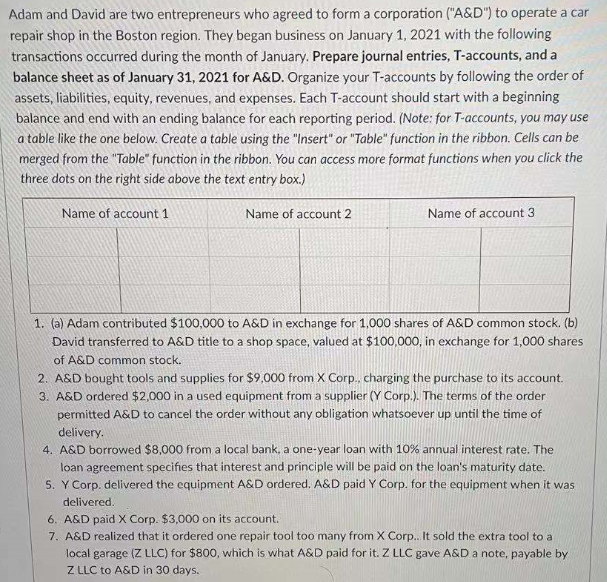

Adam and David are two entrepreneurs who agreed to form a corporation ("A&D") to operate a car repair shop in the Boston region. They began business on January 1, 2021 with the following transactions occurred during the month of January. Prepare journal entries, T-accounts, and a balance sheet as of January 31, 2021 for A&D. Organize your T-accounts by following the order of assets, liabilities, equity, revenues, and expenses. Each T-account should start with a beginning

Adam and David are two entrepreneurs who agreed to form a corporation ("A&D") to operate a car repair shop in the Boston region. They began business on January 1, 2021 with the following transactions occurred during the month of January. Prepare journal entries, T-accounts, and a balance sheet as of January 31, 2021 for A&D. Organize your T-accounts by following the order of assets, liabilities, equity, revenues, and expenses. Each T-account should start with a beginning

Chapter6: Accounting Periods And Other Taxes

Section: Chapter Questions

Problem 5MCQ: Which of the following entities is required to report on the accrual basis? An accounting firm...

Related questions

Topic Video

Question

Transcribed Image Text:Adam and David are two entrepreneurs who agreed to form a corporation ("A&D") to operate a car

repair shop in the Boston region. They began business on January 1, 2021 with the following

transactions occurred during the month of January. Prepare journal entries, T-accounts, and a

balance sheet as of January 31, 2021 for A&D. Organize your T-accounts by following the order of

assets, liabilities, equity, revenues, and expenses. Each T-account should start with a beginning

balance and end with an ending balance for each reporting period. (Note: for T-accounts, you may use

a table like the one below. Create a table using the "Insert" or "Table" function in the ribbon. Cells can be

merged from the "Table" function in the ribbon. You can access more format functions when you click the

three dots on the right side above the text entry box.)

Name of account 1

Name of account 2

Name of account 3

1. (a) Adam contributed $100,000 to A&D in exchange for 1,000 shares of A&D common stock. (b)

David transferred to A&D title to a shop space, valued at $100,000, in exchange for 1,000 shares

of A&D common stock.

2. A&D bought tools and supplies for $9,000 from X Corp., charging the purchase to its account.

3. A&D ordered $2,000 in a used equipment from a supplier (Y Corp.). The terms of the order

permitted A&D to cancel the order without any obligation whatsoever up until the time of

delivery.

4. A&D borrowed $8,000 from a local bank, a one-year loan with 10% annual interest rate. The

loan agreement specifies that interest and principle will be paid on the loan's maturity date.

S. Y Corp. delivered the equipment A&D ordered. A&D paid Y Corp. for the equipment when it was

delivered.

6. A&D paid X Corp. $3,000 on its account.

7. A&D realized that it ordered one repair tool too many from X Corp.. It sold the extra tool to a

local garage (Z LLC) for $800, which is what A&D paid for it. Z LLC gave A&D a note, payable by

Z LLC to A&D in 30 days.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College