Additional Information 1. Equipment costing $21,375 with accumulated depreciation of $11,100 is sol 2. Equipment purchases are for cash. 3. Accumulated depreciation is affected by depreciation expense and the sale 4. The balance of retained earnings is affected by dividend declarations and nE 5. All sales are made on credit.

Additional Information 1. Equipment costing $21,375 with accumulated depreciation of $11,100 is sol 2. Equipment purchases are for cash. 3. Accumulated depreciation is affected by depreciation expense and the sale 4. The balance of retained earnings is affected by dividend declarations and nE 5. All sales are made on credit.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 21E

Related questions

Question

prepeare cash flow statememt

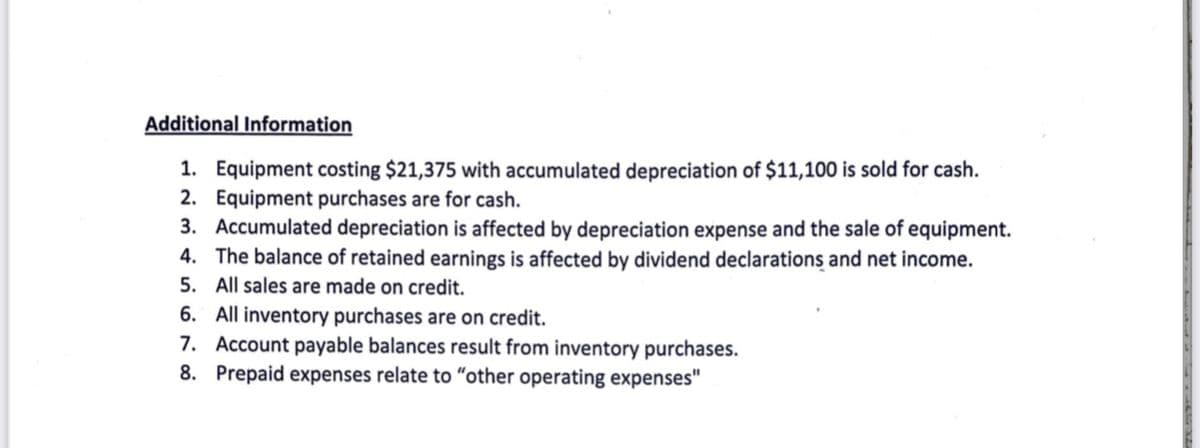

Transcribed Image Text:Additional Information

1. Equipment costing $21,375 with accumulated depreciation of $11,100 is sold for cash.

2. Equipment purchases are for cash.

3. Accumulated depreciation is affected by depreciation expense and the sale of equipment.

4. The balance of retained earnings is affected by dividend declarations and net income.

5. All sales are made on credit.

6. All inventory purchases are on credit.

7. Account payable balances result from inventory purchases.

8. Prepaid expenses relate to "other operating expenses"

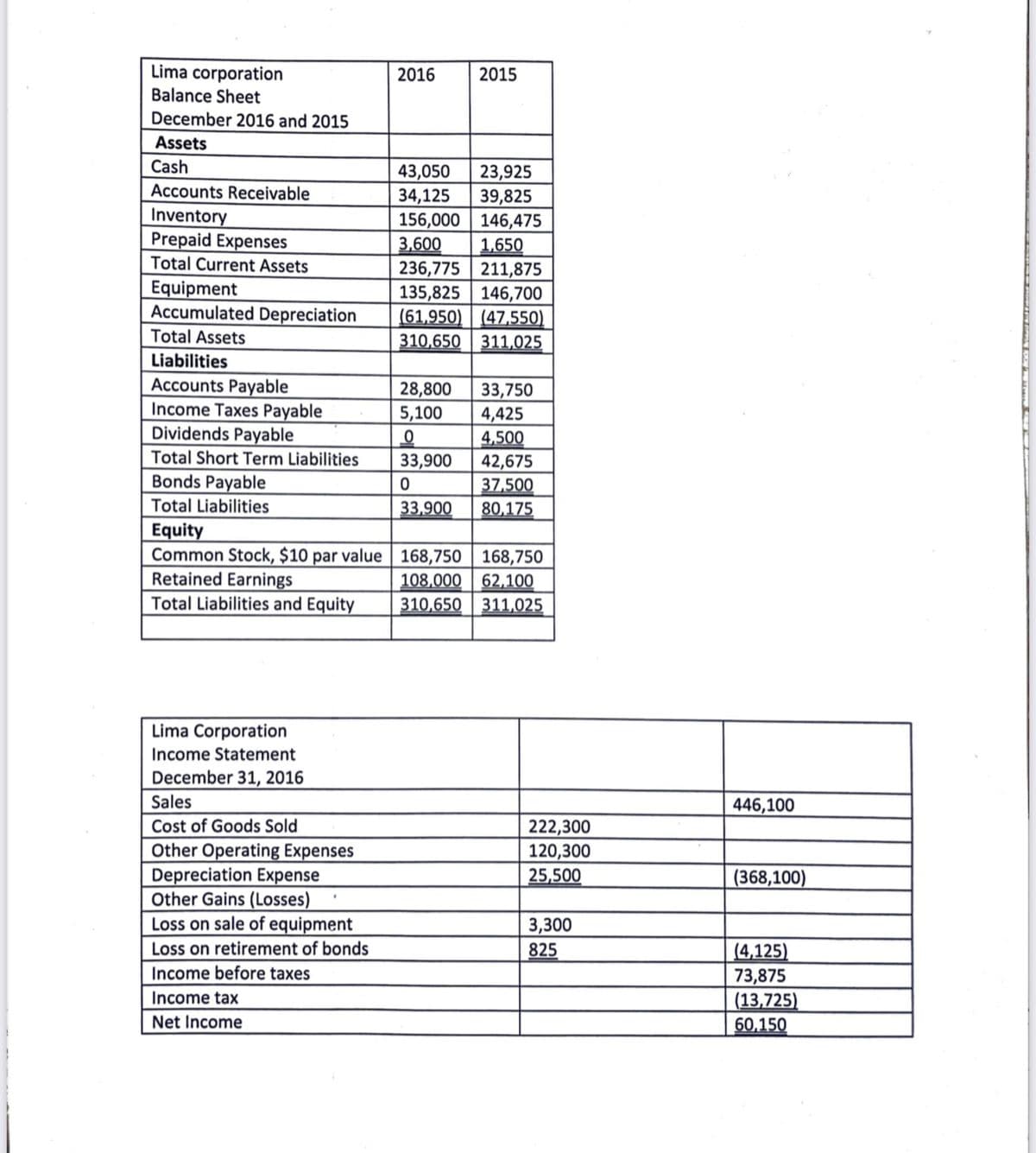

Transcribed Image Text:Lima corporation

Balance Sheet

2016

2015

December 2016 and 2015

Assets

Cash

43,050

23,925

Accounts Receivable

34,125

Inventory

Prepaid Expenses

Total Current Assets

39,825

156,000 146,475

3,600

1,650

236,775 211,875

135,825 146,700

(61,950) (47,550)

310,650 311,025

Equipment

Accumulated Depreciation

Total Assets

Liabilities

Accounts Payable

Income Taxes Payable

Dividends Payable

28,800

5,100

33,750

4,425

4,500

42,675

37,500

80,175

Total Short Term Liabilities

33,900

Bonds Payable

Total Liabilities

33,900

Equity

Common Stock, $10 par value | 168,750 | 168,750

Retained Earnings

Total Liabilities and Equity

108,000

62,100

310,650 311,025

Lima Corporation

Income Statement

December 31, 2016

Sales

446,100

Cost of Goods Sold

Other Operating Expenses

Depreciation Expense

Other Gains (Losses)

Loss on sale of equipment

222,300

120,300

25,500

(368,100)

3,300

Loss on retirement of bonds

825

(4,125)

73,875

(13,725)

60,150

Income before taxes

Income tax

Net Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub