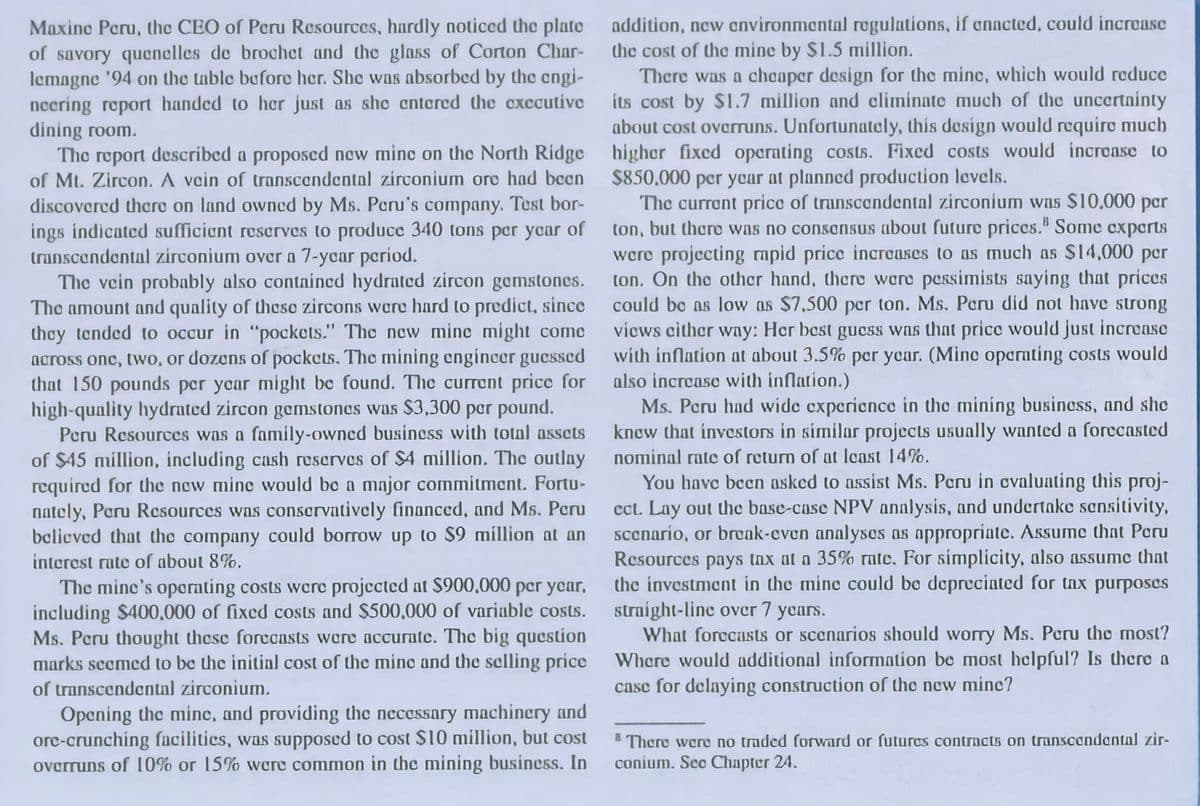

addition, new environmental regulations, if enncted, could incrouse Maxine Peru, the CEO of Peru Resources, hardly noticed the plate of savory qucnelles de brochet and the glass of Corton Char- lemagne '94 on the table before her. She was absorbed by the engi- neering report handed to her just as she antered the cxccutive dining room. The report described a proposed new minc on the North Ridge of Mt. Zircon. A vein of transcendental zirconium ore had been the cost of the mine by $1.5 million. discovered thcro on land owned by Ms. Paru's company. Test bor- ings indicated sufficiant rescrves to produce 340 tons per ycar of transcendantal zirconium over a 7-ycar period. The vein probably also contnincd hydrated zircon gemstones. The amount and quality of these zircons were hard to predict, since they tended to occur in "pockets." The new minc might come across onc, two, or dozens of pockets. The mining engincer guessed that 150 pounds per yoar might be found. The currant price for high-quality hydrated zircon gemstones was $3,300 per pound. Peru Resources was a family-owned business with totnl assets of $45 million, including cash reserves of $4 million. The outlay required for the new mine would be a major commitment. Fortu- nately, Peru Resources was conscrvatively financed, and Ms. Peru believed that the company could borrow up to $9 million at an There was a cheaper design for the mine, which would roduce its cost by $1.7 million and climinate much of the uncertainty about cost overruns. Unfortunately, this dosign would requiro much higher fixed opernting costs. Fixed costs would increase to $850,000 per ycar at planned production levels. The curront price of trunscendental zirconium was $10,000 per ton, but there was no consensus about future prices." Some cxperts were projecting rapid price increases to as much as S14,000 per ton. On the other hand, there were pessimists saying that prices could bo as low as $7,500 per ton. Ms. Peru did not have strong vicws cither wny: Her best gucss was that price would just increase with inflation at about 3.5% per year. (Minc opcrating costs would also increase with inflation.) Ms. Peru had wide experience in the mining business, and sho knew that investors in similar projects usually wanted a forecasted nominal rate of return of at least 14%. You have been asked to nssist Ms. Peru in evalunting this proj- cct. Lay out the base-case NPV annlysis, and undertnke sensitivity, scenario, or break-cven analysos as appropriate. Assume that Peru Resources pays tnx at a 35% rate. For simplicity, also assume that the investment in the mine could be deprecinted for tax purposes straight-line over 7 years. What forecasts or scenarios should worry Ms. Peru the most? Where would additional informntion be most helpful? Is thero a case for delaying construction of the new mine? interost rate of about 8%. The mine's oporating costs wcre projected at $900,000 per ycar, including $400,000 of fixed costs and $500,000 of variable costs. Ms. Peru thought these forccasts ware accuratc. The big question marks seemed to be the initinl cost of the mino and the selling price of transcendental zirconium. Opening the mine, and providing the necessary machinery and ore-crunching facilitics, was supposed to cost Sl0 million, but cost overruns of 10% or 15% were common in the mining business. In There were no traded forward or futures contracts on transcondental zir- conium. Sec Chapter 24.

addition, new environmental regulations, if enncted, could incrouse Maxine Peru, the CEO of Peru Resources, hardly noticed the plate of savory qucnelles de brochet and the glass of Corton Char- lemagne '94 on the table before her. She was absorbed by the engi- neering report handed to her just as she antered the cxccutive dining room. The report described a proposed new minc on the North Ridge of Mt. Zircon. A vein of transcendental zirconium ore had been the cost of the mine by $1.5 million. discovered thcro on land owned by Ms. Paru's company. Test bor- ings indicated sufficiant rescrves to produce 340 tons per ycar of transcendantal zirconium over a 7-ycar period. The vein probably also contnincd hydrated zircon gemstones. The amount and quality of these zircons were hard to predict, since they tended to occur in "pockets." The new minc might come across onc, two, or dozens of pockets. The mining engincer guessed that 150 pounds per yoar might be found. The currant price for high-quality hydrated zircon gemstones was $3,300 per pound. Peru Resources was a family-owned business with totnl assets of $45 million, including cash reserves of $4 million. The outlay required for the new mine would be a major commitment. Fortu- nately, Peru Resources was conscrvatively financed, and Ms. Peru believed that the company could borrow up to $9 million at an There was a cheaper design for the mine, which would roduce its cost by $1.7 million and climinate much of the uncertainty about cost overruns. Unfortunately, this dosign would requiro much higher fixed opernting costs. Fixed costs would increase to $850,000 per ycar at planned production levels. The curront price of trunscendental zirconium was $10,000 per ton, but there was no consensus about future prices." Some cxperts were projecting rapid price increases to as much as S14,000 per ton. On the other hand, there were pessimists saying that prices could bo as low as $7,500 per ton. Ms. Peru did not have strong vicws cither wny: Her best gucss was that price would just increase with inflation at about 3.5% per year. (Minc opcrating costs would also increase with inflation.) Ms. Peru had wide experience in the mining business, and sho knew that investors in similar projects usually wanted a forecasted nominal rate of return of at least 14%. You have been asked to nssist Ms. Peru in evalunting this proj- cct. Lay out the base-case NPV annlysis, and undertnke sensitivity, scenario, or break-cven analysos as appropriate. Assume that Peru Resources pays tnx at a 35% rate. For simplicity, also assume that the investment in the mine could be deprecinted for tax purposes straight-line over 7 years. What forecasts or scenarios should worry Ms. Peru the most? Where would additional informntion be most helpful? Is thero a case for delaying construction of the new mine? interost rate of about 8%. The mine's oporating costs wcre projected at $900,000 per ycar, including $400,000 of fixed costs and $500,000 of variable costs. Ms. Peru thought these forccasts ware accuratc. The big question marks seemed to be the initinl cost of the mino and the selling price of transcendental zirconium. Opening the mine, and providing the necessary machinery and ore-crunching facilitics, was supposed to cost Sl0 million, but cost overruns of 10% or 15% were common in the mining business. In There were no traded forward or futures contracts on transcondental zir- conium. Sec Chapter 24.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter7: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 2PA: The demand for solvent, one of numerous products manufactured by Logan Industries Inc., has dropped...

Related questions

Question

Transcribed Image Text:Maxine Peru, the CEO of Peru Resources, hardly noticed the plate

of savory quenelles de brochet and the glass of Corton Char-

lemagne '94 on the table before her. She was absorbed by the engi-

necring report handed to her just as sho antered the cxccutive

dining room.

The report described a proposed now minc on the North Ridge

of Mt. Zircon. A vain of transcandental zirconium oro had bean

discovered thcre on land owned by Ms. Paru's company. Test bor-

ings indicated sufficient reserves to produce 340 tons per ycar of

transcendental zirconium over a 7-ycar pariod.

The vein probably also contnincd hydrated zircon gemstones.

The amount and quality of theso zircons ware hard to predict, since

thoy tended to occur in "pockets." The new mine might como

across onc, two, or dozons of pockets. The mining cngincer gucssed

that 150 pounds per yoar might bo found. The current price for

high-quality hydrated zircon gemstones was $3,300 par pound.

Peru Resources was a family-owned business with totnl assets

of $45 million, including cash reserves of $4 million. The outlay

required for the new mine would be a major commitment. Fortu-

nately, Paru Resources wns conscrvatively financed, and Ms. Peru

believed that the company could borrow up to $9 million at an

intorost rute of about 8%.

addition, new cnvironmental rogulations, if anacted, could incroase

the cost of the mine by $1.5 million.

There was a choaper design for the minc, which would reduce

its cost by $1.7 million and climinate much of the uncertninty

about cost ovaruns. Unfortunately, this design would requiro much

higher fixed opernting costs. Fixed costs would increase to

$850,000 per ycar at planned production lovels.

The curront price of trunscandental zirconium was S10.000 pcr

ton, but thero was no consonsus about future prices." Some cxperts

wero projecting mpid price increases to as much as $14,000 per

ton. On the other hand, there were pessimistsB saying that prices

could bo as low as $7,500 per ton. Ms. Paru did not have strong

vicws cither wny: Her best gucss was that price would just increase

with inflation at about 3.5% per yoar. (Mino opcruting costs would

also increaso with inflation.)

Ms. Peru had wide cxperience in the mining business, and sho

know that investors in similar projects usually wanted a forecasted

nominal rate of return of at least 14%.

You have been asked to assist Ms. Paru in cvalunting this proj-

cct. Lay out the base-case NPV annlysis, and undertake sensitivity,

sccnario, or break-even analyses as appropriate. Assume that Peru

Resources pays tnx at a 35% ratc. For simplicity, also assume that

the investment in the mine could be depreciated for tax purposes

straight-line over 7 years.

What forecasts or scenarios should worry Ms. Peru the most?

Whare would additional informntion be most helpful? Is there a

case for delaying construction of the new minc?

The mine's opornting costs were projected at $900,000 per ycar,

including $400,000 of fixed costs and $500,000 of variable costs.

Ms. Peru thought these forccasts wore accuratc. The big question

marks seemed to bc the initinl cost of the mino and the selling price

of transcendental zirconium.

Opening the mine, and providing the necessary machinery and

ore-crunching facilities, was supposed to cost $10 million, but cost

overruns of I0% or 15% wcre common in the mining business. In

8 Thero wane no traded forward or futures contrncts on transcandantal zir-

conium. Sco Chapter 24.

Expert Solution

Trending now

This is a popular solution!

Step by step

Solved in 10 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning