The following data are obtained from Gianne Manufacturing Company: Cost of goods manufactured is P187,500 Inventory variations are as follows: raw materials ending inventory is one-third based on raw materials beginning; no initial inventory of work-in-process, but at end of period P12,500 was on hand; finished goods inventory was four times as large at end of period as at the start. Net income after taxes amounted to P26,000, income tax rate is 35%. Purchase of raw materials amounted to net income before taxes. - Breakdown of costs incurred in manufacturing cost was as follows: Raw materials consumed 50% Direct labor 30% Overhead 20% Compute the amount raw materials beginning inventory: P38,571 P60,000 P90,000 P40,000

The following data are obtained from Gianne Manufacturing Company: Cost of goods manufactured is P187,500 Inventory variations are as follows: raw materials ending inventory is one-third based on raw materials beginning; no initial inventory of work-in-process, but at end of period P12,500 was on hand; finished goods inventory was four times as large at end of period as at the start. Net income after taxes amounted to P26,000, income tax rate is 35%. Purchase of raw materials amounted to net income before taxes. - Breakdown of costs incurred in manufacturing cost was as follows: Raw materials consumed 50% Direct labor 30% Overhead 20% Compute the amount raw materials beginning inventory: P38,571 P60,000 P90,000 P40,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 1E: Inventory Accounts for a Manufacturing Company Fujita Company produces a single product. Costs...

Related questions

Question

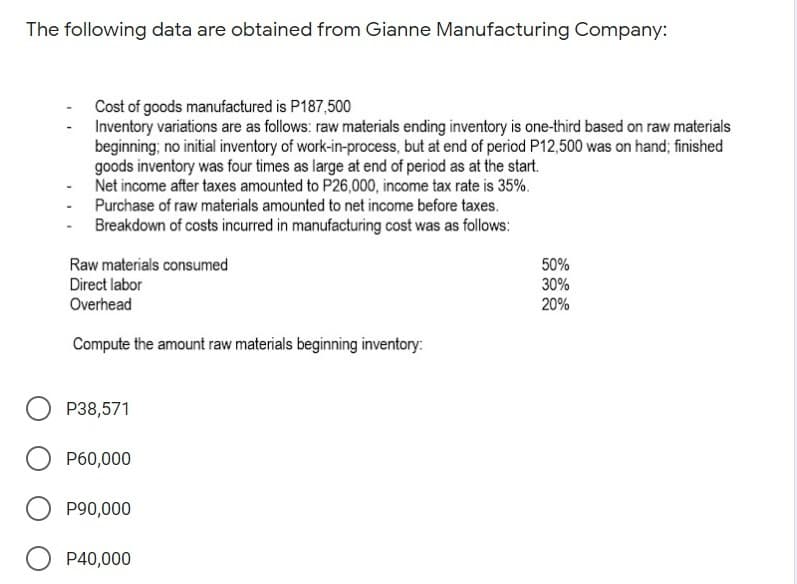

Transcribed Image Text:The following data are obtained from Gianne Manufacturing Company:

Cost of goods manufactured is P187,500

Inventory variations are as follows: raw materials ending inventory is one-third based on raw materials

beginning; no initial inventory of work-in-process, but at end of period P12,500 was on hand; finished

goods inventory was four times as large at end of period as at the start.

Net income after taxes amounted to P26,000, income tax rate is 35%.

Purchase of raw materials amounted to net income before taxes.

Breakdown of costs incurred in manufacturing cost was as follows:

Raw materials consumed

50%

30%

20%

Direct labor

Overhead

Compute the amount raw materials beginning inventory:

P38,571

P60,000

P90,000

P40,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,