Fiesta Foundry is considering a new furnace that will allow them to be more productive. Three alternative furnaces are under consideration. Perform an incremental analysis of these alternatives using the IRR method for each increment of cash flows. The MARR is 11% per year.

Fiesta Foundry is considering a new furnace that will allow them to be more productive. Three alternative furnaces are under consideration. Perform an incremental analysis of these alternatives using the IRR method for each increment of cash flows. The MARR is 11% per year.

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 1PROB

Related questions

Question

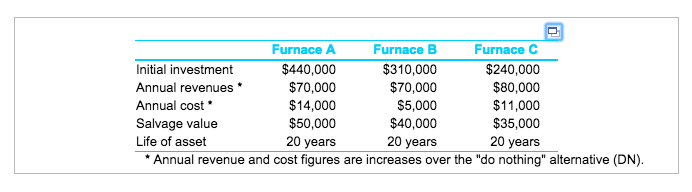

Fiesta Foundry is considering a new furnace that will allow them to be more productive. Three alternative furnaces are under consideration. Perform an incremental analysis of these alternatives using the

Transcribed Image Text:Furnace A

Furnace B

Furnace C

$440,000

$70,000

Initial investment

$310,000

$70,000

$240,000

$80,000

Annual revenues *

Annual cost

Salvage value

$14,000

$50,000

20 years

$5,000

$40,000

$11,000

$35,000

20 years

20 years

* Annual revenue and cost figures are increases over the "do nothing" alternative (DN).

Life of asset

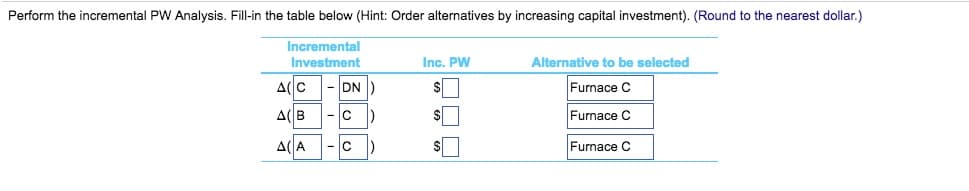

Transcribed Image Text:Perform the incremental PW Analysis. Fill-in the table below (Hint: Order alternatives by increasing capital investment). (Round to the nearest dollar.)

Incremental

Investment

Inc. PW

Alternative to be selected

A(C

DN)

Furnace C

A(B

Furnace C

A(A

Furnace C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub