Compute the amount of inventory fire loss. (R Inventory fire loss

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 6.5BPR: Multiple step income statement and balance sheet The following selected accounts anti their current...

Related questions

Question

subject:accounting

Transcribed Image Text:Problem 9-7

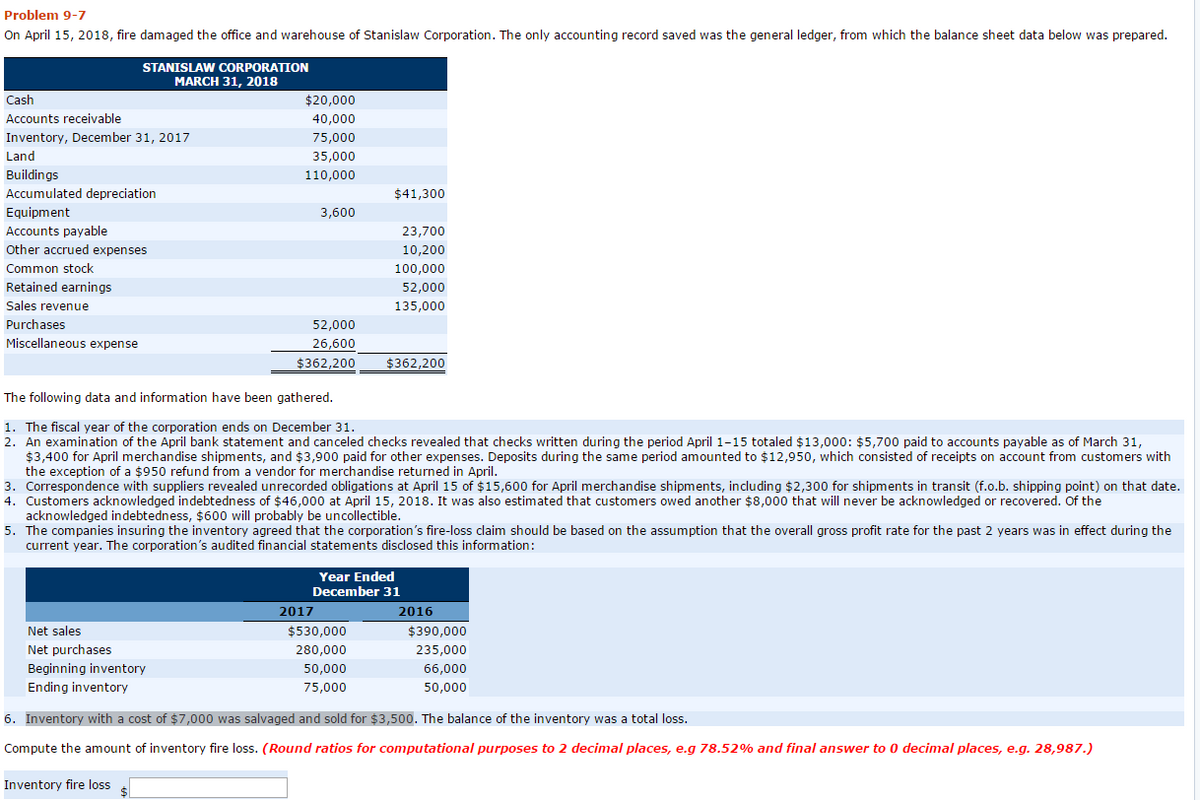

On April 15, 2018, fire damaged the office and warehouse of Stanislaw Corporation. The only accounting record saved was the general ledger, from which the balance sheet data below was prepared.

Cash

Accounts receivable

Inventory, December 31, 2017

Land

Buildings

Accumulated depreciation

Equipment

Accounts payable

Other accrued expenses

Common stock

Retained earnings

Sales revenue

Purchases

Miscellaneous expense

STANISLAW CORPORATION

MARCH 31, 2018

Net sales

Net purchases

$20,000

40,000

75,000

35,000

110,000

Beginning inventory

Ending inventory

3,600

52,000

26,600

$362,200

The following data and information have been gathered.

1. The fiscal year of the corporation ends on December 31.

2. An examination of the April bank statement and canceled checks revealed that checks written during the period April 1-15 totaled $13,000: $5,700 paid to accounts payable as of March 31,

$3,400 for April merchandise shipments, and $3,900 paid for other expenses. Deposits during the same period amounted to $12,950, which consisted of receipts on account from customers with

the exception of a $950 refund from a vendor for merchandise returned in April.

3. Correspondence with suppliers revealed unrecorded obligations at April 15 of $15,600 for April merchandise shipments, including $2,300 for shipments in transit (f.o.b. shipping point) on that date.

4. Customers acknowledged indebtedness of $46,000 at April 15, 2018. It was also estimated that customers owed another $8,000 that will never be acknowledged or recovered. Of the

acknowledged indebtedness, $600 will probably be uncollectible.

$41,300

5. The companies insuring the inventory agreed that the corporation's fire-loss claim should be based on the assumption that the overall gross profit rate for the past 2 years was in effect during the

current year. The corporation's audited financial statements disclosed this information:

2017

23,700

10,200

100,000

52,000

135,000

$362,200

$530,000

280,000

50,000

75,000

Year Ended

December 31

2016

$390,000

235,000

66,000

50,000

6. Inventory with a cost of $7,000 was salvaged and sold for $3,500. The balance of the inventory was a total loss.

Compute the amount of inventory fire loss. (Round ratios for computational purposes to 2 decimal places, e.g 78.52% and final answer to 0 decimal places, e.g. 28,987.)

Inventory fire loss $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning