Activity 2 Mr. J. G. Pigg, III is the sole owner of a brick company that manufactures custom bricks used in upscale homes. No two customers have the same type of bricks. The bricks go through three processes: mixing, shaping, and firing. The company uses a job order cost system and computes a predetermined overhead rate in each department. The mixing department bases its rate on direct materials, the shaping department bases its rate on machine hours, and the firing department bases its rate on direct labor hours. At the beginning of the year, the company made the following estimates: Mixing 80,000 30,000 $300,000 $150,000 Department Shaping 45,000 70,000 $. 40 000 $140,000 Firing 60,000 21,000 $15,000 $75,000 Direct labor hours Machine hours Direct materials Manufacturing overhead a. Compute the predetermined overhead rate to be used in each department during the upcoming year. b. Assume the overhead rates that you computed in a. above are in effect. Compute the total overhead cost to be assigned to Dr. Snout's order-Job #5417, assuming the following data: Mixing 300 80 Department Shaping 80 120 Firing 92 120 $300 Direct labor hours Machine hours Direct materials $6,000 $120 c. If actual overhead incurred totaled $3,500, compute the amount of over- or underapplied manufacturing overhead.

Activity 2 Mr. J. G. Pigg, III is the sole owner of a brick company that manufactures custom bricks used in upscale homes. No two customers have the same type of bricks. The bricks go through three processes: mixing, shaping, and firing. The company uses a job order cost system and computes a predetermined overhead rate in each department. The mixing department bases its rate on direct materials, the shaping department bases its rate on machine hours, and the firing department bases its rate on direct labor hours. At the beginning of the year, the company made the following estimates: Mixing 80,000 30,000 $300,000 $150,000 Department Shaping 45,000 70,000 $. 40 000 $140,000 Firing 60,000 21,000 $15,000 $75,000 Direct labor hours Machine hours Direct materials Manufacturing overhead a. Compute the predetermined overhead rate to be used in each department during the upcoming year. b. Assume the overhead rates that you computed in a. above are in effect. Compute the total overhead cost to be assigned to Dr. Snout's order-Job #5417, assuming the following data: Mixing 300 80 Department Shaping 80 120 Firing 92 120 $300 Direct labor hours Machine hours Direct materials $6,000 $120 c. If actual overhead incurred totaled $3,500, compute the amount of over- or underapplied manufacturing overhead.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter18: Activity-based Costing

Section: Chapter Questions

Problem 2PA: The management of Gwinnett County Chrome Company, described in Problem 1A, now plans to use the...

Related questions

Question

Please help me with Activity 2.

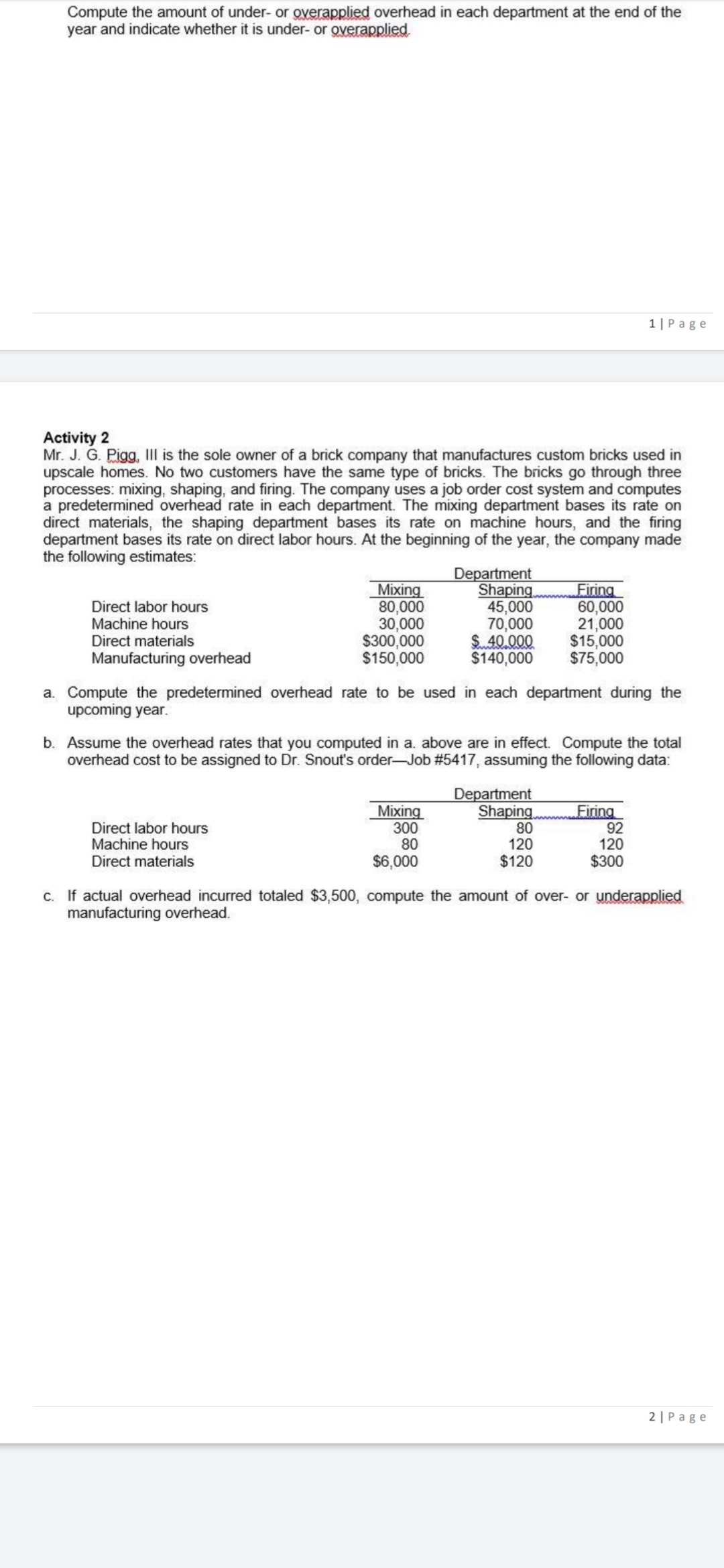

Transcribed Image Text:Compute the amount of under- or overapplied overhead in each department at the end of the

year and indicate whether it is under- or overapplied

1 |Page

Activity 2

Mr. J. G. Pigg, III is the sole owner of a brick company that manufactures custom bricks used in

upscale homes. No two customers have the same type of bricks. The bricks go through three

processes: mixing, shaping, and firing. The company uses a job order cost system and computes

a predetermined overhead rate in each department. The mixing department bases its rate on

direct materials, the shaping department bases its rate on machine hours, and the firing

department bases its rate on direct labor hours. At the beginning of the year, the company made

the following estimates:

Mixing

80,000

30,000

$300,000

$150,000

Department

Shaping

45,000

70,000

$.40.000

$140,000

Firing

60,000

21,000

$15,000

$75,000

Direct labor hours

Machine hours

Direct materials

Manufacturing overhead

a. Compute the predetermined overhead rate to be used in each department during the

upcoming year.

b. Assume the overhead rates that you computed in a. above are in effect. Compute the total

overhead cost to be assigned to Dr. Snout's order-Job #5417, assuming the following data:

Mixing

300

80

Department

Shaping

80

120

Firing

92

120

Direct labor hours

Machine hours

Direct materials

$6,000

$120

$300

C. If actual overhead incurred totaled $3,500, compute the amount of over- or underapplied

manufacturing overhead.

2 |Page

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning