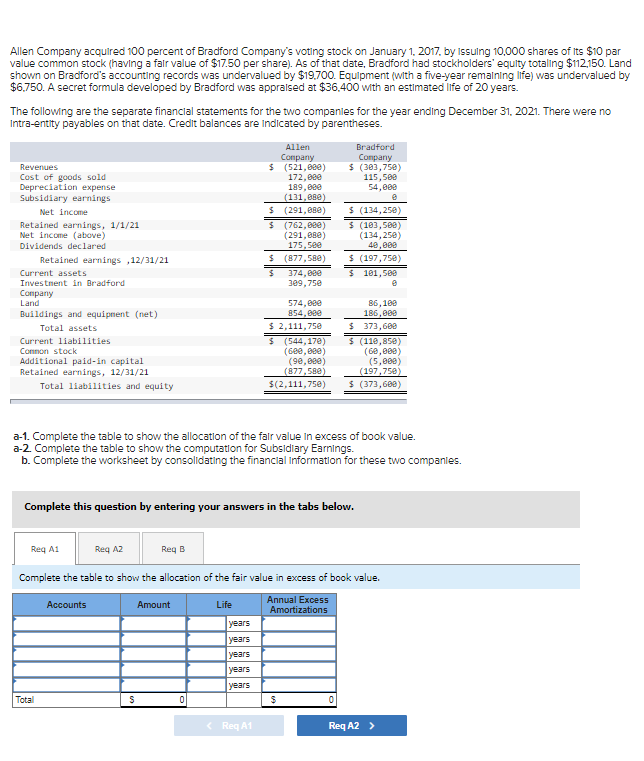

Allen Company acquired 100 percent of Bradford Company's voting stock on January 1, 2017, by Issuing 10,000 shares of Its $10 par value common stock (having a fair value of $17.50 per share). As of that date, Bradford had stockholders' equity totaling $112,150. Land shown on Bradford's accounting records was undervalued by $19.700. Equipment (with a five-year remaining life) was undervalued by $6.750. A secret formula developed by Bradford was appraised at $36.400 with an estimated life of 20 years. The following are the separate financial statements for the two companies for the year ending December 31, 2021. There were no Intra-entity payables on that date. Credit balances are indicated by parentheses. Allen Company Bradford Company $ (303,750) Revenues $ (521,000) Cost of goods sold Depreciation expense Subsidiary earnings Net Income 172,000 189,000 (131,080) 115,500 54,000 $ (291,080) Retained earnings, 1/1/21 Net income (above) $ (762,000) (291,080) 175,500 $(134,250) $ (103,500) (134,250) 40,000 Dividends declared Retained earnings,12/31/21 $ (877,580) $ (197,750) Current assets $ $ 101,500 374,000 309,750 e Investment in Bradford Company Land 574,000 854,000 86,100 186,000 Buildings and equipment (net) Total assets $ 2,111,750 $ 373,600 Current liabilities Common stock $ (544,170) (600,000) (90,000) (877,580) $ (110,850) (60,000) (5,000) (197,750) Additional paid-in capital Retained earnings, 12/31/21 Total liabilities and equity $(2,111,750) $ (373,600) a-1. Complete the table to show the allocation of the fair value in excess of book value. a-2. Complete the table to show the computation for Subsidiary Earnings. b. Complete the worksheet by consolidating the financial Information for these two companies.

Allen Company acquired 100 percent of Bradford Company's voting stock on January 1, 2017, by Issuing 10,000 shares of Its $10 par value common stock (having a fair value of $17.50 per share). As of that date, Bradford had stockholders' equity totaling $112,150. Land shown on Bradford's accounting records was undervalued by $19.700. Equipment (with a five-year remaining life) was undervalued by $6.750. A secret formula developed by Bradford was appraised at $36.400 with an estimated life of 20 years. The following are the separate financial statements for the two companies for the year ending December 31, 2021. There were no Intra-entity payables on that date. Credit balances are indicated by parentheses. Allen Company Bradford Company $ (303,750) Revenues $ (521,000) Cost of goods sold Depreciation expense Subsidiary earnings Net Income 172,000 189,000 (131,080) 115,500 54,000 $ (291,080) Retained earnings, 1/1/21 Net income (above) $ (762,000) (291,080) 175,500 $(134,250) $ (103,500) (134,250) 40,000 Dividends declared Retained earnings,12/31/21 $ (877,580) $ (197,750) Current assets $ $ 101,500 374,000 309,750 e Investment in Bradford Company Land 574,000 854,000 86,100 186,000 Buildings and equipment (net) Total assets $ 2,111,750 $ 373,600 Current liabilities Common stock $ (544,170) (600,000) (90,000) (877,580) $ (110,850) (60,000) (5,000) (197,750) Additional paid-in capital Retained earnings, 12/31/21 Total liabilities and equity $(2,111,750) $ (373,600) a-1. Complete the table to show the allocation of the fair value in excess of book value. a-2. Complete the table to show the computation for Subsidiary Earnings. b. Complete the worksheet by consolidating the financial Information for these two companies.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:Allen Company acquired 100 percent of Bradford Company's voting stock on January 1, 2017, by Issuing 10,000 shares of its $10 par

value common stock (having a fair value of $17.50 per share). As of that date, Bradford had stockholders' equity totaling $112,150. Land

shown on Bradford's accounting records was undervalued by $19.700. Equipment (with a five-year remaining life) was undervalued by

$6,750. A secret formula developed by Bradford was appraised at $36,400 with an estimated life of 20 years.

The following are the separate financial statements for the two companies for the year ending December 31, 2021. There were no

Intra-entity payables on that date. Credit balances are indicated by parentheses.

Allen

Company

Revenues

$ (521,000)

Bradford

Company

$ (303,750)

115,500

54,000

e

Cost of goods sold

Depreciation expense

Subsidiary earnings

172,000

189,000

(131,080)

(291,080)

Net income

$

$ (134,250)

Retained earnings, 1/1/21

Net income (above)

$ (762,000)

(291,080)

175,500

$ (103,500)

(134,250)

40,000

Dividends declared

Retained earnings ,12/31/21

$ (877,580)

$ (197,750)

Current assets

$

101,500

$ 374,000

309,750

Investment in Bradford

Company

Land

574,000

854,000

86,100

186,000

Buildings and equipment (net)

Total assets

$ 2,111,750

$ 373,600

Current liabilities

Common stock

$

Additional paid-in capital

(544,170)

(600,000)

(90,000)

(877,580)

$ (110,850)

(60,000)

(5,000)

(197,750)

Retained earnings, 12/31/21

Total liabilities and equity

$(2,111,750)

$ (373,600)

a-1. Complete the table to show the allocation of the fair value in excess of book value.

a-2. Complete the table to show the computation for Subsidiary Earnings.

b. Complete the worksheet by consolidating the financial Information for these two companies.

Complete this question by entering your answers in the tabs below.

Req A1

Reg A2

Req B

Complete the table to show the allocation of the fair value in excess of book value.

Accounts

Amount

Life

Annual Excess

Amortizations

0

Req A2 >

Total

S

0

years

years

years

years

years

< Req A1

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning