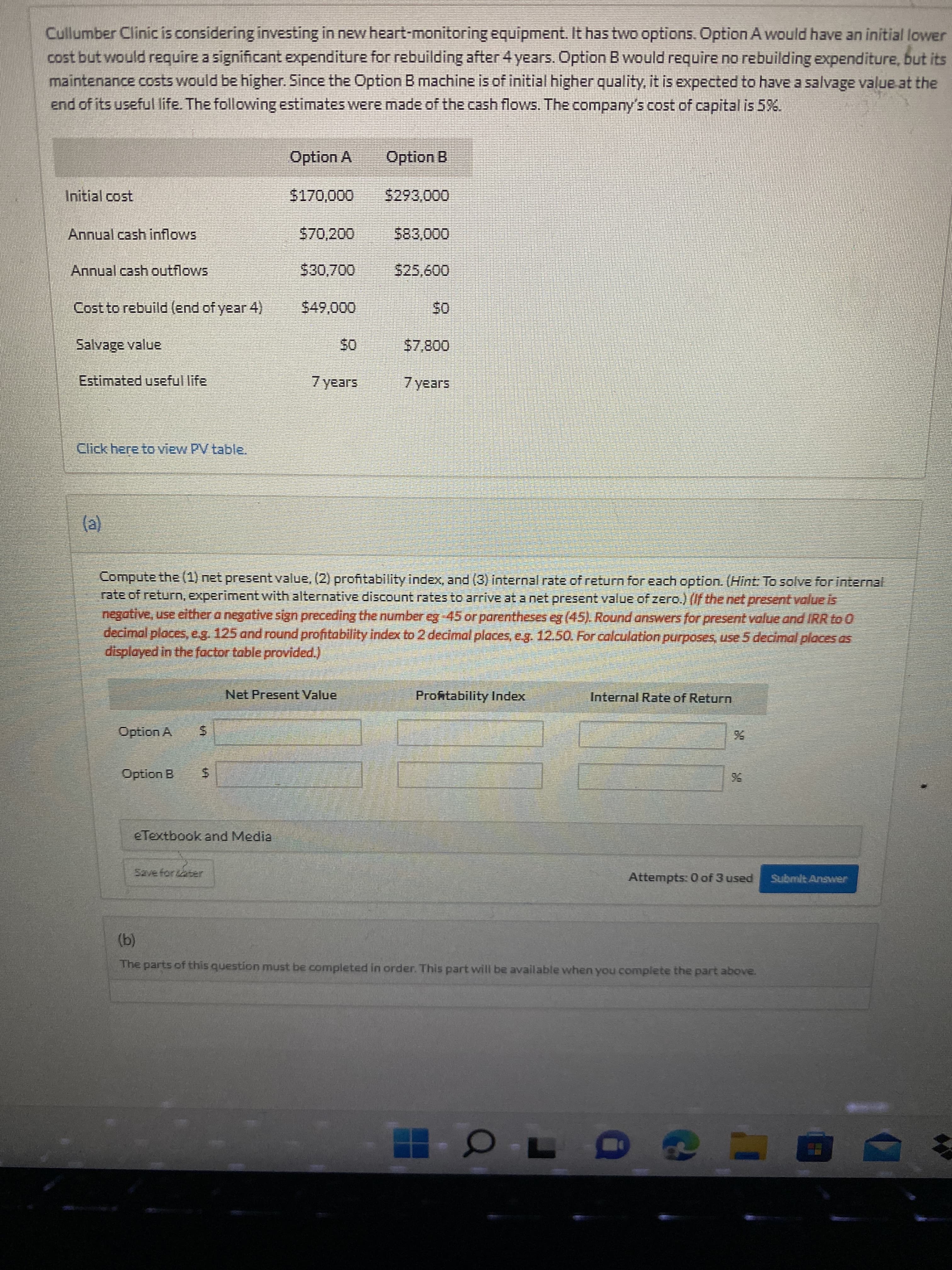

%24 %24 Cullumber Clinic is considerinz investing in newheart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimateS were made of the cash flows. The company's cost of capital is 5%. Option A Option B Initial cost Annual cash inflows 570,200 583,000 Annual cash outflows 0090 Cost to rebuild (end of year 4) Salvage value 0080 Estimated useful life 7years 7years Click here to view PV table. (a) Compute the(1) net present value, (2) profitability index, and (3) internal rate of return for each option. (Hint: To solve for iternal. rate of return, experiment with alternative discount rates to arrive at a net present value of zero.) (If the net present value is negative, use either a negative sign preceding the number eg-45 or parentheses eg (45). Round answers for present value and IRR to O decimal places, e.g. 125 and round profitability index to 2 decimal places, e.g. 12.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net Present Value Profitability Index Internal Rate of Return Option A Option B 56 eTextbook and Media Attempts: 0 of 3 used Submit Answwer (b) The parts of this question must be completed in order. This part will be available when you complete the part above.

%24 %24 Cullumber Clinic is considerinz investing in newheart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimateS were made of the cash flows. The company's cost of capital is 5%. Option A Option B Initial cost Annual cash inflows 570,200 583,000 Annual cash outflows 0090 Cost to rebuild (end of year 4) Salvage value 0080 Estimated useful life 7years 7years Click here to view PV table. (a) Compute the(1) net present value, (2) profitability index, and (3) internal rate of return for each option. (Hint: To solve for iternal. rate of return, experiment with alternative discount rates to arrive at a net present value of zero.) (If the net present value is negative, use either a negative sign preceding the number eg-45 or parentheses eg (45). Round answers for present value and IRR to O decimal places, e.g. 125 and round profitability index to 2 decimal places, e.g. 12.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net Present Value Profitability Index Internal Rate of Return Option A Option B 56 eTextbook and Media Attempts: 0 of 3 used Submit Answwer (b) The parts of this question must be completed in order. This part will be available when you complete the part above.

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 11P: REPLACEMENT ANALYSIS St. Johns River Shipyards is considering the replacement of an 8-year-old...

Related questions

Question

Unit VIII Question 18 part a

Transcribed Image Text:%24

%24

Cullumber Clinic is considerinz investing in newheart-monitoring equipment. It has two options. Option A would have an initial lower

cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its

maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the

end of its useful life. The following estimateS were made of the cash flows. The company's cost of capital is 5%.

Option A

Option B

Initial cost

Annual cash inflows

570,200

583,000

Annual cash outflows

0090

Cost to rebuild (end of year 4)

Salvage value

0080

Estimated useful life

7years

7years

Click here to view PV table.

(a)

Compute the(1) net present value, (2) profitability index, and (3) internal rate of return for each option. (Hint: To solve for iternal.

rate of return, experiment with alternative discount rates to arrive at a net present value of zero.) (If the net present value is

negative, use either a negative sign preceding the number eg-45 or parentheses eg (45). Round answers for present value and IRR to O

decimal places, e.g. 125 and round profitability index to 2 decimal places, e.g. 12.50. For calculation purposes, use 5 decimal places as

displayed in the factor table provided.)

Net Present Value

Profitability Index

Internal Rate of Return

Option A

Option B

56

eTextbook and Media

Attempts: 0 of 3 used

Submit Answwer

(b)

The parts of this question must be completed in order. This part will be available when you complete the part above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning