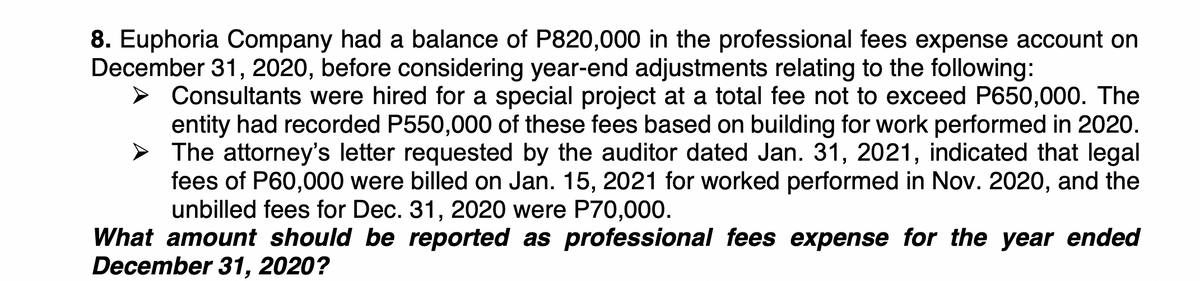

Euphoria Company had a balance of P820 ecember 31, 2020, before considering year-e > Consultants were hired for a special p entity had recorded P550,000 of these

Q: Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and s...

A: FIFO: FIFO stands for First-In, First-Out. In this method inventory purchased first will be sell ou...

Q: FDN Company shows the following balances on December 31, 2021: Accounts receivable P250,000 Accumula...

A: Current assets: Current assets are all those assets that are expected to be sold or used as a result...

Q: Which of the following requires an adjustment to the opening balance of retained earnings in the ear...

A: The term "retrospective effect" refers to the application of a change in principle to financial outc...

Q: Circuit Fitness (CF) sells customized exercise equipment to fitness centers. On February 2nd, 2022,...

A: Transaction price can be defined as the consideration that an entity receives after the goods are tr...

Q: The following information is available for the pension plan of Vaughn Company for the year 2020. A...

A: Solution:- Preparation of the journal entry to record pension expense and the employer’s contributio...

Q: Required: a. Prepare a traditional income statement. b. Prepare an activity-based income statemen...

A: Income statement refers to a statement which shows the revenue and expense of the company of a parti...

Q: Use T-accounts to record the 4 months’ of transactions noted below for this new start-up company. R...

A: A t-account is a log or list of accounts that keeps track of account transfers.

Q: what is earnings per share

A: The fraction of a corporation's earnings that is assigned to each individual share of stock is refer...

Q: Berwin Inc. is a small industrial equipment manufacturer with approximately $3.5 million in annual s...

A: Introduction: Return on investment (ROI) or return on costs (ROC) is the ratio of net income to inve...

Q: n March 1, AYE Merchandising had an inventory of P560,000 in its retail store. Purchases made in Mar...

A: solution given Inventory March 1 560000 Purchases during March 480000 Sales during m...

Q: Ash Traynor opened a Pokèmon dress shop called Pokeshoppe. During the first month of operations, the...

A: Adjusting Entry – Adjusting Entries are the entries that make the accrual principle work for the org...

Q: 11. Cullumber Corp. has the following beginning-of-the-year present values for its projected benefi...

A: SOLUTION PENSION EXPENSE SIGNALS AN EMPLOYER'S ANNUAL COST FOR MAINTAINING AN EMPLOYEES PENSION PLAN...

Q: g. An increase in the Deferred Tax Liability account on the statement of financial position is recor...

A: Solution Note Dear student as per the Q&A guideline we are required to answer the first question...

Q: 2,068 4,728 3,900 turns and allowances Costs of transportation-in Required: 1. Compute the company's...

A: Income Statement The purpose of preparing income statement is to know the actual net income which ar...

Q: Appliance Company makes cooling fans. The firm’s income statement is as follows: Sales (7,000 fans a...

A: Degree of Financial Leverage is a financial ratio that measures the sensitivity of the entity's net ...

Q: A new notebook in basic color cost $50 each, and Linda combined with her design selling for $100 eac...

A: Basic color cost for the year = 200 x 12 x 50 = 120000 Material cost = 200 x 10 x 12 = 24000 Adverti...

Q: he worksheet consisted of five pairs of debit and credit columns. The amount of one item appeared in...

A: Answer: There is always double entry effect and one single entry can be reflected on both income sta...

Q: One of the three DVD players left in stock, with serial #1012, was purchased on June 1 at a cost of ...

A: Under FIFO method of inventory valuation goods purchased first, are sold first. Specific identifica...

Q: Milktopia, Inc. produces and sells milk flavored bubble gum. Over the last five months Milktopia had...

A: Lets understand the basics. In High low method, variable cost is separated from the fixed cost. It u...

Q: fill out the yellow highlighted cells based on the information provided

A: There are several forms of cost accounting that is being used in business. One of them is Job costin...

Q: Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required ...

A: The question is based on the concept of Financial Accounting.

Q: The premium on a four-year insurance policy expiring on december 31, 2034 was paid in total on Janua...

A: Prepaid assets is one of the current asset of the business, which means expenses which are related w...

Q: In a defined-benefit plan, the process of funding refers to determining the projected benefit obli...

A: Pension plan refers to the plans or scheme sponsored by the employers for the retirement benefits of...

Q: The Manning Company has financial statements as shown next, which are representative of the company’...

A: Income Statement The purpose of preparing the income statement is to know the net income which are d...

Q: 1. What amount should be reported as net income after the current year? a. 2,000,000 b. 2,500,000 ...

A: The question provides us with the summary of account balances for the year end of Empress Company. W...

Q: Cost $124,000 263.000 $387.000 1,000 shares of Stryker Corp., common 3,000 shares of Medtronic, Inc....

A: Investment in other company is shown as asset in investor company financial statement. The method of...

Q: Felix and Freddie are married with annual taxable income of $230,000. They pay income tax according ...

A: Taxable income is that income in which a person has to pay tax after availing all exemptions.

Q: 24 Paid the shop assistant for the one week salary, P3,600. 25 Cash service income for the week, P8,...

A: Statement of Owner's Equity - Statement of owner's equity includes amount contributed by the owner o...

Q: On March 1, the actual cash received from cash sales was $25,538, and the amount indicated by the ca...

A: The practice of recording financial activity for the first time in the books of accounts is known as...

Q: The company recorded a net loss of P245,000 for the year just ended. Total operating expenses was P3...

A: Formula: Net Profit = Gross Sales – Sales Discounts – Cost of Sales – Operating Expenses

Q: In the world of specialized industries, identify some specialized transactions in hotels. Provide br...

A: Accounting in the Hotel industry normally pertains to providing accommodation and food. Although, th...

Q: Explain the financial presentation and also classification of cash and cash equivalent. (Write a com...

A: •Cash and cash equivalents includes cash, assets immediately convertible into cash, bank balance and...

Q: Units Beginning inventory Started during the month Total units to account for Completed and transfer...

A: The equivalent units are calculated on the basis of percentage of the work completed during the peri...

Q: Jada Company had the following transactions during the year: Purchased a machine for $430,000 using...

A: GIVEN Jada Company had the following transactions during the year: Purchased a machine for $430,0...

Q: PROBLEM 54A The account balances of Bryan Company as of June 30, the end of the current fiscal year,...

A: The income statement is prepared to record revenues and expenses of the current period.

Q: Use the following to answer questions 16 – 20 Following are the transaction of TR Inc., which provid...

A: The statement of cash flow (CFS), also known as the statement of cash flows, is a financial statemen...

Q: is counted only every month-end. All sales are made on account and mark up on cost is 25%. The follo...

A: Sales during June = Collections made in June + Ending accounts receivable - beginning accounts recei...

Q: 5. A sales manager has 30 representatives. She receives a commission of 20% from her own sales and 5...

A: Since you have asked multiple questions, we will solve the first question for you. If you want any s...

Q: HONGTIST Co. have segment C and segment U. During the past years, 50,000 and 20, 000 were produced ...

A: The differential analysis is performed to compare the different alternatives available with the busi...

Q: On January 1, 20x1, PRISTINE UNCORRUPTED Co. acquired an equipment for ₱4,000,000. The equipment wil...

A: solution working note annual depreciation under SLM = cost – residual value / life ...

Q: A CIS environment exists when a computer of any type o. size is involved in processing of an entity'...

A: Answer: CIS is defined as one of information system which is based on computer information system. T...

Q: Indigo Company provides the following information about its defined benefit pension plan for the yea...

A: SOLUTION CALCULATION OF PENSION EXPENSE-. SERVICE COST 91000 INTERST COST (701800*10%) 70180 ...

Q: How do the activities of a company benefit society?

A: Even though a company have a profit motive, a cost can benefit society in many ways.

Q: On December 1, the Accounts Receivable account had a $22.000 debit balance. During December the busi...

A: Ending Account receivable = Beginning account receivable + Revenue on account - Collection from cust...

Q: What are the reasons which cause investor managing their portfolios passively to make changes their ...

A: Answer: There are two types of investors: Active Passive Passive investors are those who invests i...

Q: Marvin’s Kitchen Supply delivers restaurant supplies throughout the city. The firm adds 10 percent t...

A: As per the given question delivery charges are equal to 10% of cost of supplies i.e. 10% of orde...

Q: Which of the following adjusting entries prepared on December 31, 2021 (without amounts and explanat...

A: Adjusting journal entry: At year-end when the company finalizes its accounts then any unrecognized i...

Q: Accrual accounting requires estimates of future outcomes. For example, the reserve for bad debts is ...

A: Financial Statements These are a company's financial activities and position in a nutshell. The data...

Q: Required: A. How many units were completed during the period? Answer the following using the...

A: Process costing refers to the allocation of direct costs and indirect costs to a manufacturing proce...

Q: CENTER for the calendar year 200A: P 1,200 8,000 P 85,000 Notes Receivable 12,000 Notes Payable 16,6...

A: The Financial Statements are prepared to check the financial health of the organization. These are t...

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Step by step

Solved in 2 steps

- Koolman Construction Company began work on a contract in 2019. The contract price is 3,000,000, and the company determined that its performance obligation was satisfied over time. Other information relating to the contract is as follows: Required: 1. Compute the gross profit or loss recognized in 2019 and 2020. 2. Prepare the appropriate sections of the income statement and ending balance sheet for each year.Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended December 31, 2019 and 2020, contained the following errors: In addition, on December 31, 2020, fully depreciated machinery was sold for 10,800 cash, but the sale was not recorded until 2021. There were no other errors during 2019 or 2020, and no corrections have been made for any of the errors. Refer to the information for Shannon Corporation above. Ignoring income taxes, what is the total effect of the errors on the amount of working capital (current assets minus current liabilities) at December 31, 2020? a. working capital overstated by 4,200 b. working capital understated by 5,800 c. working capital understated by 6,000 d. working capital understated by 9,800Soon after December 31, 2019, the auditor requested a depreciation schedule for trucks of Jarrett Trucking Company, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2016 to 2019, inclusive. The following data were in the Trucks account as of January 1, 2016: The Accumulated DepreciationTrucks account, previously adjusted to January 1,2016, and duly entered in the ledger, had a balance on that date of 16,460. This amount represented the straight-line depreciation on the four trucks from the respective dates of purchase, based on a 5-year life and no residual value. No debits had been made to this account prior to January 1, 2016. Transactions between January 1,2017, and December 31, 2019, and their record in the ledger were as follows: 1. July 1, 2016: Truck no. 1 was sold for 1,000 cash. The entry was a debit to Cash and a credit to Trucks, 1,000. 2. January 1, 2017: Truck no. 3 was traded for a larger one (no. 5) with a 5-year life. The agreed purchase price was 12,000. Jarrett paid the other company 1,780 cash on the transaction. The entry was a debit to Trucks, 1,780, and a credit to Cash, 1,780. 3. July 1, 2018: Truck no. 4 was damaged in a wreck to such an extent that it was sold as junk for 50 cash. Jarrett received 950 from the insurance company. The entry made by the bookkeeper was a debit to Cash, 1,000, and credits to Miscellaneous Revenue, 50, and Trucks, 950, 4. July 1, 2018: A new truck (no. 6) was acquired for 20,000 cash and debited at that amount to the Trucks account. The truck has a 5-year life. Entries for depreciation had been made at the close of each year as follows: 2016, 8,840; 2017, 5,436; 2018, 4,896; 2019, 4,356. Required: 1. Next Level For each of the 4 years, calculate separately the increase or decrease in earnings arising from the companys errors in determining or entering depreciation or in recording transactions affecting trucks. 2. Prove your work by one compound journal entry as of December 31, 2019; the adjustment of the Trucks account is to reflect the correct balances, assuming that the books have not been closed for 2019.

- It is February 16, 2020, and you are auditing Davenport Corporation's financial statements for 2019 (which will be issued in March 2020). You read in the newspaper that Travis Corporation, a major customer of Davenport, is in financial difficulty. Included in Davenports accounts receivable is 50,000 (a material amount) owed to it by Travis. You approach Jim Davenport, president, with this information and suggest that a reduction of accounts receivable and recognition of a loss for 2019 might be appropriate. Jim replies, Why should we make an adjustment? Ted Travis, the president of Travis Corporation, is a friend of mine; he will find a way to pay us, one way or another. Furthermore, this occurred in 2020, so lets wait and see what happens; we can always make an adjustment later this year. Our 2019 income and year-end working capital are not that high; our creditors and shareholders wouldnt stand for lower amounts than they already are. Required: From financial reporting and ethical perspectives, prepare a response to Jim Davenport regarding this issue.At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.The following are independent errors: a. In January 2019, repair costs of 9,000 were debited to the Machinery account. At the beginning of 2019, the book value of the machinery was 100,000. No residual value is expected, the remaining estimated life is 10 years, and straight-line depreciation is used. b. All purchases of materials for construction contracts still in progress have been immediately expensed. It is discovered that the use of these materials was 10,000 during 2018 and 12,000 during 2019. c. Depreciation on manufacturing equipment has been excluded from manufacturing costs and treated as a period expense. During 2019, 40,000 of depreciation was accounted for in that manner. Production was 15,000 units during 2019, of which 3,000 remained in inventory at the end of the year. Assume there was no inventory at the beginning of 2019. Required: Prepare journal entries for the preceding errors discovered during 2020. Ignore income taxes.

- At the end of 2019, Framber Company received 8,000 as a prepayment for renting a building to a tenant during 2020. The company erroneously recorded the transaction by debiting Cash and crediting Rent Revenue in 2019 instead of 2020. Upon discovery of this error in 2020, what correcting journal entry will Framber make? Ignore income taxes.During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.In December 2019, Swanstrom Inc. receives a cash payment of $3,500 for services performed in December 2019 and a cash payment of S4,500 for services to be performed in January 2020. Swanstrom also receives the December utility bill for S600 but does not pay this bill until 2020. For 2019, under the accrual basis of accounting, Swanstrom would recognize: a. $8,000 of revenue and $600 of expense. b. $8,000 of revenue and $0 of expense. c. $3,500 of revenue and $600 of expense. d. $3,500 Of revenue and $0 of expense.

- It is the end of 2019 and you are an accountant for Stone Company. During 2019, sales of the companys products slumped and the companys earnings are expected to be much less than those of 2018. The president comes to you with an idea. He says, Our companys property, plant, and equipment cost 300,000, and that is the amount we usually report on our balance sheet. However, I just had these assets appraised by an independent appraiser, and she says they are worth 400,000. I think that the company should report the property, plant, and equipment at this amount on its December 31, 2019, balance sheet and should report the 100,000 increase in value as a gain on the 2019 income statement. If we use this approach, it will show how much our company is really worth and increase our earnings. This will make our shareholders happy. What do you think? Required: Prepare a written response to the president.At the end of 2020, while auditing Sandlin Companys books, before the books have been closed, you find the following items: a. A building with a 30-year life (no residual value, depreciated using the straight-line method) was purchased on January 1, 2020, by issuing a 90,000 non-interest-bearing, 4-year note. The entry made to record the purchase was a debit to Building and a credit to Notes Payable for 90,000; 12% is a fair rate of interest on the note. b. The inventory at the end of 2020 was found to be overstated by 15,000. At the same time, it was discovered that the inventory at the end of 2019 had been overstated by 35,000. The company uses the perpetual inventory system. c. For the last 3 years, the company has failed to accrue salaries and w-ages. The correct amounts at the end of each year were: 2018, 12,000; 2019, 18,000; and 2020, 10,000. Required: 1. Prepare journal entries to correct the errors. Ignore income taxes. 2. Assume, instead, that the company discovered the errors after it had closed the books. Prepare journal entries to correct the errors. Ignore income taxes.Worksheet Devlin Company has prepared the following partially completed worksheet for the year ended December 31, 2019: The following additional information is available: (a) salaries accrued but unpaid total 250; (b) the 80 heat and light bill for December has not been recorded or paid; (c) depreciation expense totals 810 on the buildings and equipment; (d) interest accrued on the note payable totals 380 (this will be paid when the note is repaid); (e) the company leases a portion of its floor space to KT Daniel Specialty Company for 50 per month, and KT Daniel has not yet paid its December rent; (f) interest accrued on the note receivable totals 80; (g) bad debts expense is 70; and (h) the income tax rate is 30% on current income and is payable in the first quarter of 2017. Required: 1. Complete the worksheet. (Round to the nearest dollar.) 2. Prepare the companys financial statements. 3. Prepare (a) adjusting and (b) closing entries in the general journal.