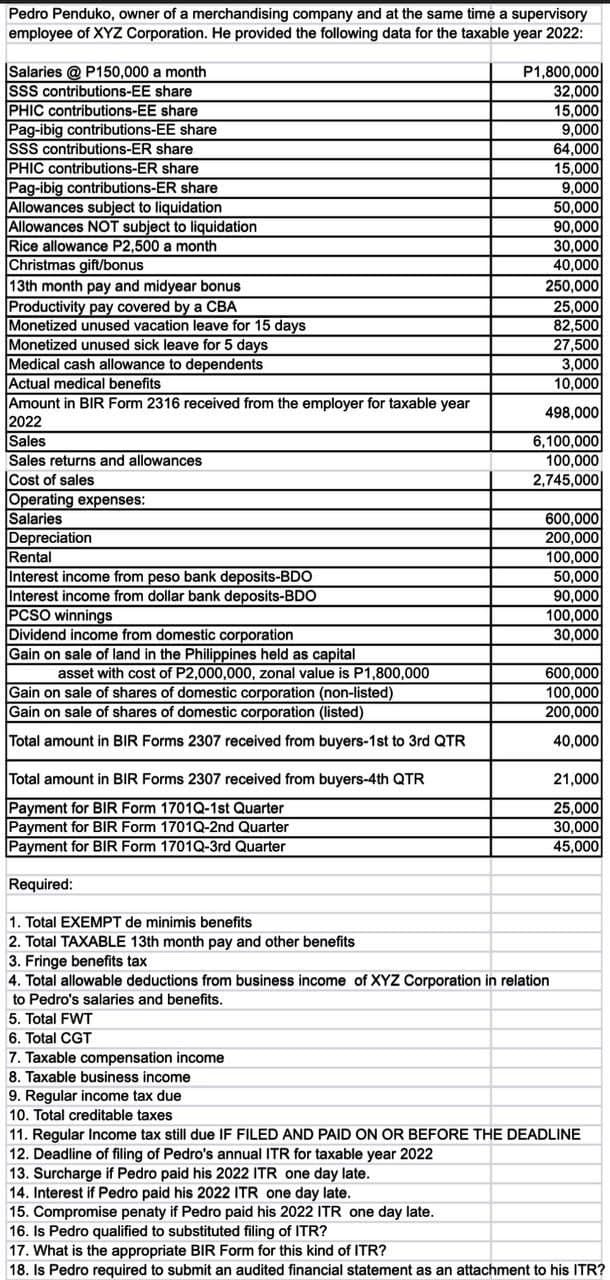

upervis employee of XYZ Corporation. He provided the following data for the taxable year 2022: Salaries @ P150,000 a month share SSS contributions-EE PHIC contributions-EE share Pag-ibig contributions-EE share SSS contributions-ER share PHIC contributions-ER share Pag-ibig contributions-ER share Allowances subject to liquidation Allowances NOT subject to liquidation Rice allowance P2,500 a month Christmas gift/bonus 13th month pay and midyear bonus Productivity pay covered by a CBA Monetized unused vacation leave for 15 days Monetized unused sick leave for 5 days Medical cash allowance to dependents Actual medical benefits Amount in BIR Form 2316 received from the employer for taxable year 2022 Sales Sales returns and allowances Cost of sales Operating expenses: Salaries Depreciation Rental Interest income from peso bank deposits-BDO Interest income from dollar bank deposits-BDO PCSO winnings Dividend income from domestic corporation Gain on sale of land in the Philippines held as capital asset with cost of P2,000,000, zonal value is P1,800,000 Gain on sale of shares of domestic corporation (non-listed) Gain on sale of shares of domestic corporation (listed) Total amount in BIR Forms 2307 received from buyers-1st to 3rd QTR Total amount in BIR Forms 2307 received from buyers-4th QTR Payment for BIR Form 1701Q-1st Quarter Payment for BIR Form 1701Q-2nd Quarter Payment for BIR Form 1701Q-3rd Quarter Required: P1,800,000 32,000 15,000 9,000 64,000 15,000 9,000 50,000 90,000 30,000 40,000 250,000 25,000 82,500 27,500 3,000 10,000 498,000 6,100,000 100,000 2,745,000 600,000 200,000 100,000 50,000 90,000 100,000 30,000 600,000 100,000 200,000 40,000 1. Total EXEMPT de minimis benefits 2. Total TAXABLE 13th month pay and other benefits 3. Fringe benefits tax 4. Total allowable deductions from business income of XYZ Corporation in relation to Pedro's salaries and benefits. 5. Total FWT 6. Total CGT 7. Taxable compensation income 8. Taxable business income 9. Regular income tax due 10. Total creditable taxes 21,000 25,000 30,000 45,000 11. Regular Income tax still due IF FILED AND PAID ON OR BEFORE THE DEADLINE 12. Deadline of filing of Pedro's annual ITR for taxable year 2022 13. Surcharge if Pedro paid his 2022 ITR one day late. 14. Interest if Pedro paid his 2022 ITR one day late. 15. Compromise penaty if Pedro paid his 2022 ITR one day late. 16. Is Pedro qualified to substituted filing of ITR? 17. What is the appropriate BIR Form for this kind of ITR? 18. Is Pedro required to submit an audited financial statement as an attachment to his ITR?

upervis employee of XYZ Corporation. He provided the following data for the taxable year 2022: Salaries @ P150,000 a month share SSS contributions-EE PHIC contributions-EE share Pag-ibig contributions-EE share SSS contributions-ER share PHIC contributions-ER share Pag-ibig contributions-ER share Allowances subject to liquidation Allowances NOT subject to liquidation Rice allowance P2,500 a month Christmas gift/bonus 13th month pay and midyear bonus Productivity pay covered by a CBA Monetized unused vacation leave for 15 days Monetized unused sick leave for 5 days Medical cash allowance to dependents Actual medical benefits Amount in BIR Form 2316 received from the employer for taxable year 2022 Sales Sales returns and allowances Cost of sales Operating expenses: Salaries Depreciation Rental Interest income from peso bank deposits-BDO Interest income from dollar bank deposits-BDO PCSO winnings Dividend income from domestic corporation Gain on sale of land in the Philippines held as capital asset with cost of P2,000,000, zonal value is P1,800,000 Gain on sale of shares of domestic corporation (non-listed) Gain on sale of shares of domestic corporation (listed) Total amount in BIR Forms 2307 received from buyers-1st to 3rd QTR Total amount in BIR Forms 2307 received from buyers-4th QTR Payment for BIR Form 1701Q-1st Quarter Payment for BIR Form 1701Q-2nd Quarter Payment for BIR Form 1701Q-3rd Quarter Required: P1,800,000 32,000 15,000 9,000 64,000 15,000 9,000 50,000 90,000 30,000 40,000 250,000 25,000 82,500 27,500 3,000 10,000 498,000 6,100,000 100,000 2,745,000 600,000 200,000 100,000 50,000 90,000 100,000 30,000 600,000 100,000 200,000 40,000 1. Total EXEMPT de minimis benefits 2. Total TAXABLE 13th month pay and other benefits 3. Fringe benefits tax 4. Total allowable deductions from business income of XYZ Corporation in relation to Pedro's salaries and benefits. 5. Total FWT 6. Total CGT 7. Taxable compensation income 8. Taxable business income 9. Regular income tax due 10. Total creditable taxes 21,000 25,000 30,000 45,000 11. Regular Income tax still due IF FILED AND PAID ON OR BEFORE THE DEADLINE 12. Deadline of filing of Pedro's annual ITR for taxable year 2022 13. Surcharge if Pedro paid his 2022 ITR one day late. 14. Interest if Pedro paid his 2022 ITR one day late. 15. Compromise penaty if Pedro paid his 2022 ITR one day late. 16. Is Pedro qualified to substituted filing of ITR? 17. What is the appropriate BIR Form for this kind of ITR? 18. Is Pedro required to submit an audited financial statement as an attachment to his ITR?

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 44P

Related questions

Question

Kindly answer asap. Thank yoouuuu!!

Transcribed Image Text:Pedro Penduko, owner of a merchandising company and at the same time a supervisory

employee of XYZ Corporation. He provided the following data for the taxable year 2022:

Salaries @ P150,000 a month

SSS contributions-EE share

PHIC contributions-EE share

Pag-ibig contributions-EE share

SSS contributions-ER share

PHIC contributions-ER share

Pag-ibig contributions-ER share

Allowances subject to liquidation

Allowances NOT subject to liquidation

Rice allowance P2,500 a month

Christmas gift/bonus

13th month pay and midyear bonus

Productivity pay covered by a CBA

Monetized unused vacation leave for 15 days

Monetized unused sick leave for 5 days

Medical cash allowance to dependents

Actual medical benefits

Amount in BIR Form 2316 received from the employer for taxable year

2022

Sales

Sales returns and allowances

Cost of sales

Operating expenses:

Salaries

Depreciation

Rental

Interest income from peso bank deposits-BDO

Interest income from dollar bank deposits-BDO

PCSO winnings

Dividend income from domestic corporation

Gain on sale of land in the Philippines held as capital

asset with cost of P2,000,000, zonal value is P1,800,000

Gain on sale of shares of domestic corporation (non-listed)

Gain on sale of shares of domestic corporation (listed)

Total amount in BIR Forms 2307 received from buyers-1st to 3rd QTR

Total amount in BIR Forms 2307 received from buyers-4th QTR

Payment for BIR Form 1701Q-1st Quarter

Payment for BIR Form 1701Q-2nd Quarter

Payment for BIR Form 1701Q-3rd Quarter

Required:

1. Total EXEMPT de minimis benefits

2. Total TAXABLE 13th month pay and other benefits

3. Fringe benefits tax

5. Total FWT

6. Total CGT

7. Taxable compensation income

8. Taxable business income

P1,800,000

32,000

15,000

9,000

9. Regular income tax due

10. Total creditable taxes

64,000

15,000

9,000

50,000

90,000

30,000

40,000

250,000

25,000

82,500

27,500

3,000

10,000

498,000

6,100,000

100,000

2,745,000

4. Total allowable deductions from business income of XYZ Corporation in relation

to Pedro's salaries and benefits.

600,000

200,000

100,000

50,000

90,000

100,000

30,000

600,000

100,000

200,000

40,000

21,000

25,000

30,000

45,000

11. Regular Income tax still due IF FILED AND PAID ON OR BEFORE THE DEADLINE

12. Deadline of filing of Pedro's annual ITR for taxable year 2022

13. Surcharge if Pedro paid his 2022 ITR one day late.

14. Interest if Pedro paid his 2022 ITR one day late.

15. Compromise penaty if Pedro paid his 2022 ITR one day late.

16. Is Pedro qualified to substituted filing of ITR?

17. What is the appropriate BIR Form for this kind of ITR?

18. Is Pedro required to submit an audited financial statement as an attachment to his ITR?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT