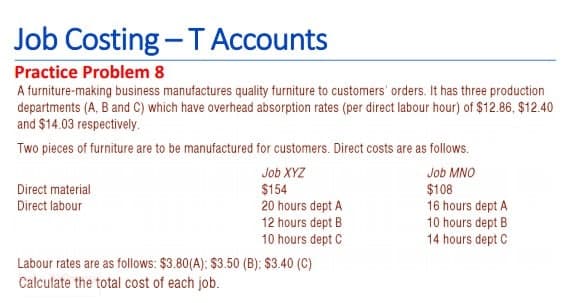

Job Costing -TAccounts Practice Problem 8 A furniture-making business manufactures quality furniture to customers' orders. It has three production departments (A, B and C) which have overhead absorption rates (per direct labour hour) of $12.86, $12.40 and $14.03 respectively. Two pieces of furniture are to be manufactured for customers. Direct costs are as follows. Job XYZ $154 20 hours dept A 12 hours dept B 10 hours dept C Job MNO Direct material Direct labour $108 16 hours dept A 10 hours dept B 14 hours dept C Labour rates are as follows: $3.80(A): $3.50 (B): $3.40 (C) Calculate the total cost of each job.

Job Costing -TAccounts Practice Problem 8 A furniture-making business manufactures quality furniture to customers' orders. It has three production departments (A, B and C) which have overhead absorption rates (per direct labour hour) of $12.86, $12.40 and $14.03 respectively. Two pieces of furniture are to be manufactured for customers. Direct costs are as follows. Job XYZ $154 20 hours dept A 12 hours dept B 10 hours dept C Job MNO Direct material Direct labour $108 16 hours dept A 10 hours dept B 14 hours dept C Labour rates are as follows: $3.80(A): $3.50 (B): $3.40 (C) Calculate the total cost of each job.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter4: Job-order Costing And Overhead Application

Section: Chapter Questions

Problem 47E: Cost Flows Consider the following independent jobs. Overhead is applied in Department 1 at the rate...

Related questions

Question

Transcribed Image Text:Job Costing - T Accounts

Practice Problem 8

A furniture-making business manufactures quality furniture to customers' orders. It has three production

departments (A, B and C) which have overhead absorption rates (per direct labour hour) of $12.86, $12.40

and $14.03 respectively.

Two pieces of furniture are to be manufactured for customers. Direct costs are as follows.

Job XYZ

Job MNO

Direct material

Direct labour

$154

20 hours dept A

12 hours dept B

10 hours dept C

$108

16 hours dept A

10 hours dept B

14 hours dept C

Labour rates are as follows: $3.80(A): $3.50 (B): $3.40 (C)

Calculate the total cost of each job.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning