. Assume Social Security is 6.2% on $128,400 and 1.45% for Medicare. a. By the end of week 52, how much did Westway deduct for Suzie's Social Security and Medicare for the year? (Round your answers to the nearest cent.) Deductions Social Security Medicare b. What state and federal unemployment taxes does Westway pay on Suzie's yearly salary? The state unemployment rate is 5.1% and the federal unemployment tax is 0.6% on the first $7,000. (Enter your answers as whole numbers.) Payment State unemployment taxes Federal unemployment taxes < Prev 15 of 15 Next> hp DII @ %23 24 & 3. 4. 6. e r f * 00 In 35

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 10PA: Lemur Corp. is going to pay three employees a year-end bonus. The amount of the year-end bonus and...

Related questions

Question

Transcribed Image Text:ers 7-9)

Saved

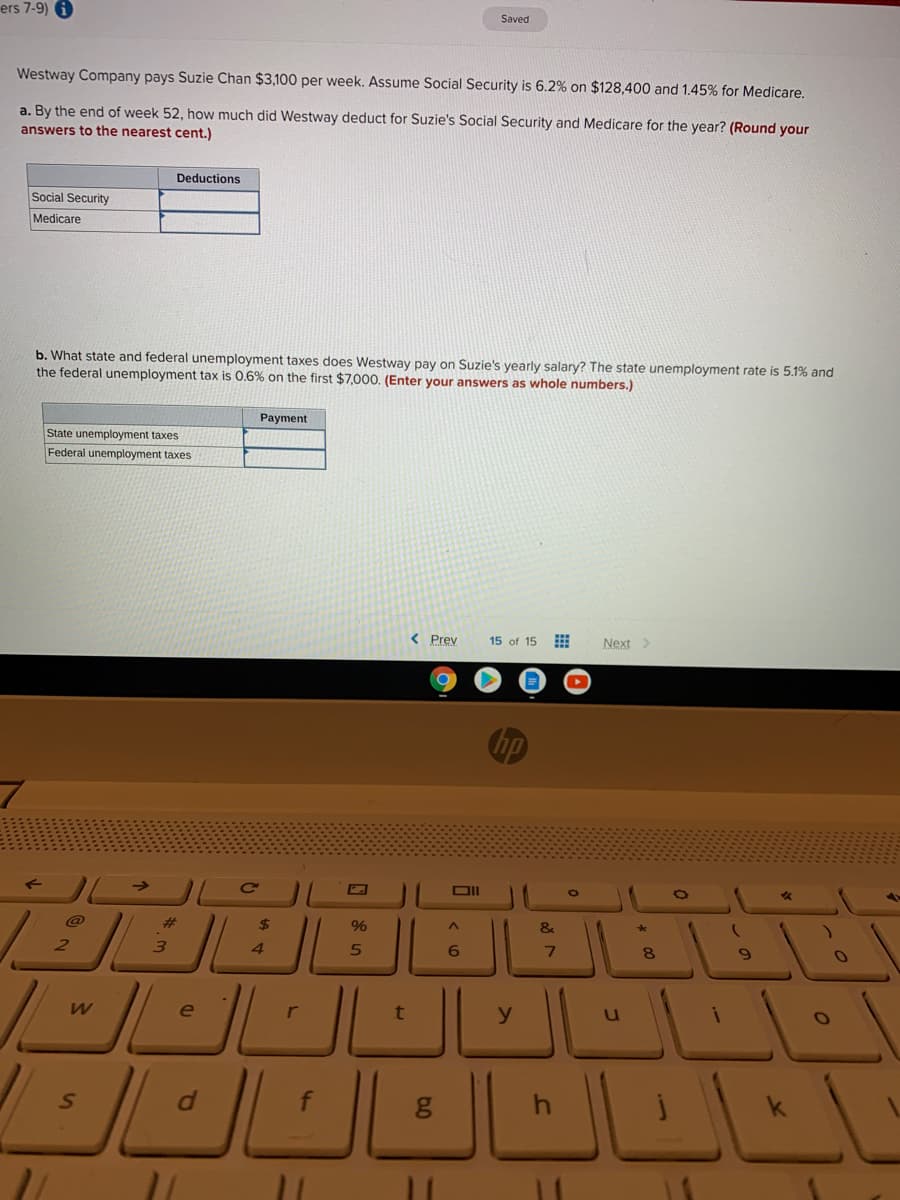

Westway Company pays Suzie Chan $3,100 per week. Assume Social Security is 6.2% on $128,400 and 1.45% for Medicare.

a. By the end of week 52, how much did Westway deduct for Suzie's Social Security and Medicare for the year? (Round your

answers to the nearest cent.)

Deductions

Social Security

Medicare

b. What state and federal unemployment taxes does Westway pay on Suzie's yearly salary? The state unemployment rate is 5.1% and

the federal unemployment tax is 0.6% on the first $7,000. (Enter your answers as whole numbers.)

Payment

State unemployment taxes

Federal unemployment taxes

< Prev

15 of 15

Next>

hp

DII

@

%23

24

&

3.

4.

6.

e

r

f

* 00

In

35

Expert Solution

Step 1

Tax refers to the amount charged by the government on individuals, partnership firms, HUF’s or any corporation. It is a mandatory contribution which every individual, firms or company should have to pay towards the welfare of the society.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,