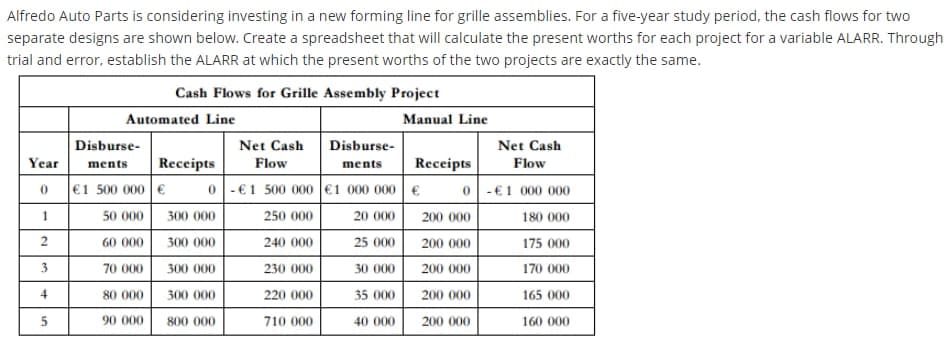

Alfredo Auto Parts is considering investing in a new forming line for grille assemblies. For a five-year study period, the cash flows for two separate designs are shown below. Create a spreadsheet that will calculate the present worths for each project for a variable ALARR. Through trial and error, establish the ALARR at which the present worths of the two projects are exactly the same. Cash Flows for Grille Assembly Project Automated Line Manual Line Disburse- Net Cash Disburse- Net Cash Year Receipts Flow Receipts Flow ments ments €1 500 000 € 0 -€1 500 000 €1 000 000 € 0-€1 000 000 1 50 000 300 000 250 000 20 000 200 000 180 000 60 000 300 000 240 000 25 000 200 000 175 000 3 70 000 300 000 230 000 30 000 200 000 170 000 4 80 000 300 000 220 000 35 000 200 000 165 000 90 000 800 000 710 000 40 000 200 000 160 000 2.

Alfredo Auto Parts is considering investing in a new forming line for grille assemblies. For a five-year study period, the cash flows for two separate designs are shown below. Create a spreadsheet that will calculate the present worths for each project for a variable ALARR. Through trial and error, establish the ALARR at which the present worths of the two projects are exactly the same. Cash Flows for Grille Assembly Project Automated Line Manual Line Disburse- Net Cash Disburse- Net Cash Year Receipts Flow Receipts Flow ments ments €1 500 000 € 0 -€1 500 000 €1 000 000 € 0-€1 000 000 1 50 000 300 000 250 000 20 000 200 000 180 000 60 000 300 000 240 000 25 000 200 000 175 000 3 70 000 300 000 230 000 30 000 200 000 170 000 4 80 000 300 000 220 000 35 000 200 000 165 000 90 000 800 000 710 000 40 000 200 000 160 000 2.

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 1P

Related questions

Question

Alfredo Auto Parts is considering investing in a new forming line for grille assemblies. For a five-year study period, the cash flows for two separate designs are shown below. Create a spreadsheet that will calculate the present worths for each project for a variable ALARR. Through trial and error, establish the ALARR at which the present worths of the two projects are exactly the same. Cash Flows for Grille Assembly Project Automated Line Manual Line Disburse- Net Cash | Disburse- Net Cash Year | ments | Receipts | Flow ments | Receipts Flow 0 [e1 500000 [€ 0 [-€1 500 000 [€1 000 000 | € o[ -€1 000 000 1 50 000 | 300 000 250000 [ 20000 [ 200 000 180 000 2 60 000 | 300 000 240000 [ 25000 [ 200 000 175 000 3 70 000 | 300 000 230 000 30 000 | 200 000 170 000 4 80000 [ 300 000 220 000 35000 | 200 000 165 000 5 90 000 [ 800 000 710000 40000 [ 200 000 160 000

Transcribed Image Text:Alfredo Auto Parts is considering investing in a new forming line for grille assemblies. For a five-year study period, the cash flows for two

separate designs are shown below. Create a spreadsheet that will calculate the present worths for each project for a variable ALARR. Through

trial and error, establish the ALARR at which the present worths of the two projects are exactly the same.

Cash Flows for Grille Assembly Project

Automated Line

Manual Line

Disburse-

Net Cash

Disburse-

Net Cash

Year

ments

Receipts

Flow

ments

Receipts

Flow

|€1 500 000 €

0-€1 500 000 €1 000 000 € 0 -€1 000 000

1

50 000 300 000

250 000

20 000 200 000

180 000

2

60 000

300 000

240 000

25 000

200 000

175 000

3

70 000

300 000

230 000

30 000

200 000

170 000

4

80 000

300 000

220 000

35 000

200 000

165 000

5

90 000

800 000

710 000

40 000

200 000

160 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning