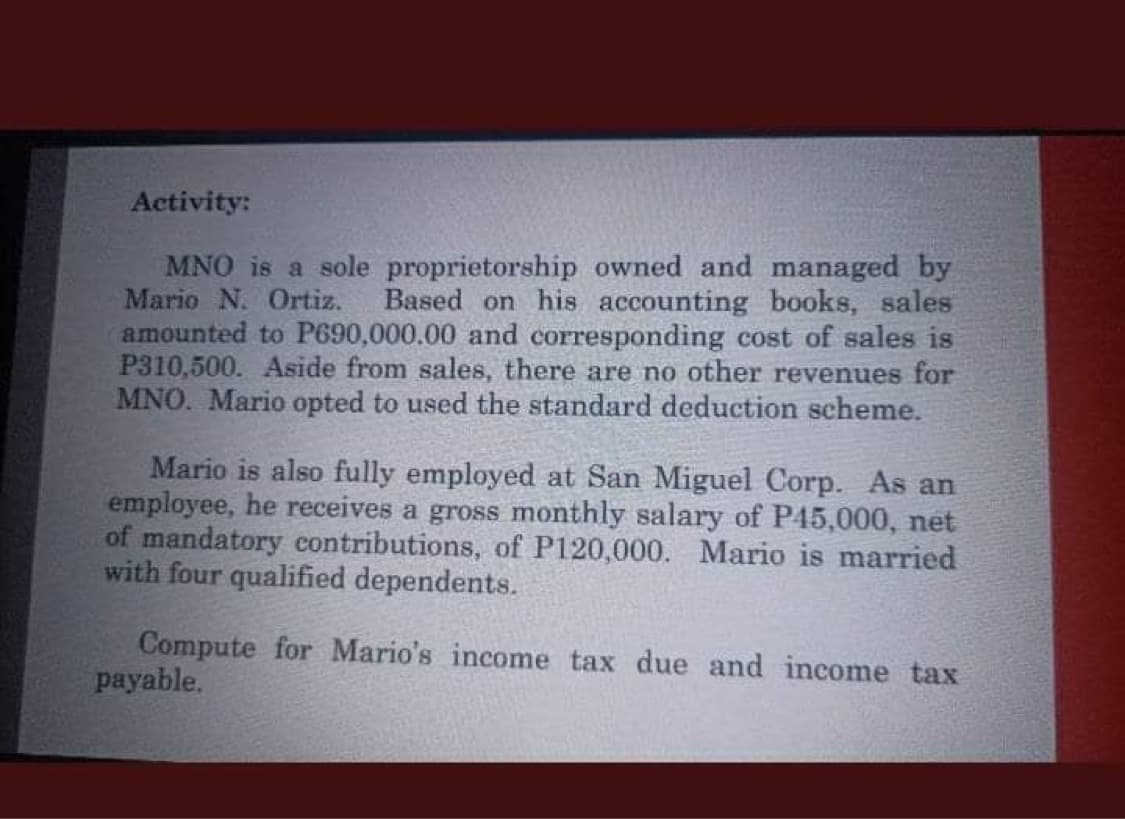

Activity: MNO is a sole proprietorship owned and managed by Mario N. Ortiz. amounted to P690,000.00 and corresponding cost of sales is P310,500. Aside from sales, there are no other revenues for MNO. Mario opted to used the standard deduction scheme. Based on his accounting books, sales Mario is also fully employed at San Miguel Corp. As an employee, he receives a gross monthly salary of P45,000, net of mandatory contributions, of P120,000. Mario is married with four qualified dependents. Compute for Mario's income tax due and income tax payable.

Activity: MNO is a sole proprietorship owned and managed by Mario N. Ortiz. amounted to P690,000.00 and corresponding cost of sales is P310,500. Aside from sales, there are no other revenues for MNO. Mario opted to used the standard deduction scheme. Based on his accounting books, sales Mario is also fully employed at San Miguel Corp. As an employee, he receives a gross monthly salary of P45,000, net of mandatory contributions, of P120,000. Mario is married with four qualified dependents. Compute for Mario's income tax due and income tax payable.

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 59P

Related questions

Question

Transcribed Image Text:Activity:

MNO is a sole proprietorship owned and managed by

Mario N. Ortiz.

amounted to P690,000.00 and corresponding cost of sales is

P310,500. Aside from sales, there are no other revenues for

MNO. Mario opted to used the standard deduction scheme.

Based on his accounting books, sales

Mario is also fully employed at San Miguel Corp. As an

employee, he receives a gross monthly salary of P45,000, net

of mandatory contributions, of P120,000. Mario is married

with four qualified dependents.

Compute for Mario's income tax due and income tax

payable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT