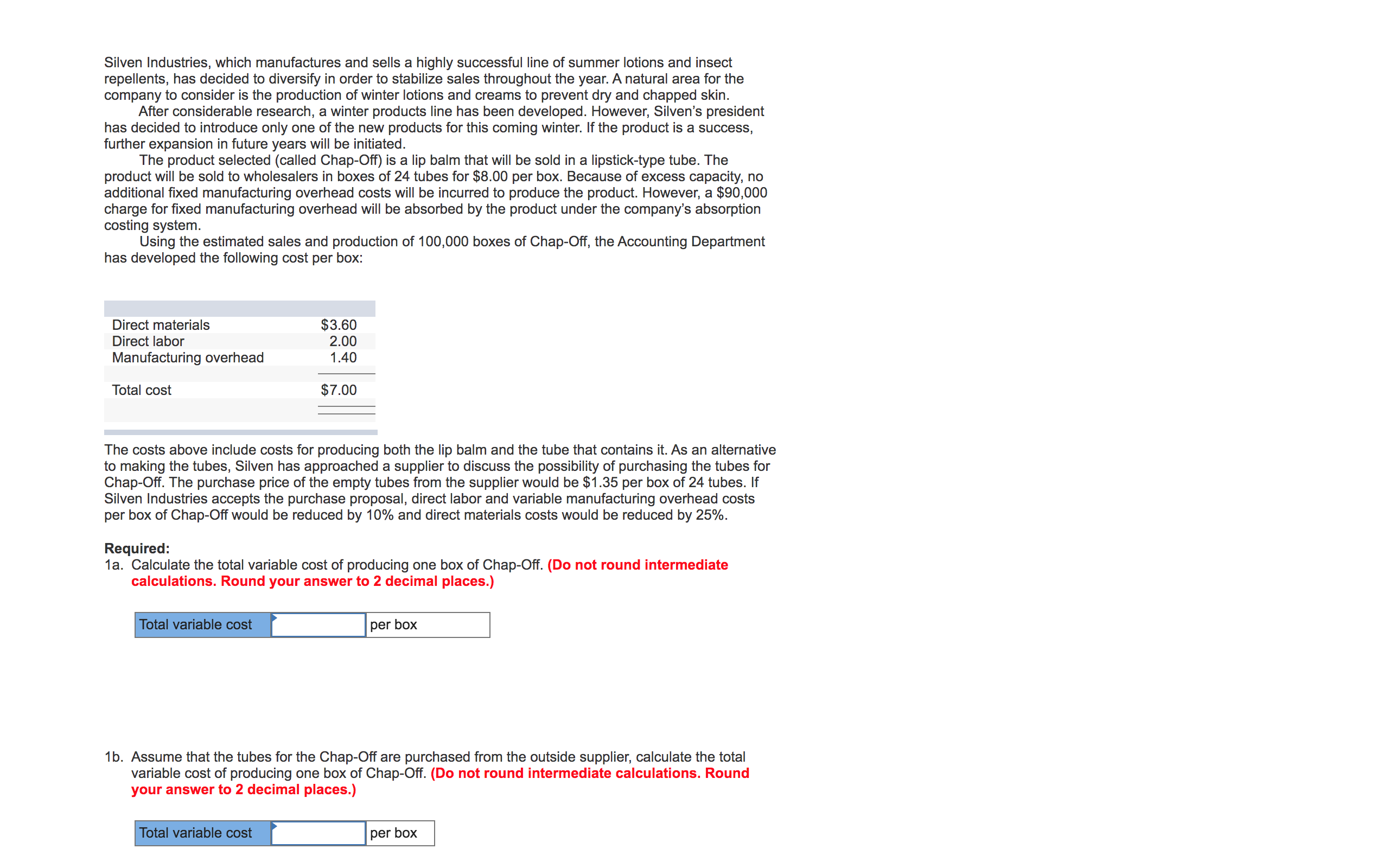

Silven Industries, which manufactures and sells a highly successful line of summer lotions and insect repellents, has decided to diversify in order to stabilize sales throughout the year. A natural area for the company to consider is the production of winter lotions and creams to prevent dry and chapped skin. After considerable research, a winter products line has been developed. However, Silven's president has decided to introduce only one of the new products for this coming winter. If the product is a success, further expansion in future years will be initiated. The product selected (called Chap-Off) is a lip balm that will be sold in a lipstick-type tube. The product will be sold to wholesalers in boxes of 24 tubes for $8.00 per box. Because of excess capacity, no additional fixed manufacturing overhead costs will be incurred to produce the product. However, a $90,000 charge for fixed manufacturing overhead will be absorbed by the product under the company's absorption costing system. Using the estimated sales and production of 100,000 boxes of Chap-Off, the Accounting Department has developed the following cost per box: Direct materials Direct labor $3.60 2.00 1.40 Manufacturing overhead Total cost $7.00 The costs above include costs for producing both the lip balm and the tube that contains it. As an alternative to making the tubes, Silven has approached a supplier to discuss the possibility of purchasing the tubes for Chap-Off. The purchase price of the empty tubes from the supplier would be $1.35 per box of 24 tubes. If Silven Industries accepts the purchase proposal, direct labor and variable manufacturing overhead costs per box of Chap-Off would be reduced by 10% and direct materials costs would be reduced by 25%. Required: 1a. Calculate the total variable cost of producing one box of Chap-Off. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Total variable cost per box

Silven Industries, which manufactures and sells a highly successful line of summer lotions and insect repellents, has decided to diversify in order to stabilize sales throughout the year. A natural area for the company to consider is the production of winter lotions and creams to prevent dry and chapped skin. After considerable research, a winter products line has been developed. However, Silven's president has decided to introduce only one of the new products for this coming winter. If the product is a success, further expansion in future years will be initiated. The product selected (called Chap-Off) is a lip balm that will be sold in a lipstick-type tube. The product will be sold to wholesalers in boxes of 24 tubes for $8.00 per box. Because of excess capacity, no additional fixed manufacturing overhead costs will be incurred to produce the product. However, a $90,000 charge for fixed manufacturing overhead will be absorbed by the product under the company's absorption costing system. Using the estimated sales and production of 100,000 boxes of Chap-Off, the Accounting Department has developed the following cost per box: Direct materials Direct labor $3.60 2.00 1.40 Manufacturing overhead Total cost $7.00 The costs above include costs for producing both the lip balm and the tube that contains it. As an alternative to making the tubes, Silven has approached a supplier to discuss the possibility of purchasing the tubes for Chap-Off. The purchase price of the empty tubes from the supplier would be $1.35 per box of 24 tubes. If Silven Industries accepts the purchase proposal, direct labor and variable manufacturing overhead costs per box of Chap-Off would be reduced by 10% and direct materials costs would be reduced by 25%. Required: 1a. Calculate the total variable cost of producing one box of Chap-Off. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Total variable cost per box

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter7: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 2PA: The demand for solvent, one of numerous products manufactured by Logan Industries Inc., has dropped...

Related questions

Question

I would like some help answering this accounting problem. Screen shots are included. Thank you.

Transcribed Image Text:Silven Industries, which manufactures and sells a highly successful line of summer lotions and insect

repellents, has decided to diversify in order to stabilize sales throughout the year. A natural area for the

company to consider is the production of winter lotions and creams to prevent dry and chapped skin.

After considerable research, a winter products line has been developed. However, Silven's president

has decided to introduce only one of the new products for this coming winter. If the product is a success,

further expansion in future years will be initiated.

The product selected (called Chap-Off) is a lip balm that will be sold in a lipstick-type tube. The

product will be sold to wholesalers in boxes of 24 tubes for $8.00 per box. Because of excess capacity, no

additional fixed manufacturing overhead costs will be incurred to produce the product. However, a $90,000

charge for fixed manufacturing overhead will be absorbed by the product under the company's absorption

costing system.

Using the estimated sales and production of 100,000 boxes of Chap-Off, the Accounting Department

has developed the following cost per box:

Direct materials

Direct labor

$3.60

2.00

1.40

Manufacturing overhead

Total cost

$7.00

The costs above include costs for producing both the lip balm and the tube that contains it. As an alternative

to making the tubes, Silven has approached a supplier to discuss the possibility of purchasing the tubes for

Chap-Off. The purchase price of the empty tubes from the supplier would be $1.35 per box of 24 tubes. If

Silven Industries accepts the purchase proposal, direct labor and variable manufacturing overhead costs

per box of Chap-Off would be reduced by 10% and direct materials costs would be reduced by 25%.

Required:

1a. Calculate the total variable cost of producing one box of Chap-Off. (Do not round intermediate

calculations. Round your answer to 2 decimal places.)

Total variable cost

per box

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning