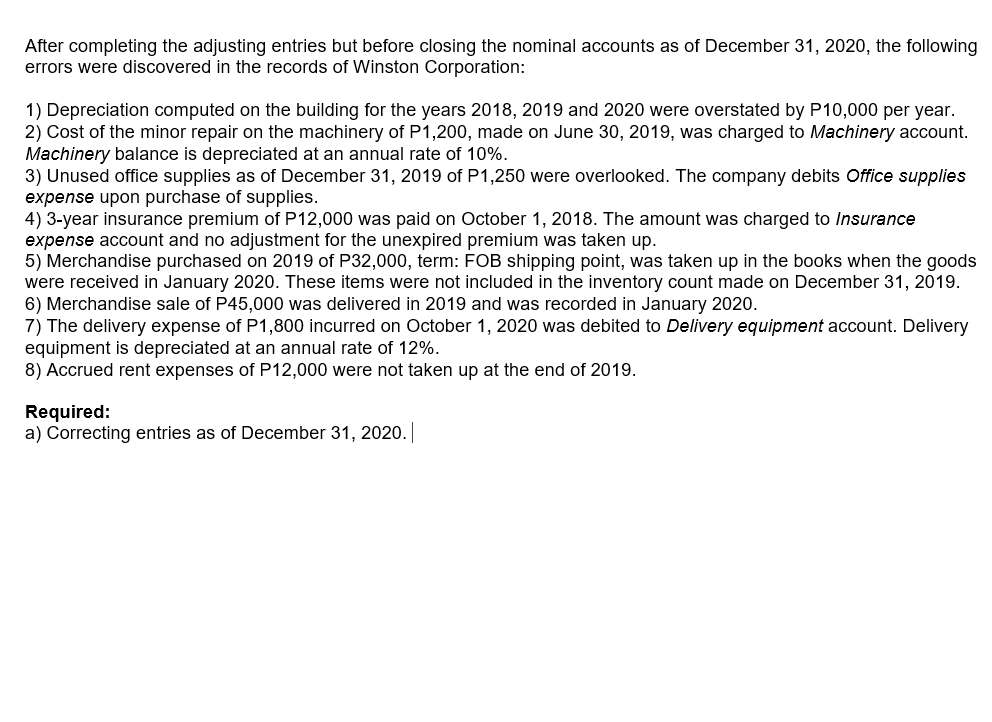

After completing the adjusting entries but before closing the nominal accounts as of December 31, 2020, the following errors were discovered in the records of Winston Corporation: 1) Depreciation computed on the building for the years 2018, 2019 and 2020 were overstated by P10,000 per year. 2) Cost of the minor repair on the machinery of P1,200, made on June 30, 2019, was charged to Machinery account. Machinery balance is depreciated at an annual rate of 10%. 3) Unused office supplies as of December 31, 2019 of P1,250 were overlooked. The company debits Office supplies expense upon purchase of supplies. 4) 3-year insurance premium of P12,000 was paid on October 1, 2018. The amount was charged to Insurance expense account and no adjustment for the unexpired premium was taken up. 5) Merchandise purchased on 2019 of P32,000, term: FOB shipping point, was taken up in the books when the goods were received in January 2020. These items were not included in the inventory count made on December 31, 2019. 5) Merchandise sale of P45,000 was delivered in 2019 and was recorded in January 2020. 7) The delivery expense of P1,800 incurred on October 1, 2020 was debited to Delivery equipment account. Delivery equipment is depreciated at an annual rate of 12%. 3) Accrued rent expenses of P12,000 were not taken up at the end of 2019. Required:

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images