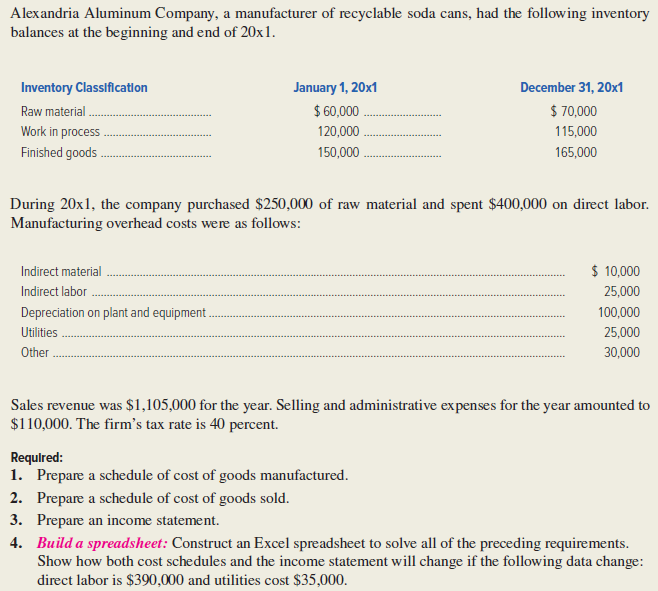

Alexandria Aluminum Company, a manufacturer of recyclable soda cans, had the following inventory balances at the beginning and end of 20x1. January 1, 20x1 $ 60,000. 120,000. Inventory Classificatlon December 31, 20x1 Raw material. $ 70,000 Work in process 115,000 Finished goods 150,000 . 165,000 During 20x1, the company purchased $250,000 of raw material and spent $400,000 on direct labor. Manufacturing overhead costs were as follows: Indirect material $ 10,000 Indirect labor 25,000 Depreciation on plant and equipment . 100,000 Utilities 25,000 Other 30,000 Sales revenue was $1,105,000 for the year. Selling and administrative expenses for the year amounted to $110,000. The firm's tax rate is 40 percent. Requlred: 1. Prepare a schedule of cost of goods manufactured. 2. Prepare a schedule of cost of goods sold. 3. Prepare an income statement. 4. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how both cost schedules and the income statement will change if the following data change: direct labor is $390,000 and utilities cost $35,000.

Alexandria Aluminum Company, a manufacturer of recyclable soda cans, had the following inventory balances at the beginning and end of 20x1. January 1, 20x1 $ 60,000. 120,000. Inventory Classificatlon December 31, 20x1 Raw material. $ 70,000 Work in process 115,000 Finished goods 150,000 . 165,000 During 20x1, the company purchased $250,000 of raw material and spent $400,000 on direct labor. Manufacturing overhead costs were as follows: Indirect material $ 10,000 Indirect labor 25,000 Depreciation on plant and equipment . 100,000 Utilities 25,000 Other 30,000 Sales revenue was $1,105,000 for the year. Selling and administrative expenses for the year amounted to $110,000. The firm's tax rate is 40 percent. Requlred: 1. Prepare a schedule of cost of goods manufactured. 2. Prepare a schedule of cost of goods sold. 3. Prepare an income statement. 4. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how both cost schedules and the income statement will change if the following data change: direct labor is $390,000 and utilities cost $35,000.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 14E: For each of the following independent situations, calculate the missing values: 1. The Belen plant...

Related questions

Question

Transcribed Image Text:Alexandria Aluminum Company, a manufacturer of recyclable soda cans, had the following inventory

balances at the beginning and end of 20x1.

January 1, 20x1

$ 60,000.

120,000.

Inventory Classificatlon

December 31, 20x1

Raw material.

$ 70,000

Work in process

115,000

Finished goods

150,000 .

165,000

During 20x1, the company purchased $250,000 of raw material and spent $400,000 on direct labor.

Manufacturing overhead costs were as follows:

Indirect material

$ 10,000

Indirect labor

25,000

Depreciation on plant and equipment .

100,000

Utilities

25,000

Other

30,000

Sales revenue was $1,105,000 for the year. Selling and administrative expenses for the year amounted to

$110,000. The firm's tax rate is 40 percent.

Requlred:

1. Prepare a schedule of cost of goods manufactured.

2. Prepare a schedule of cost of goods sold.

3. Prepare an income statement.

4. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements.

Show how both cost schedules and the income statement will change if the following data change:

direct labor is $390,000 and utilities cost $35,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning