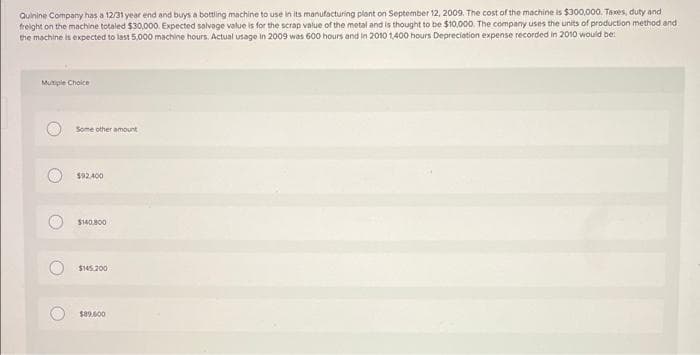

Quinine Company has a 12/31 year end and buys a bottling machine to use in its manufacturing plant on September 12, 2009. The cost of the machine is $300,000, Taxes, duty and freight on the machine totaled $30,000 Expected salvage value is for the scrap value of the metal and is thought to be $10.000. The company uses the units of production method and he machine is expected to last 5.000 machine hours. Actual usage in 2009 was 600 hours and in 2010 1,400 hours Depreciation expense recorded in 2010 would be: Mutiple Choice Some other amount $92400 $140.800 $145.200 $89.600

Quinine Company has a 12/31 year end and buys a bottling machine to use in its manufacturing plant on September 12, 2009. The cost of the machine is $300,000, Taxes, duty and freight on the machine totaled $30,000 Expected salvage value is for the scrap value of the metal and is thought to be $10.000. The company uses the units of production method and he machine is expected to last 5.000 machine hours. Actual usage in 2009 was 600 hours and in 2010 1,400 hours Depreciation expense recorded in 2010 would be: Mutiple Choice Some other amount $92400 $140.800 $145.200 $89.600

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 4PROB

Related questions

Question

Transcribed Image Text:Quinine Company has a 12/31 year end and buys a bottling machine to use in its manufacturing plant on September 12, 2009. The cost of the machine is $300,000, Taxes, duty and

freight on the machine totaled $30,000. Expected solvage value is for the scrap value of the metal and is thought to be $10,000. The company uses the units of production method and

the machine is expected to last 5.000 machine hours. Actual usage in 2009 was 600 hours and in 2010 1,400 hours Depreciation expense recorded in 2010 would be:

Mutiple Choice

Some other amount

$92,400

$140.800

$145.200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT