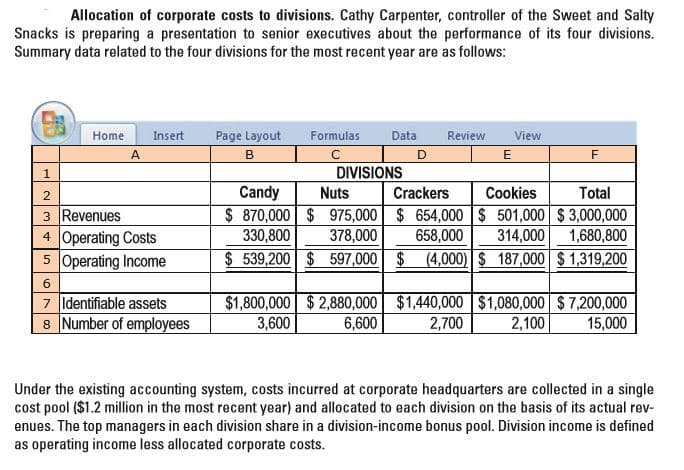

Allocation of corporate costs to divisions. Cathy Carpenter, controller of the Sweet and Salty Snacks is preparing a presentation to senior executives about the performance of its four divisions. Summary data related to the four divisions for the most recent year are as follows: Home Insert Page Layout Formulas Data Review View A в DIVISIONS Nuts 1. Candy Crackers Cookies Total 3 Revenues 4 Operating Costs 5 Operating Income $ 870,000 $ 975,000 | $ 654,000 |$ 501,000 $ 3,000,000 330,800 378,000 658,000 314,000 1,680,800 $ 539,200 $ 597,000 $ (4,000)$ 187,000 $ 1,319,200 7 Identifiable assets 8 Number of employees $1,800,000 $ 2,880,000 $1,440,000 $1,080,000 $7,200,000 2,700 3,600 6,600 2,100 15,000 Under the existing accounting system, costs incurred at corporate headquarters are collected in a single cost pool ($1.2 million in the most recent year) and allocated to each division on the basis of its actual rev- enues. The top managers in each division share in a division-income bonus pool. Division income is defined as operating income less allocated corporate costs. Carpenter has analyzed the components of corporate costs and proposes that corporate costs be col- lected in four cost pools. The components of corporate costs for the most recent year and Carpenter's sug- gested cost pools and allocation bases are as follows: Home Insert Page Layout Formulas Data Review View Suggested Cost Pool Suggested Allocation Base 11 Corporate Cost Category Amount 12 Interest on debt 13 Corporate salaries 14 Accounting and control 15 General marketing 16 Public affairs 17 Personnel and payroll 18 Total $380,000 Cost Pool 1 200,000 Cost Pool 2 160,000 Identifiable assets Pool 2 170,000 Cost Pool 2 150,000 Cost Pool 3 140,000 Cost Pool 4 $1,200,000 Division revenues Positive operating income* Number of employees 19 20 "Carpenter proposes that this cost be allocated using the operating income (if positive) of divisions, 21 with only divisions with positive operating income included in the allocation base.

Allocation of corporate costs to divisions. Cathy Carpenter, controller of the Sweet and Salty Snacks is preparing a presentation to senior executives about the performance of its four divisions. Summary data related to the four divisions for the most recent year are as follows: Home Insert Page Layout Formulas Data Review View A в DIVISIONS Nuts 1. Candy Crackers Cookies Total 3 Revenues 4 Operating Costs 5 Operating Income $ 870,000 $ 975,000 | $ 654,000 |$ 501,000 $ 3,000,000 330,800 378,000 658,000 314,000 1,680,800 $ 539,200 $ 597,000 $ (4,000)$ 187,000 $ 1,319,200 7 Identifiable assets 8 Number of employees $1,800,000 $ 2,880,000 $1,440,000 $1,080,000 $7,200,000 2,700 3,600 6,600 2,100 15,000 Under the existing accounting system, costs incurred at corporate headquarters are collected in a single cost pool ($1.2 million in the most recent year) and allocated to each division on the basis of its actual rev- enues. The top managers in each division share in a division-income bonus pool. Division income is defined as operating income less allocated corporate costs. Carpenter has analyzed the components of corporate costs and proposes that corporate costs be col- lected in four cost pools. The components of corporate costs for the most recent year and Carpenter's sug- gested cost pools and allocation bases are as follows: Home Insert Page Layout Formulas Data Review View Suggested Cost Pool Suggested Allocation Base 11 Corporate Cost Category Amount 12 Interest on debt 13 Corporate salaries 14 Accounting and control 15 General marketing 16 Public affairs 17 Personnel and payroll 18 Total $380,000 Cost Pool 1 200,000 Cost Pool 2 160,000 Identifiable assets Pool 2 170,000 Cost Pool 2 150,000 Cost Pool 3 140,000 Cost Pool 4 $1,200,000 Division revenues Positive operating income* Number of employees 19 20 "Carpenter proposes that this cost be allocated using the operating income (if positive) of divisions, 21 with only divisions with positive operating income included in the allocation base.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter10: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 7E: Horton Technology has two divisions, Consumer and Commercial, and two corporate support departments,...

Related questions

Question

How do you think the division managers will receive the new proposal? What are the strengths and weaknesses of Carpenter’s proposal relative to the existing single cost-pool method?

Transcribed Image Text:Allocation of corporate costs to divisions. Cathy Carpenter, controller of the Sweet and Salty

Snacks is preparing a presentation to senior executives about the performance of its four divisions.

Summary data related to the four divisions for the most recent year are as follows:

Home

Insert

Page Layout

Formulas

Data

Review

View

A

в

DIVISIONS

Nuts

1.

Candy

Crackers

Cookies

Total

3 Revenues

4 Operating Costs

5 Operating Income

$ 870,000 $ 975,000 | $ 654,000 |$ 501,000 $ 3,000,000

330,800

378,000

658,000

314,000

1,680,800

$ 539,200 $ 597,000 $ (4,000)$ 187,000 $ 1,319,200

7 Identifiable assets

8 Number of employees

$1,800,000 $ 2,880,000 $1,440,000 $1,080,000 $7,200,000

2,700

3,600

6,600

2,100

15,000

Under the existing accounting system, costs incurred at corporate headquarters are collected in a single

cost pool ($1.2 million in the most recent year) and allocated to each division on the basis of its actual rev-

enues. The top managers in each division share in a division-income bonus pool. Division income is defined

as operating income less allocated corporate costs.

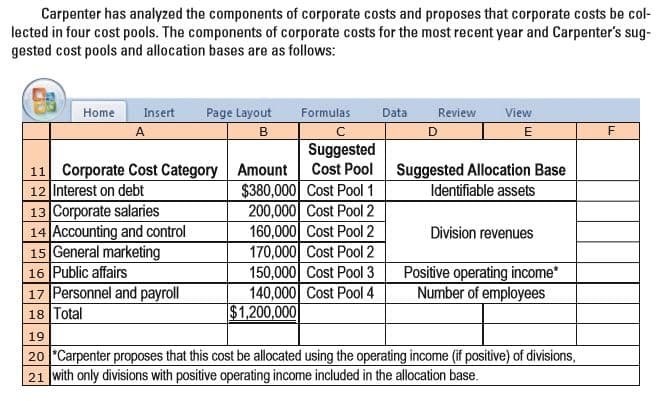

Transcribed Image Text:Carpenter has analyzed the components of corporate costs and proposes that corporate costs be col-

lected in four cost pools. The components of corporate costs for the most recent year and Carpenter's sug-

gested cost pools and allocation bases are as follows:

Home

Insert

Page Layout

Formulas

Data

Review

View

Suggested

Cost Pool Suggested Allocation Base

11 Corporate Cost Category Amount

12 Interest on debt

13 Corporate salaries

14 Accounting and control

15 General marketing

16 Public affairs

17 Personnel and payroll

18 Total

$380,000 Cost Pool 1

200,000 Cost Pool 2

160,000

Identifiable assets

Pool 2

170,000 Cost Pool 2

150,000 Cost Pool 3

140,000 Cost Pool 4

$1,200,000

Division revenues

Positive operating income*

Number of employees

19

20 "Carpenter proposes that this cost be allocated using the operating income (if positive) of divisions,

21 with only divisions with positive operating income included in the allocation base.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College