Business income 50,000 100,000 400,000 300,000 30,000 Professional fees Compensation income 200,000 000.000,29 40,000 000 00e.g Rent income Interest income 1. Assuming Sarah is a resident citizen, compute the total income subject Philippine income tax. P1,390,000 b. P1,180,000 c. P1,030,000 d. P1,420,000 а. Sxsi ol oojdua omo Isto 2. Assuming Sarah is a resident alien, compute the total income subject to Philipp income tax.

Business income 50,000 100,000 400,000 300,000 30,000 Professional fees Compensation income 200,000 000.000,29 40,000 000 00e.g Rent income Interest income 1. Assuming Sarah is a resident citizen, compute the total income subject Philippine income tax. P1,390,000 b. P1,180,000 c. P1,030,000 d. P1,420,000 а. Sxsi ol oojdua omo Isto 2. Assuming Sarah is a resident alien, compute the total income subject to Philipp income tax.

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 6BCRQ

Related questions

Question

100%

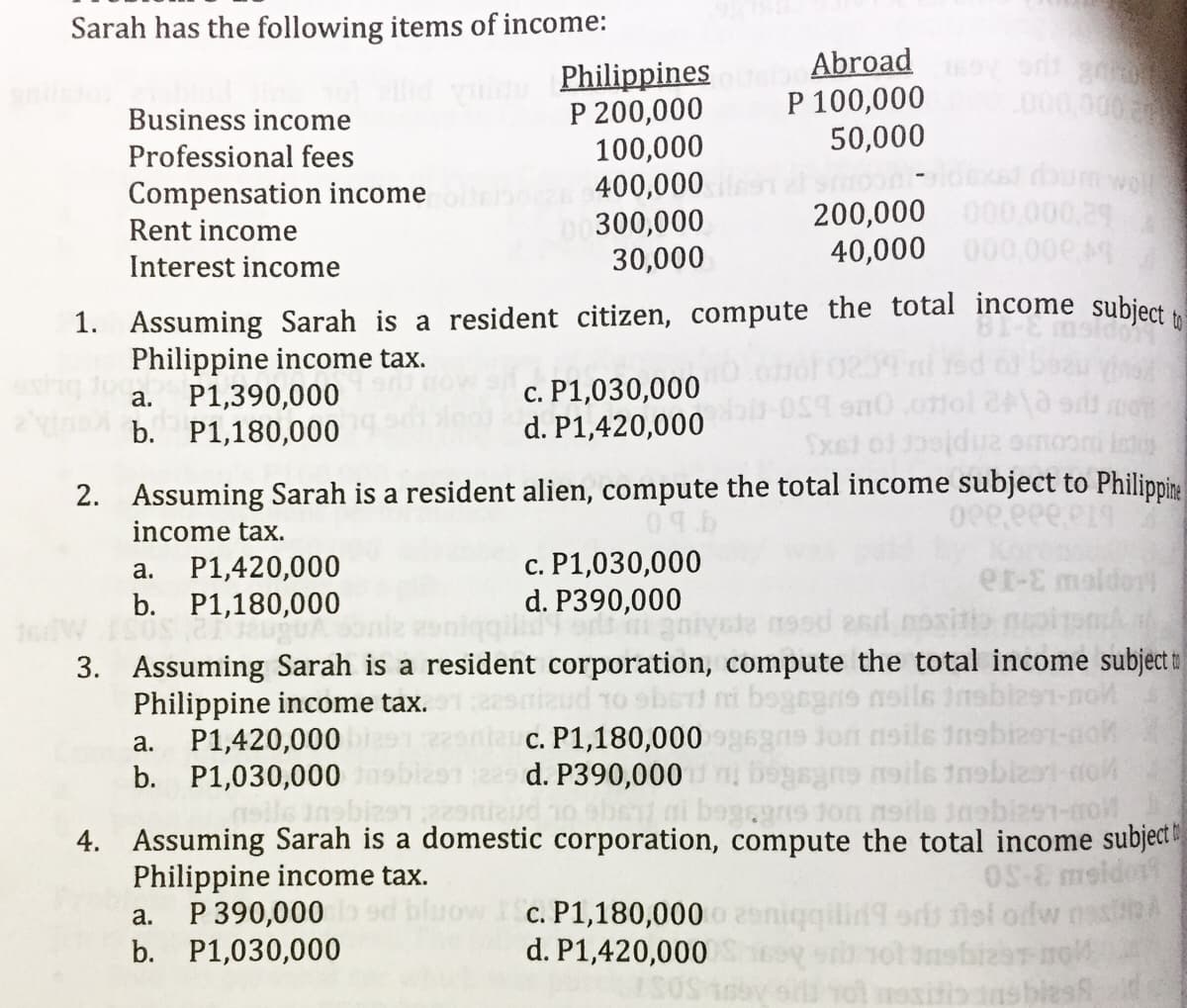

Transcribed Image Text:Sarah has the following items of income:

Abroad

P 100,000

50,000

Philippines

P 200,000

100,000

400,000

300,000

30,000

000000

Business income

Professional fees

Compensation income

Rent income

200,000 000.000,29

40,000 000.0oe 49

Interest income

1. Assuming Sarah is a resident citizen, compute the total income subject

Philippine income tax.

P1,390,000

b. P1,180,000

c. P1,030,000

d. P1,420,000

а.

Sxel ol 0jdua omor

Isto

2. Assuming Sarah is a resident alien, compute the total income subject to Philippine

income tax.

P1,420,000

b. P1,180,000

c. P1,030,000

d. P390,000

a.

er-E maldor

19sd 2sd

3. Assuming Sarah is a resident corporation, compute the total income subject t

Philippine income tax.

P1,420,000

b. P1,030,000

gajon noile inabize

c. P1,180,000

d. P390,000

ho ebs ni bogegns ton neils inabize1-no

а.

4. Assuming Sarah is a domestic corporation, compute the total income subject

Philippine income tax.

P 390,000

b. P1,030,000

OS-E

c. P1,180,000 o 2eniqqilid9 ors lol odw

nshizar no

0sy o ol mositio ans biesh

a.

d. P1,420,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT