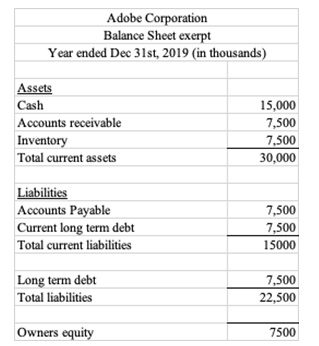

Adobe is a software company that creates the most innovative creativity apps. Recently their software has become cloud-based. Their price to book ratio is 1.67 and they currently have 1,000,000 shares outstanding. Below you will find an excerpt from their balance sheet for 2019 Calculate the stock price

Q: The Turnip Company plans to issue preferred stock. Currently, the company’s stock sells for $115.…

A: Company needs to finance the assets for the purpose of regulating the business activities. These…

Q: Mr. Baiju is working in I.T company, he wants to enter stock market by investing in shares of listed…

A: Purchase Price = 120 Dividend = 10 Price at end = 140

Q: Being a newly appointed analyst at Credit Suisse, one of your prime role is to facilitate the Global…

A: According to dividend discount model value of stock is nothing but present value of future dividend.

Q: The company has offered you a $5,000 bonus, which you may receive today, or 100 shares of the…

A: Definition: Present value: This is the amount of future value reduced or discounted at a rate of…

Q: Answer the following questions in a separate document. Explain how you reached the answer or show…

A: a). = 8 x 0..65…

Q: Assume you want to invest in the stock market, and your friends tell you about a company s stock…

A: Stock market is a place where numerous buyers and sellers meet, interact with each other to make…

Q: Being a newly appointed analyst at Credit Suisse, one of your prime role is to facilitate the Global…

A: Stock price: Stock price is the present value of the future payments. Future payments includes…

Q: Being a newly appointed analyst at Credit Suisse, one of your prime role is to facilitate the Global…

A: Dividend is considered as the payment made by the company to the shareholders from the earnings.…

Q: Adobe is a software company that creates the most innovative creativity apps. Recently their…

A: The PB ratio compares the market value of a company’s stock (market capitalization) with its book…

Q: IL Assume that now is June 1, 2021, and that you are looking at the U.S. equity market with a…

A: As you have posted a question with the specific mention (3). So, we will solve the same for you.

Q: You are comparing the preferred stocks of 2 companies. League of Legendary Wizards and Grand Flying…

A: An individual shall select a stock that has a higher or equal expected return than the required…

Q: on the news and find out the stock market has gone up 10%. Based on the data in Table 10.6, by how…

A: Equity beta is % change in stock with respect to 1% change in market. Expected change % in stock =…

Q: IL Assume that now is June 1, 2021, and that you are looking at the US. equity market with a special…

A: As you have mentioned a specific question (3rd) to solve, we will solve the same question for you.

Q: Pielago is eyeing for another company to invest her excess funds. She is interested in a publicly…

A: Given: Year Dividend per share 2014 7.03 2015 7.05 2016 7.16 2017 7.21 2018 7.27 2019…

Q: You have been hired as a financial analyst in a consulting firm which primary deals with financial…

A: Price of Stock = Expected Dividend / (Re -g) RUBIK LLC Price of Stock =$ 56 Expected growth rate =…

Q: Smith Enterprises recently was profiled on a financial informa tion website and touted as a "hot"…

A: The information about the volume and average volume of stock traded help to analyze whether the…

Q: The company has offered you a $5,000 bonus, which you may receive today, or 100 shares of the…

A: 1) In mathematically worth is equal in both shares option and bonus option. meanwhile, the worker…

Q: Michelle Walker is interested in buying the stock of Sandhill, Inc., which is increasing its…

A: Calculation of current value of stock: Answer: Current value of stock is $53.85 Given information:…

Q: IL Assume that now is June 1, 2021, and that you are looking at the U.S. equity market with a…

A: As you have mentioned question 3 to solve, so we will solve the same question for you.

Q: n is a savvy investor. On january 1, 2010, she bought shares of stock in amazon, chiptole, and Hulu.…

A: The given problem can be solved using RATE function in excel. RATE function will compute annual…

Q: Assume we are now in mid- or late February 2022. After conducting your own analysis, you have made a…

A: Behavioral finance is finance that helps in understanding the behavior and mindset of investors in…

Q: True false

A: The price-earnings ratio is a ratio that tells investors what is the worth of the company they have…

Q: Being a newly appointed analyst at Credit Suisse, one of your prime role is to facilitate the Global…

A: Note : As per the bartelby guidelines only first question will be answered. Part 1. The dividend…

Q: Apple corporation is looking to invest in Dark Sky computing company. Dark Sky is specialized in…

A: Dividend Yield is the financial ratio which determines the amount of dividend paid as compared to…

Q: Being a newly appointed analyst at Credit Suisse, one of your prime role is to facilitate the Global…

A: Stock Price: Value of the stock is the present value of future payments. Future payments includes…

Q: Apple corporation is looking to invest in Dark Sky computing company. Dark Sky is specialized in…

A: Calculation of expected value of dividend: Answer: The expected value of dividend is $1.34 Annual…

Q: Suppose that, as a fund manager, you purchase 5,000 shares of Company X on 1 January 2019 for $10…

A: The available-for-sale investments were made by the corporation with a prescribed motive to trade…

Q: Being a newly appointed analyst at Credit Suisse, one of your prime role is to facilitate the Global…

A: Current stock price is the present value of the future payment. Future payments includes expected…

Q: eing a newly appointed analyst at Credit Suisse, one of your prime role is to facilitate the Global…

A: The questions are based on the calculation of price of stock by use of dividend discounting methods.

Q: Answer the Situation correctly show your Solution.(Also show the formulas that used) As a new…

A: Stock is also known as equity, refers to a security that represents the ownership of a portion of…

Q: Currently, inventors in the stock market expect the price of the XYZ corporation's stock next year…

A: The efficient market hypothesis states that the asset prices reflect all the information present in…

Q: "Bein g a newly appointed analyst at Credit Suiss e, one of your prime role is to facilitate the…

A: Introduction: Dividend discount model is the model which is used to calculate the stock price. It is…

Q: Being a newly appointed analyst at Credit Suisse, one of your prime role is to facilitate the Global…

A: Dividend discount model (DDM)- It is a method of valuing a company's stock price based on the logic…

Q: You invest $7,873 in stock and receive $102, $123, $121, and $155 in dividends over the following 4…

A: IRR is the internal rate of return at which net present value is equal to zero.

Q: You decide to invest in stock in a particular kind of company and set the guideline that you will…

A: Percentile shows the percentage of the number of values below the specified item as compared to the…

Q: Lahhey Publishing wishes to estimate the value of its outstanding preferred stock. The preferred…

A: Annual dividend (D) = RM 7.50 Annual rate of return (r) = 8%

Q: Adobe is a software company that creates the most innovative creativity apps. Recently their…

A: Ratio is a tool which is used to evaluate the relation between different financial items of a…

Q: You are considering purchasing shares in First Dawn Inc. Your research reveals the dividend trend…

A: Dividend per share is the amount paid to the shareholders from the earnings available to the…

Q: An investment club has set a goal of earning 15% on the money it invests in stocks. The members are…

A: “Hey, since the question contains multiple sub-parts, we will answer first three sub-parts. So…

Q: "Bein g a newly appointed analyst at Credit Suisse, one of your prime role is to facilitate the…

A: 1. What would be the expected price of Travles stock today, given the streams of future dividends of…

Q: Compute for the following problems. Show your solution. Assume you buy 100 shares of stock at Php40…

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one…

Q: Assume we are now in mid- or late February 2022. After conducting your own analysis, you have made a…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: You are trying to estimate the intrinsic value of the shares of Flying High Ltd, a manufacturer of…

A: Residual Income Valuation Method is a technique in which the value per share is determined as the…

Q: On November 7, 2013, Twitter released its initial public offering (IPO) priced at $26 per share.…

A: Given: Initial public offering price: $26 per share At the end of the day price: $44.90 Four years…

Q: You notice that Cisco Computer Systems has a share price of $30.72 and earnings per share of $0.52.…

A: We know that P/E ratio = Market Price per share/Earnings per share

Adobe is a software company that creates the most innovative creativity apps. Recently their software has become cloud-based. Their price to book ratio is 1.67 and they currently have 1,000,000 shares outstanding. Below you will find an excerpt from their balance sheet for 2019

- Calculate the stock price using the price to book ratio.

- If their stock price is listed on the stock market at $9, should the stockholders sell or hold the stock?

- Critically discuss the price to book ratio in valuing stocks and provide an alternative method to see if a stock is undervalued or overvalued.

Step by step

Solved in 3 steps

- Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000Balance Sheet Baggett Companys balance sheet accounts and amounts as of December 31, 2019, are shown in random order as follows: Required: 1. Prepare a December 31, 2019, balance sheet for Baggett. 2. Compute the debt to-assets ratio.

- Investments in Equity Securities Manson Incorporated reported investments in equity securities of 60,495 as a current asset on its December 31, 2018, balance sheet. An analysis of Mansons investments on December 31, 2018, reveals the following: During 2019, the following transactions related to Mansons investments occurred: Required: 1. Assuming Manson prepares quarterly financial statements, prepare journal entries to record the preceding information. 2. Show the items of income or loss from investment transactions that Manson reports for each quarter of 2019. 3. Show how Mansons investments are reported on the balance sheet on March 31, 2019; June 30, 2019; September 30, 2019; and December 31, 2019.Spreadsheet from Trial Balance Heinz Companys post closing trial balance as of December 31, 2018, and the adjusted trial balance as of December 31, 2019, are shown here: A review of the accounting records reveals the following additional information: a. Bomb payable with a face value, book value, and market value of 14,000 were retired on June 30, 2019. b. Bonds payable with a face value of 8,000 were issued at 90.25 on August 1, 2019. They mature on August 1, 2024. The company uses the straight-line method to amortize the bond discount. c. The company sold a building that had an original cost of 8,000 and a book value of 4,800. The company received 2,200 in cash for the building and recorded a loss of 2,600. d. Equipment with a cost of 4,000 and a book value of 1,400 was exchanged for an acre of land valued at 2,700. No cash was exchanged. e. Long-term investments in bonds being held to maturity with a cost of 1,000 were sold for 800. f. Sixty-five shares of common stock were exchanged for a patent. The common stock was selling for 20 per share at the time of the exchange. Required: Prepare a spreadsheet to support a statement of cash flows for 2019.Ratio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and state mcnt of cash flows: Long-term debt S 4,400 Interest expense S 398 Total liabilities 8,972 Net income 559 Total assets 38,775 Interest payments 432 Total equity 29,803 Cash flows from operations 1.015 Operating income 1.223 Income tax expenses 266 Income taxes paid 150 Required: Calculate the following ratios for Rising Stars: (a) debt to equity, (b) debt to total assets, (c) long-term debt to equity, (d) times interest earned (accrual basis), and (e) times interest earned (cash basis). (Note: Round answers to three decimal places.) CONCEPTUAL CONNECTION Interpret these results. 3.What does it mean if a bond is callable

- Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.Multiple-Step and Single-Step Income Statements, and Statement of Comprehensive Income On December 31, 2019, Opgenorth Company listed the following items in its adjusted trial balance: Additional data: 1. Seven thousand shares of common stock have been outstanding the entire year. 2. The income tax rate is 30% on all items of income. Required: 1. Prepare a 2019 multiple-step income statement. 2. Prepare a 2019 single-step income statement. 3. Prepare a 2019 statement of comprehensive income.Investments in Equity Securities Noonan Corporation prepares quarterly financial statements and invests its excess funds in marketable securities. At the end of 2018, Noonans portfolio of investments consisted of the following equity securities: Dunne the first half of 2019, Noonan engaged in the following investment transactions: Required: 1. Record Noonans investment transactions for January 6 through June 30, 2019. 2. Show the items of income or loss from investment transactions that Noonan reports for each of the first and second quarters of 2019. 3. Show how the preceding items are reported on the first and second quarter 2019 ending balance sheets, assuming that management expects to dispose of the Keene and Sachs securities within the next year.

- Problem Reporting Long-Term Debt Fridley Manufacturings accounting records reveal the following account balances after adjusting entries are made on December 31, 2020. Required: Prepare the current liabilities and long-term debt portions of Fridleys balance sheet at December 31, 2020. Provide a separate line item for each issue (do not combine separate bonds or notes payable), but some items may need to be split into more than one item. Accounts payable $ 62,500 Bonds payable (9.4%, due in 2027) 800,000 Lease liability* 41,500 Bonds payable (8.7%, due in 2023) 50,000 Deferred tax liability* 133.400 Discount on bonds payable (94%, due in 2027) 12,600 Income taxes payable 26,900 * Long term liability Interest payable $ 38,700 Installment note payable (8%, equal installments due 2021 to 2024) 120,000 Notes payable (7.8%, due in 2025) 400,000 Premium on notes payable (7.8%, due in 2025) 6, [00 Note payable, 4% $50,000 face amount. due in 2026 (net of discount) 31,900Refer to the information in RE13-5. Assume that on December 31, 2019, the investment in Smith Corporation bonds has a market value of 12,500. Prepare the year-end journal entry to record the unrealized gain or loss.Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.