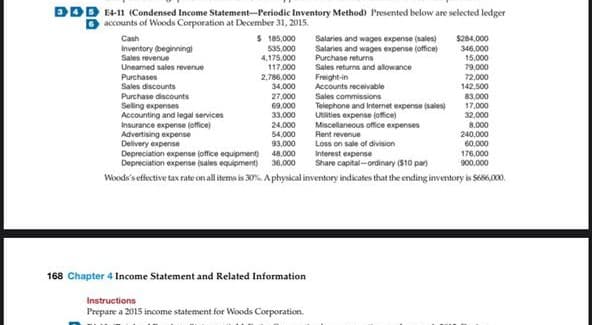

DDD 14-11 (Condensed Income Statement-Periodic Inventory Method) Presented below are selected ledger Daccounts of Woods Corporation at December 31, 2015. Cash Inventory (beginning) Sales revenue Uneamed sales revenue Purchases Sales discounts Purchase discounts Selling expenses Accounting and legal services Insurance expense (office) Advertising expense Delivery expense $ 185,000 535,000 4,175,000 117,000 2,780.000 34,000 27,000 69,000 33,000 24,000 54,000 93,000 168 Chapter 4 Income Statement and Related Information Salaries and wages expense (sales) Salaries and wages expense (office) Purchase returns Instructions Prepare a 2015 income statement for Woods Corporation. Sales returns and allowance Freight-in Accounts receivable Sales commissions Telephone and Internet expense (sales) Utilities expense (office) Miscellaneous office expenses $284,000 346,000 15.000 79,000 72,000 Rent revenue Loss on sale of division Interest expense Depreciation expense (office equipment) 48,000 Depreciation expense (sales equipment) 36,000 Share capital-ordinary ($10 par Woods's effective tax rate on all items is 30%. A physical inventory indicates that the ending inventory is $686,000 142.500 83,000 17,000 32,000 8,000 240,000 60,000 176,000 900,000

DDD 14-11 (Condensed Income Statement-Periodic Inventory Method) Presented below are selected ledger Daccounts of Woods Corporation at December 31, 2015. Cash Inventory (beginning) Sales revenue Uneamed sales revenue Purchases Sales discounts Purchase discounts Selling expenses Accounting and legal services Insurance expense (office) Advertising expense Delivery expense $ 185,000 535,000 4,175,000 117,000 2,780.000 34,000 27,000 69,000 33,000 24,000 54,000 93,000 168 Chapter 4 Income Statement and Related Information Salaries and wages expense (sales) Salaries and wages expense (office) Purchase returns Instructions Prepare a 2015 income statement for Woods Corporation. Sales returns and allowance Freight-in Accounts receivable Sales commissions Telephone and Internet expense (sales) Utilities expense (office) Miscellaneous office expenses $284,000 346,000 15.000 79,000 72,000 Rent revenue Loss on sale of division Interest expense Depreciation expense (office equipment) 48,000 Depreciation expense (sales equipment) 36,000 Share capital-ordinary ($10 par Woods's effective tax rate on all items is 30%. A physical inventory indicates that the ending inventory is $686,000 142.500 83,000 17,000 32,000 8,000 240,000 60,000 176,000 900,000

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.5E

Related questions

Question

Transcribed Image Text:DDD E4-11 (Condensed Income Statement-Periodic Inventory Method) Presented below are selected ledger

accounts of Woods Corporation at December 31, 2015.

Cash

Inventory (beginning)

Sales revenue

Uneamed sales revenue

Purchases

$185,000

535.000

4,175,000

117,000

2,786.000

34,000

27,000

69,000

168 Chapter 4 Income Statement and Related Information

Salaries and wages expense (sales)

Salaries and wages expense (office)

Purchase returns

Sales returns and allowance

Instructions

Prepare a 2015 income statement for Woods Corporation.

Freight-in

Accounts receivable

Sales discounts

Purchase discounts

Selling expenses

Accounting and legal services

33,000

24,000

Insurance expense (office)

Advertising expense

Delivery expense

54,000

93,000

Depreciation expense (office equipment) 48,000

Depreciation expense (sales equipment) 36,000

Woods's effective tax rate on all items is 30%. A physical inventory indicates that the ending inventory is $686,000.

Sales commissions

Telephone and Internet expense (sales)

Uslities expense (office)

$284,000

346,000

15,000

79,000

Miscellaneous office expenses

Rent revenue

Loss on sale of division

Interest expense

Share capital-ordinary ($10 par)

72,000

142,500

83,000

17,000

32,000

8.000

240,000

60,000

176,000

900,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning