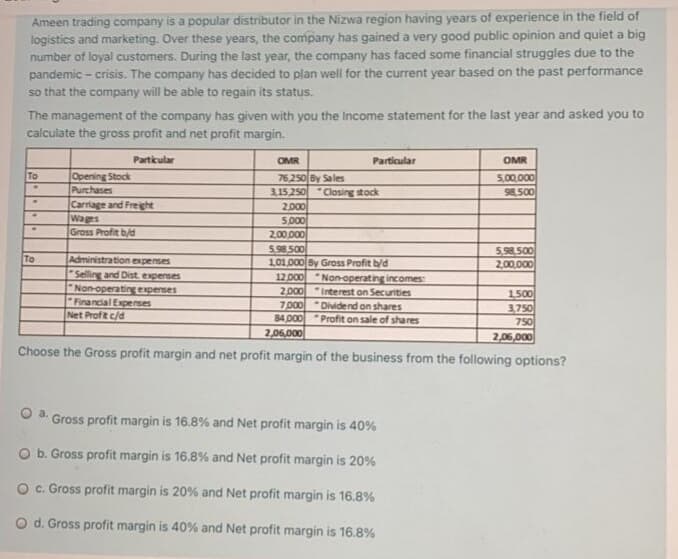

Ameen trading company is a popular distributor in the Nizwa region having years of experience in the field of logistics and marketing. Over these years, the company has gained a very good public opinion and quiet a big number of loyal customers. During the last year, the company has faced some financial struggles due to the pandemic - crisis. The company has decided to plan well for the current year based on the past performance so that the company will be able to regain its status. The management of the company has given with you the Income statement for the last year and asked you to calculate the gross profit and net profit margin. Partikular OMR Particular OMR Opening Stock Purchases To 76250 By Sales 315250 "Closing stock 5,00,000 98,500 Carriage and Freighe Wages Gross Profit b/d 2,000 5,000 2,00000 5,98.500 101.000 By Gross Profit bd 12D00 Non-operating incomes 2D00 7 p00 84 000 Profit on sale of shares 2,06,000 5,98 50 2,00,000 To Administration expenses "Selling and Dist experses Non-operatinexperses Financal Expenses Net Proftc/d *Interest on Securities "Dividend on shares 1500 3,750 750 2,06,000 Choose the Gross profit margin and net profit margin of the business from the following options? Oa. Gross profit margin is 16.8% and Net profit margin is 40% O b. Gross profit margin is 16.8% and Net profit margin is 20% O C. Gross profit margin is 20% and Net profit margin is 16.8% O d. Gross profit margin is 40% and Net profit margin is 16.8%

Ameen trading company is a popular distributor in the Nizwa region having years of experience in the field of logistics and marketing. Over these years, the company has gained a very good public opinion and quiet a big number of loyal customers. During the last year, the company has faced some financial struggles due to the pandemic - crisis. The company has decided to plan well for the current year based on the past performance so that the company will be able to regain its status. The management of the company has given with you the Income statement for the last year and asked you to calculate the gross profit and net profit margin. Partikular OMR Particular OMR Opening Stock Purchases To 76250 By Sales 315250 "Closing stock 5,00,000 98,500 Carriage and Freighe Wages Gross Profit b/d 2,000 5,000 2,00000 5,98.500 101.000 By Gross Profit bd 12D00 Non-operating incomes 2D00 7 p00 84 000 Profit on sale of shares 2,06,000 5,98 50 2,00,000 To Administration expenses "Selling and Dist experses Non-operatinexperses Financal Expenses Net Proftc/d *Interest on Securities "Dividend on shares 1500 3,750 750 2,06,000 Choose the Gross profit margin and net profit margin of the business from the following options? Oa. Gross profit margin is 16.8% and Net profit margin is 40% O b. Gross profit margin is 16.8% and Net profit margin is 20% O C. Gross profit margin is 20% and Net profit margin is 16.8% O d. Gross profit margin is 40% and Net profit margin is 16.8%

Chapter3: Analysis Of Financial Statements

Section: Chapter Questions

Problem 1gM

Related questions

Question

Transcribed Image Text:Ameen trading company is a popular distributor in the Nizwa region having years of experience in the field of

logisties and marketing. Over these years, the company has gained a very good public opinion and quiet a big

number of loyal customers. During the last year, the company has faced some financial struggles due to the

pandemic - crisis. The company has decided to plan well for the current year based on the past performance

so that the company will be able to regain its status.

The management of the company has given with you the Income statement for the last year and asked you to

calculate the gross profit and net profit margin.

Partkular

OMR

Particular

OMR

Opening Stock

Purchases

Carriage and Freight

Wages

Gross Profit bd

To

76,250 By Sales

315 250 "Closing stock

2,000

5,000

2,00,000

5,98500

1,01,000 By Gross Profit b/d

12000 Non-operating incomes

2,000

7 p00 *Dividend on shares

84 000 Profit on sale of shares

2,06,000

5,00,000

98,500

5,98,500

2,00,000

To

Administration expenses

Selling and Dist expenses

"Non-operatingexperses

Financial Expenses

Net Profit c/d

*Interest on Securities

1500

3,750

750

2,06,000

Choose the Gross profit margin and net profit margin of the business from the following options?

Oa.

Gross profit margin is 16.8% and Net profit margin is 40%

b. Gross profit margin is 16.8% and Net profit margin is 20%

O. Gross profit margin is 20% and Net profit margin is 16.8%

O d. Gross profit margin is 40% and Net profit margin is 16.8%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub