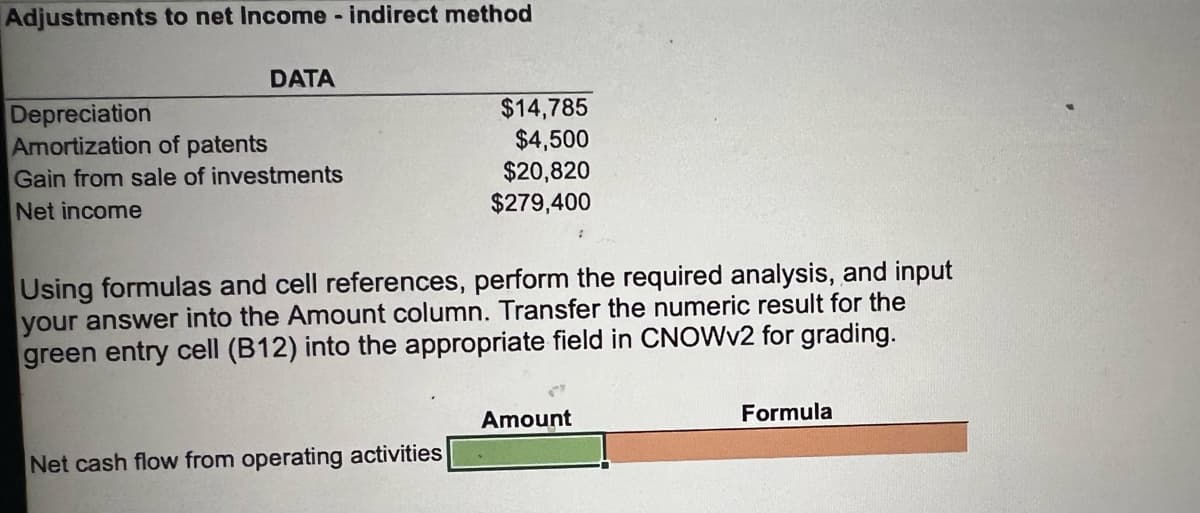

Adjustments to net Income - indirect method DATA $14,785 $4,500 Depreciation Amortization of patents Gain from sale of investments Net income $20,820 $279,400 Using formulas and cell references, perform the required analysis, and input your answer into the Amount column. Transfer the numeric result for the green entry cell (B12) into the appropriate field in CNOWV2 for grading. Amount Formula Net cash flow from operating activities

Adjustments to net Income - indirect method DATA $14,785 $4,500 Depreciation Amortization of patents Gain from sale of investments Net income $20,820 $279,400 Using formulas and cell references, perform the required analysis, and input your answer into the Amount column. Transfer the numeric result for the green entry cell (B12) into the appropriate field in CNOWV2 for grading. Amount Formula Net cash flow from operating activities

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter15: Statement Of Cash Flows

Section: Chapter Questions

Problem 2BE

Related questions

Question

17

Transcribed Image Text:Adjustments to net Income - indirect method

DATA

Depreciation

Amortization of patents

Gain from sale of investments

Net income

$14,785

$4,500

$20,820

$279,400

Using formulas and cell references, perform the required analysis, and input

your answer into the Amount column. Transfer the numeric result for the

green entry cell (B12) into the appropriate field in CNOWV2 for grading.

Amount

Formula

Net

ash flow from operating activities

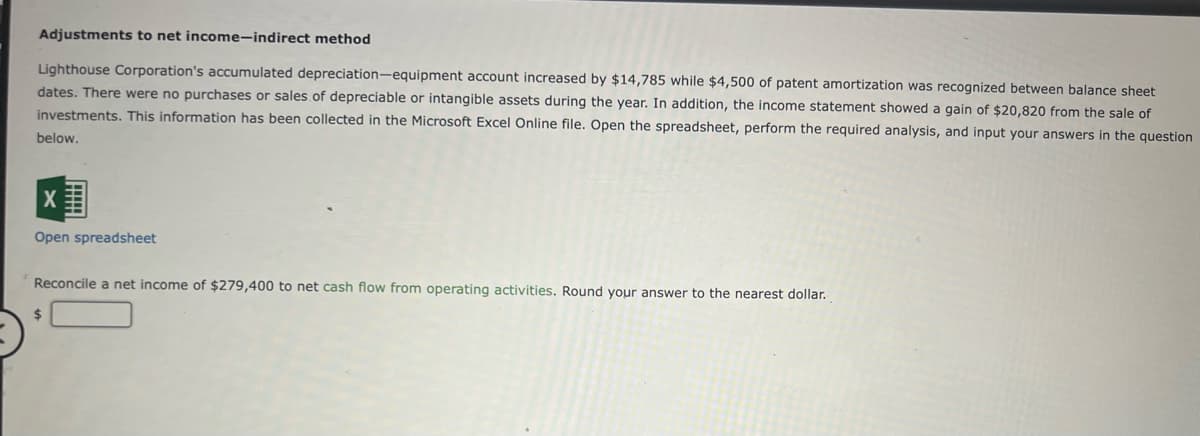

Transcribed Image Text:Adjustments to net income-indirect method

Lighthouse Corporation's accumulated depreciation-equipment account increased by $14,785 while $4,500 of patent amortization was recognized between balance sheet

dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a gain of $20,820 from the sale of

investments. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the question

below.

Open spreadsheet

Reconcile a net income of $279,400 to net cash flow from operating activities. Round your answer to the nearest dollar.

2$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,