alculate the following ratios for Friendly Fashions in 2021. (Enter your Dividend yield and Price-earning ratic laces. Enter your answers in millions (i.e. 5,500,000 should be entered as 5.5).) FRIENDLY FASHIONS Choose Numerator Choose Denominator Return on equity Return on equity Dividend yield Dividend yield Earnings per share Earnings per share Price-earnings ratio

alculate the following ratios for Friendly Fashions in 2021. (Enter your Dividend yield and Price-earning ratic laces. Enter your answers in millions (i.e. 5,500,000 should be entered as 5.5).) FRIENDLY FASHIONS Choose Numerator Choose Denominator Return on equity Return on equity Dividend yield Dividend yield Earnings per share Earnings per share Price-earnings ratio

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter17: Financial Statement Analysis

Section17.4: Analyzing Financial Statements Using Financial Ratios

Problem 1WT

Related questions

Question

I need help with this question to understand the topic

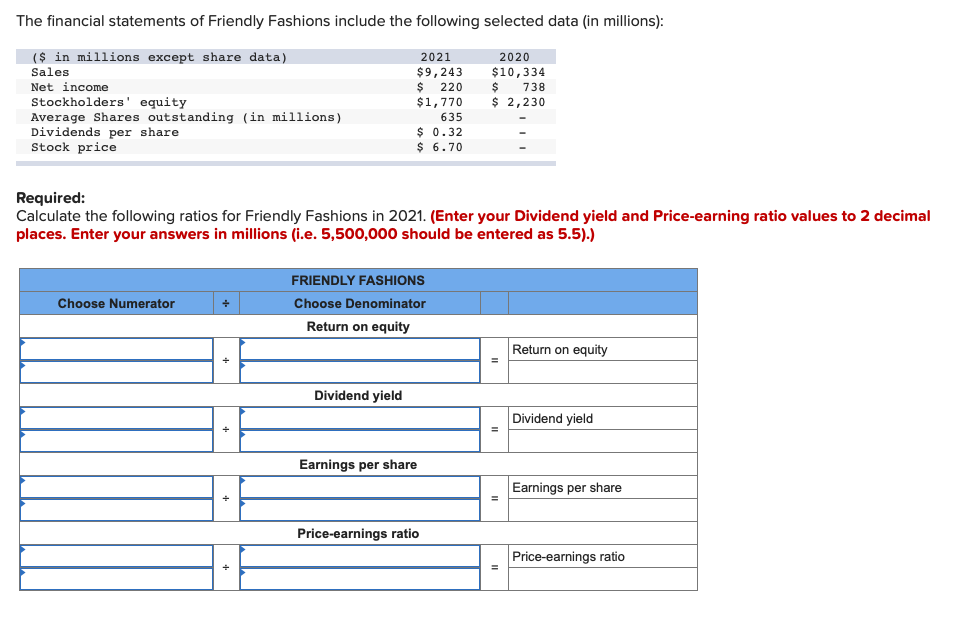

Transcribed Image Text:The financial statements of Friendly Fashions include the following selected data (in millions):

($ in millions except share data)

Sales

2021

$9,243

$ 220

$1,770

2020

$10,334

Net income

Stockholders' equity

Average Shares outstanding (in millions)

Dividends per share

Stock price

738

$ 2,230

635

$ 0.32

$ 6.70

Required:

Calculate the following ratios for Friendly Fashions in 2021. (Enter your Dividend yield and Price-earning ratio values to 2 decimal

places. Enter your answers in millions (i.e. 5,500,000 should be entered as 5.5).)

FRIENDLY FASHIONS

Choose Numerator

Choose Denominator

Return on equity

Return on equity

Dividend yield

Dividend yield

Earnings per share

Earnings per share

%3D

Price-earnings ratio

Price-earnings ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning