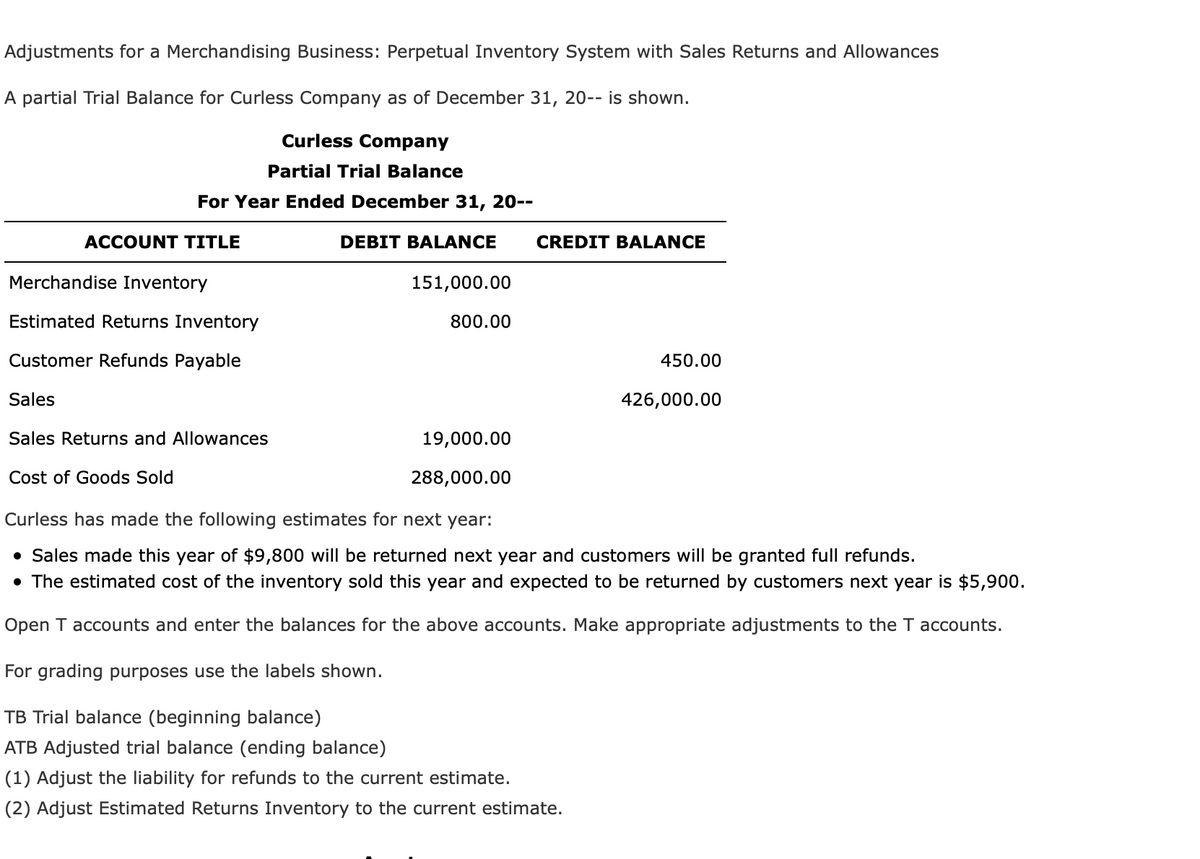

Adjustments for a Merchandising Business: Perpetual Inventory System with Sales Returns and Allowances A partial Trial Balance for Curless Company as of December 31, 20-- is shown. Curless Company Partial Trial Balance For Year Ended December 31, 20-- ACCOUNT TITLE DEBIT BALANCE CREDIT BALANCE Merchandise Inventory 151,000.00 Estimated Returns Inventory 800.00 Customer Refunds Payable 450.00 Sales 426,000.00 Sales Returns and Allowances 19,000.00 Cost of Goods Sold 288,000.00 Curless has made the following estimates for next year: • Sales made this year of $9,800 will be returned next year and customers will be granted full refunds. • The estimated cost of the inventory sold this year and expected to be returned by customers next year is $5,900. Open T accounts and enter the balances for the above accounts. Make appropriate adjustments to the T accounts. For grading purposes use the labels shown. TB Trial balance (beginning balance) ATB Adjusted trial balance (ending balance) (1) Adjust the liability for refunds to the current estimate. (2) Adjust Estimated Returns Inventory to the current estimate.

Adjustments for a Merchandising Business: Perpetual Inventory System with Sales Returns and Allowances A partial Trial Balance for Curless Company as of December 31, 20-- is shown. Curless Company Partial Trial Balance For Year Ended December 31, 20-- ACCOUNT TITLE DEBIT BALANCE CREDIT BALANCE Merchandise Inventory 151,000.00 Estimated Returns Inventory 800.00 Customer Refunds Payable 450.00 Sales 426,000.00 Sales Returns and Allowances 19,000.00 Cost of Goods Sold 288,000.00 Curless has made the following estimates for next year: • Sales made this year of $9,800 will be returned next year and customers will be granted full refunds. • The estimated cost of the inventory sold this year and expected to be returned by customers next year is $5,900. Open T accounts and enter the balances for the above accounts. Make appropriate adjustments to the T accounts. For grading purposes use the labels shown. TB Trial balance (beginning balance) ATB Adjusted trial balance (ending balance) (1) Adjust the liability for refunds to the current estimate. (2) Adjust Estimated Returns Inventory to the current estimate.

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter14: Adjustments And The Work Sheet For A Merchandising Business

Section: Chapter Questions

Problem 4SEB: WORK SHEET EXTENSIONS FOR MERCHANDISE INVENTORY ADJUSTMENTS: PERIODIC INVENTORY SYSTEM The following...

Related questions

Question

Assets

Merchandise Inventory

______ __________

Estimated Returns Inventory

________ _____________

________ ____________

________ ____________

Liabilities

Customer Refunds Payable

___________ ___________

___________ ___________

___________ ___________

Owner's Equity

Revenues

Sales

___________ ____________

Sales Returns and Allowances

__________ _____________

_________ _____________

_________ _____________

Expenses

Cost of Goods Sold

__________ _____________

_________ ______________

_________ ____________

Transcribed Image Text:Adjustments for a Merchandising Business: Perpetual Inventory System with Sales Returns and Allowances

A partial Trial Balance for Curless Company as of December 31, 20-- is shown.

Curless Company

Partial Trial Balance

For Year Ended December 31, 20--

ACCOUNT TITLE

DEBIT BALANCE

CREDIT BALANCE

Merchandise Inventory

151,000.00

Estimated Returns Inventory

800.00

Customer Refunds Payable

450.00

Sales

426,000.00

Sales Returns and Allowances

19,000.00

Cost of Goods Sold

288,000.00

Curless has made the following estimates for next year:

• Sales made this year of $9,800 will be returned next year and customers will be granted full refunds.

• The estimated cost of the inventory sold this year and expected to be returned by customers next year is $5,900.

Open T accounts and enter the balances for the above accounts. Make appropriate adjustments to the T accounts.

For grading purposes use the labels shown.

TB Trial balance (beginning balance)

ATB Adjusted trial balance (ending balance)

(1) Adjust the liability for refunds to the current estimate.

(2) Adjust Estimated Returns Inventory to the current estimate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,