Round all answers to two decimal places except for dividend payout ratio which is rounded to four decimal places. 1. Compute the following: a. Return on sales 17.85 % b. Return on assets 8.71 c. Return on stockholders' equity 18.45 % d. Earnings per share 0.29 e. Price-earnings ratio f. Dividend yield % g. Dividend payout ratio 2. CONCEPTUAL CONNECTION: Assume you are considering an investment to provide retirement income. Based on the above, which would be of particular interest to you? Since all the ratios are profitability ratios, they should all be of interest to investors. Some, however, may be of more interest than others depending on the objectives of the potential investor. For an investor looking for an investment to provide retirement income, the price-earnings ratio would be of particular interest.

Round all answers to two decimal places except for dividend payout ratio which is rounded to four decimal places. 1. Compute the following: a. Return on sales 17.85 % b. Return on assets 8.71 c. Return on stockholders' equity 18.45 % d. Earnings per share 0.29 e. Price-earnings ratio f. Dividend yield % g. Dividend payout ratio 2. CONCEPTUAL CONNECTION: Assume you are considering an investment to provide retirement income. Based on the above, which would be of particular interest to you? Since all the ratios are profitability ratios, they should all be of interest to investors. Some, however, may be of more interest than others depending on the objectives of the potential investor. For an investor looking for an investment to provide retirement income, the price-earnings ratio would be of particular interest.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 64P: Albion Inc. provided the following information for its most recent year of operations. The tax rate...

Related questions

Question

Practice Pack

I'm stuck on this problem

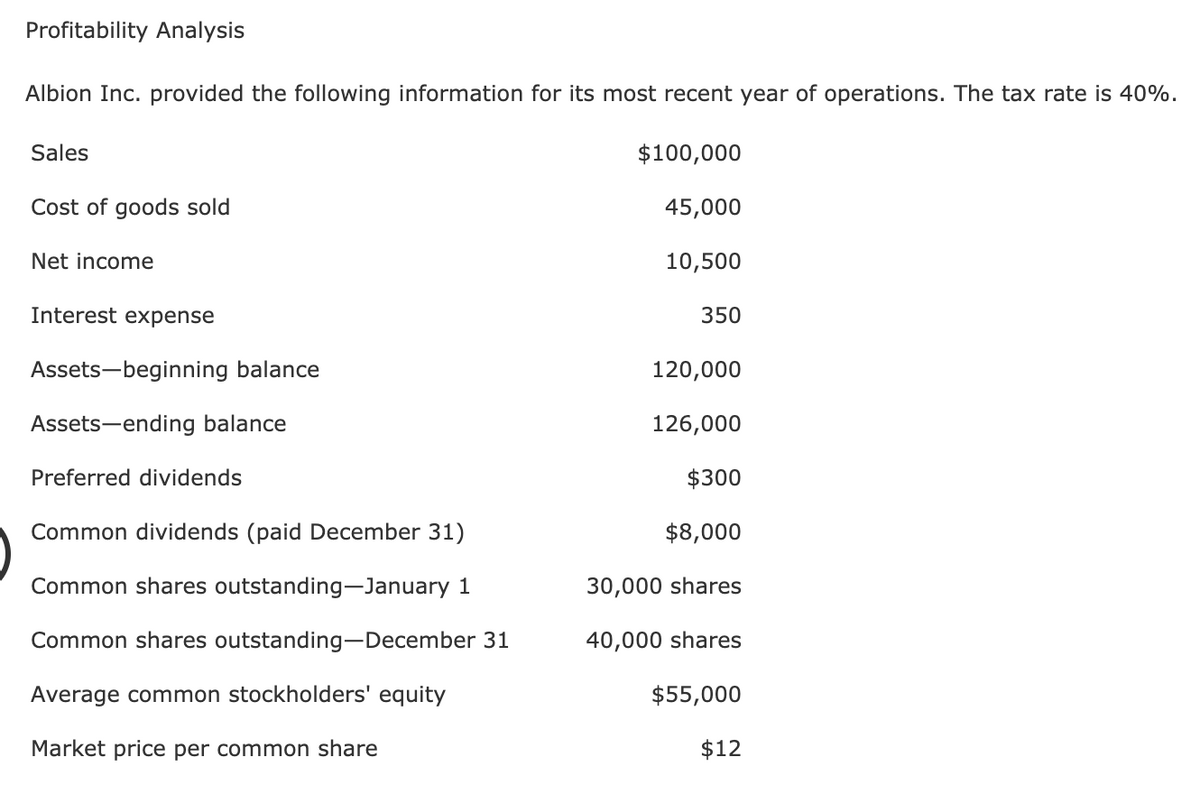

Transcribed Image Text:Profitability Analysis

Albion Inc. provided the following information for its most recent year of operations. The tax rate is 40%.

Sales

$100,000

Cost of goods sold

45,000

Net income

10,500

Interest expense

350

Assets-beginning balance

120,000

Assets-ending balance

126,000

Preferred dividends

$300

Common dividends (paid December 31)

$8,000

Common shares outstanding-January 1

30,000 shares

Common shares outstanding-December 31

40,000 shares

Average common stockholders' equity

$55,000

Market price per common share

$12

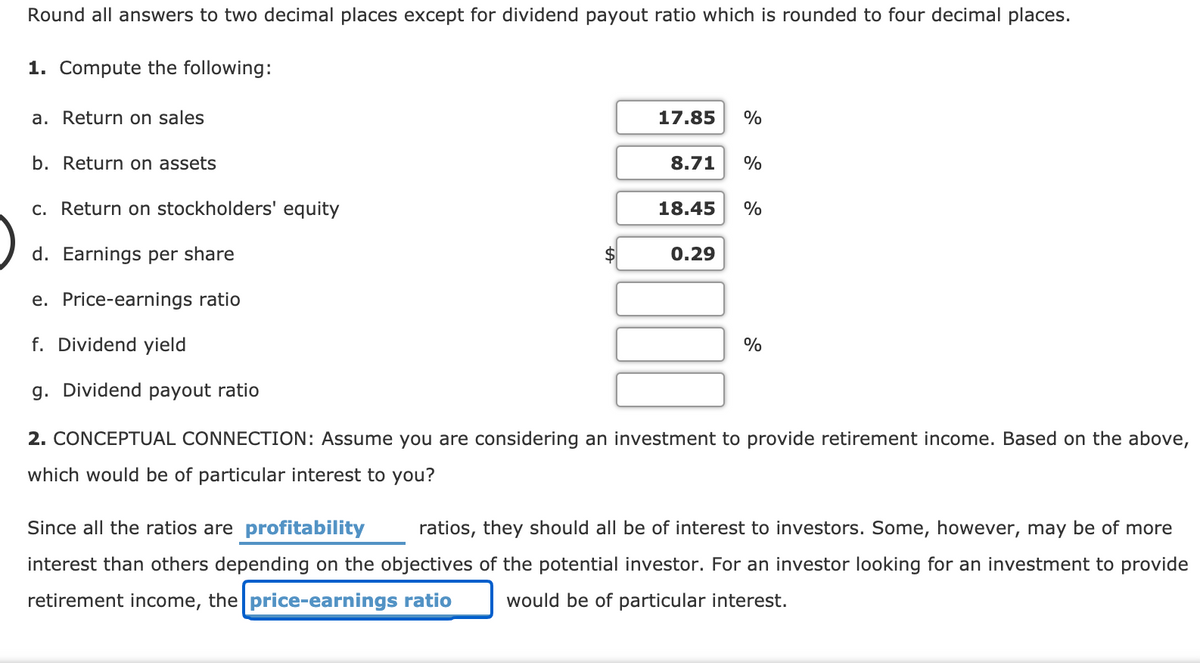

Transcribed Image Text:Round all answers to two decimal places except for dividend payout ratio which is rounded to four decimal places.

1. Compute the following:

a. Return on sales

17.85

%

b. Return on assets

8.71

%

c. Return on stockholders' equity

18.45

%

d. Earnings per share

0.29

e. Price-earnings ratio

f. Dividend yield

%

g. Dividend payout ratio

2. CONCEPTUAL CONNECTION: Assume you are considering an investment to provide retirement income. Based on the above,

which would be of particular interest to you?

Since all the ratios are profitability

ratios, they should all be of interest to investors. Some, however, may be of more

interest than others depending on the objectives of the potential investor. For an investor looking for an investment to provide

retirement income, the price-earnings ratio

would be of particular interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning