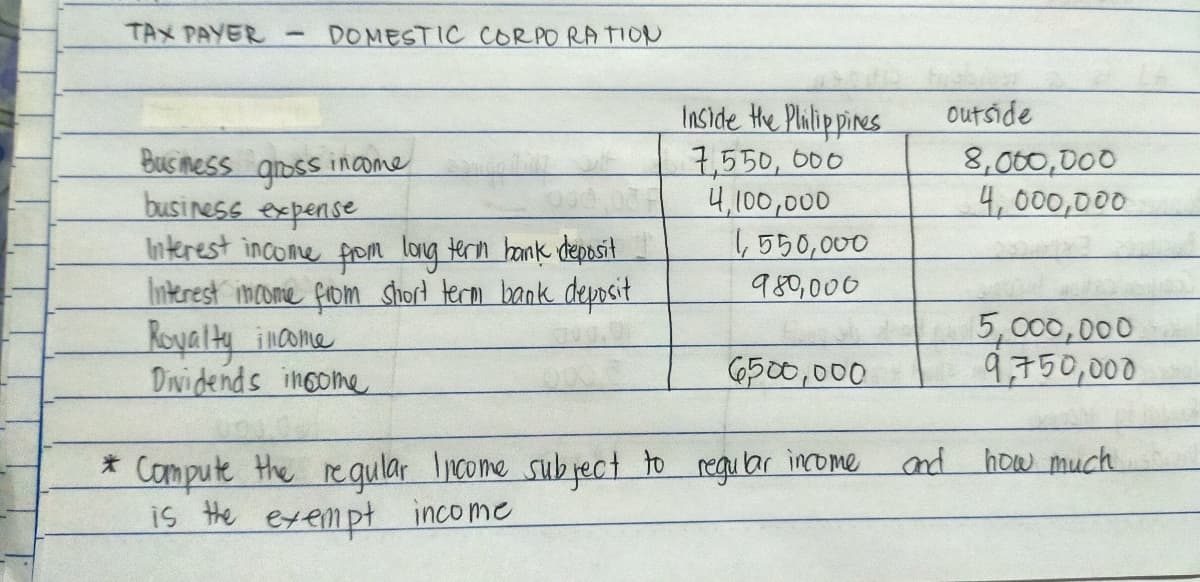

TAX PAYER DOMESTIC CORPO RATIO Inside the Plalippines 7,550, 000 4,100,000 1550,000 outside Bus mess aoss income business expense Interest income fom long tern hank deposit Interest imcome firom short terom bank deposit Koyalty income Dividends inoome 8,000,000 4,000,000 १४,००० 5,000,000 9,750,000 6500,000 *Compute Hhe reqular lcome sub ject to regular income is the exempt income and how much

TAX PAYER DOMESTIC CORPO RATIO Inside the Plalippines 7,550, 000 4,100,000 1550,000 outside Bus mess aoss income business expense Interest income fom long tern hank deposit Interest imcome firom short terom bank deposit Koyalty income Dividends inoome 8,000,000 4,000,000 १४,००० 5,000,000 9,750,000 6500,000 *Compute Hhe reqular lcome sub ject to regular income is the exempt income and how much

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 6DQ: LO.3, 4, 5 Contrast the income taxation of individuals and C corporations as to: a. Alternative...

Related questions

Question

Transcribed Image Text:TAX PAYER

DOMESTIC CORPO RATIO

Inside the Plalippines

7,550, 000

4,100,000

1550,000

outside

Bus mess aoss income

business expense

Interest income fom long tern hank deposit

Interest imcome firom short terom bank deposit

Koyalty income

Dividends inoome

8,000,000

4,000,000

१४,०००

5,000,000

9,750,000

6500,000

*Compute Hhe reqular lcome sub ject to regular income

is the exempt income

and how much

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT