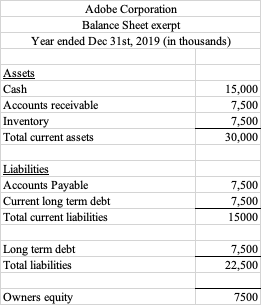

Adobe is a software company that creates the most innovative creativity apps. Recently their software has become cloud based. Their price to book ratio is 1.67 and they currently have 1,000,000 shares outstanding. Below you will find an excerpt from their balance sheet for 2019 Critically discuss the price to book ratio in valuing stocks and provide an alternative method to see if a stock is undervalued or overvalued.

Q: o have gone up or down: Starbucks Tiffany & Co. Hershey McDonald's…

A: Given Starbucks Tiffany & Co. Hershey McDonald's Beta…

Q: Dumo is a trader at ZNF Equity traders and has just identified a stock, UFSI Limited, which is…

A: For long position (purchase) in Put option, Pay off from long position in stock:

Q: You invest $1,500 into a "hot stock" through the Robin Hood app. The stock does well in the first…

A: We can find the money-weighted return by taking the investment made in the stock $1500 and $1000 and…

Q: You have added to your stockholdings in ABC, as follows: 11/2016 – 100 shares at $18 per share…

A: As which shares to be sold are not specified the gain will be calculated based on the average buying…

Q: The company has offered you a $5,000 bonus, which you may receive today, or 100 shares of the…

A: Definition: Present value: This is the amount of future value reduced or discounted at a rate of…

Q: Using your iphone, you noticed that IBM was trading at a bargain price, so you decided to purchase…

A: A person who is buying or selling the shares of a company that is already listed will have to do the…

Q: How would I calculate this using excel? or a financial calculator? the common stock of clinton…

A: It is given that,Current price of stock is $20.Increasing rate is 3%.Decreasing rate is 3%.

Q: on the news and find out the stock market has gone up 10%. Based on the data in Table 10.6, by how…

A: Equity beta is % change in stock with respect to 1% change in market. Expected change % in stock =…

Q: Based on five years of manthiy data, you derive the following information for the companies listed:…

A: Financial statements are statements which states the business activities performed by the company .…

Q: What is the price per share (PPS) of the round and the total number of shares post-round?

A: Correct Option: C. Only (3) is correct The price per share (PPS) equals 1,280.00 €; the total…

Q: The Durkin Investing Agency has been the best stock picker in the country for the past two years.…

A: Efficient market: A market in which all the related data is available to all the investors in…

Q: A tech firm that has developed a new type of internet browser is planning an IPO of 7,000,000 shares…

A: Gross proceeds = No. of shares of common stock issued x issue value per share = 7,000,000 shares x…

Q: Gasgard is a country which is going through a historical structural change in its economy. Experts…

A: The expected return of stocks is generally based on different types of market factors and the…

Q: asic Earnings per share? b. The number of shares to be used in computing the diluted…

A: Given in the question: Net Income during the year of 2021 = $1,712,500 300,000 shares of common…

Q: On November 7, 2013, Twitter released its initial public offering (IPO) priced at $26 per share.…

A: Initial public offering is the method by which corporations raise capital by issuing shares to…

Q: The specific stock SPX:IND, which is an abbreviation for the S&P 500 stock is like a collection of…

A: The question is based on the concept of interest earned on the investment by the use of the…

Q: You have risen through the ranks of a coffee company, from the lowly green-apron barista to the…

A: Cost of equity represent the portion of financed amount of equity which is paid to common stock…

Q: Wall Street performs a sort of “financial alchemy” enabling the individual to benefit from…

A: Investment means engaging your funds to generate income for the coming years. There are various…

Q: The company has offered you a $5,000 bonus, which you may receive today, or 100 shares of the…

A: Cash bonus is the amount of money which the individual will get today. This might depend on the…

Q: Your company has two divisions: One division sells software and the other division sells computers…

A: Answer a) Cost of debt Kd=(1-tax rate)×YTM=(1-35%)×6.4%=4.16%Cost of Equity Kd=Risk free…

Q: You’re acting as a financial reporting consultant for a client called Parkway who operates a chain…

A: Introduction: Our profit after tax that year was £2,600,000, and figuring operating profits (EPS)…

Q: Adobe is a software company that creates the most innovative creativity apps. Recently their…

A: Ratio is a tool which is used to evaluate the relation between different financial items of a…

Q: You are a Financial Investment Counselor, and you have several clients who are working for a very…

A: since they are a very successful technology company, as they are a financial counselor they are…

Q: average

A: Formula for mean: Sum of values/n Formula for SD: sd = sqrt of (summation of (x - mean)^2/n Formula…

Q: You have risen through the ranks of a coffee comany, from the lowly green-apron barista to the…

A: The conceptual formula used:

Q: Due to growing demand for computer software, the Perry Company has had a very successful year and…

A: GIVEN ÷ EPS = $5.50 Price/earning ratio = 12 FORMULA Share price = EPS × price/earning ratio

Q: Dumo is a trader at ZNF Equity traders and has just identified a stock, UFSI Limited, which is…

A: The question is based on calculation of total return from an investment strategy in combination of…

Q: ane is ready to invest $200,000 in stocks and her financial consultant provided six different…

A: This problem is based on the context of Capital rationing. Under this we need to allocate the funds…

Q: After learning how to value a stock in his Corporate Finance class, Mark Stark decided to put his…

A: The constant growth rate model determines the cost of capital by assuming that the dividend will…

Q: Dudley Trudy, CFA, recently met with one of his clients. Trudy typically invests in a master list of…

A: The question is based on the concept and types of risk involved in security selection and portfolio…

Q: Assume we are now in mid- or late February 2022. After conducting your own analysis, you have made a…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: Your company has two divisions: One division sells software and the other division sells computers…

A: Given: Particulars Common stock Debt Beta 1.25 Risk free rate 4.20% Market value…

Q: You are trying to estimate the intrinsic value of the shares of Flying High Ltd, a manufacturer of…

A: Residual Income Valuation Method is a technique in which the value per share is determined as the…

Q: On November 7, 2013, Twitter released its initial public offering (IPO) priced at $26 per share.…

A: Given: Initial public offering price: $26 per share At the end of the day price: $44.90 Four years…

Q: (Margin Purchase and Selling Short) You are very optimistic about the personal computer industry, so…

A: Margin purchase is the strategy of borrowing funds from a bank or a broker to buy stocks. Short…

Q: Corporations often distribute profits to their shareholders in the form of dividends, which are…

A: Step1:Introduction The annual percentage rate of return: It refers to the amount earned on a…

Q: Your company has two divisions: One division sells software and the other division sells computers…

A: WACC: It refers to the overall cost of the company. In this cost of capital, every portion of…

Q: A global equity manager is assigned to select stocks from a universe of large stocks throughout the…

A: Calculation of total value added of all managers’ decision and value added by her country and value…

Q: James had an equity portfolio that contains $40,000 investment in Tesla (TSLA) and $60,000…

A: The mathematical equation for computing: Note: Z Value of 97% confidence level is 2.17 (From Z…

Q: You have risen through the ranks of a coffee comany, from the lowly green-apron barista to the…

A: In the given question we need to calculate the expected return on company's stock. We can solve this…

Adobe is a software company that creates the most innovative creativity apps. Recently their software has become cloud based. Their price to book ratio is 1.67 and they currently have 1,000,000 shares outstanding. Below you will find an excerpt from their balance sheet for 2019

- Critically discuss the price to book ratio in valuing stocks and provide an alternative method to see if a stock is undervalued or overvalued.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000Balance Sheet Baggett Companys balance sheet accounts and amounts as of December 31, 2019, are shown in random order as follows: Required: 1. Prepare a December 31, 2019, balance sheet for Baggett. 2. Compute the debt to-assets ratio.

- Spreadsheet from Trial Balance Heinz Companys post closing trial balance as of December 31, 2018, and the adjusted trial balance as of December 31, 2019, are shown here: A review of the accounting records reveals the following additional information: a. Bomb payable with a face value, book value, and market value of 14,000 were retired on June 30, 2019. b. Bonds payable with a face value of 8,000 were issued at 90.25 on August 1, 2019. They mature on August 1, 2024. The company uses the straight-line method to amortize the bond discount. c. The company sold a building that had an original cost of 8,000 and a book value of 4,800. The company received 2,200 in cash for the building and recorded a loss of 2,600. d. Equipment with a cost of 4,000 and a book value of 1,400 was exchanged for an acre of land valued at 2,700. No cash was exchanged. e. Long-term investments in bonds being held to maturity with a cost of 1,000 were sold for 800. f. Sixty-five shares of common stock were exchanged for a patent. The common stock was selling for 20 per share at the time of the exchange. Required: Prepare a spreadsheet to support a statement of cash flows for 2019.Ratio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and state mcnt of cash flows: Long-term debt S 4,400 Interest expense S 398 Total liabilities 8,972 Net income 559 Total assets 38,775 Interest payments 432 Total equity 29,803 Cash flows from operations 1.015 Operating income 1.223 Income tax expenses 266 Income taxes paid 150 Required: Calculate the following ratios for Rising Stars: (a) debt to equity, (b) debt to total assets, (c) long-term debt to equity, (d) times interest earned (accrual basis), and (e) times interest earned (cash basis). (Note: Round answers to three decimal places.) CONCEPTUAL CONNECTION Interpret these results. 3.What does it mean if a bond is callableNet Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.

- Investments in Equity Securities Manson Incorporated reported investments in equity securities of 60,495 as a current asset on its December 31, 2018, balance sheet. An analysis of Mansons investments on December 31, 2018, reveals the following: During 2019, the following transactions related to Mansons investments occurred: Required: 1. Assuming Manson prepares quarterly financial statements, prepare journal entries to record the preceding information. 2. Show the items of income or loss from investment transactions that Manson reports for each quarter of 2019. 3. Show how Mansons investments are reported on the balance sheet on March 31, 2019; June 30, 2019; September 30, 2019; and December 31, 2019.Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.

- Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.Multiple-Step and Single-Step Income Statements, and Statement of Comprehensive Income On December 31, 2019, Opgenorth Company listed the following items in its adjusted trial balance: Additional data: 1. Seven thousand shares of common stock have been outstanding the entire year. 2. The income tax rate is 30% on all items of income. Required: 1. Prepare a 2019 multiple-step income statement. 2. Prepare a 2019 single-step income statement. 3. Prepare a 2019 statement of comprehensive income.Balance Sheet Calculations Cornerstone Development Companys balance sheet information at the end of 2019 and 2020 is provided in random order, as follows: Additional information: At the end of 2019, (a) the amount of long-term liabilities is twice the amount of current liabilities and (b) there are 2,900 shares of common stock outstanding. During 2020, the company (a) issued 100 shares of common stock for 25 per share, (b) earned net income of 20,600, and (c) paid dividends of 1 per share on the common stock outstanding at year-end. Required: Next Level Fill in the blanks lettered (a) through (p). All of the necessary information is provided. (Hint: It is not necessary to calculate your answers in alphabetical order.)