soditonal intormation Soe Year 2 n Seld vallable for ade securities costing TS for s500 Equipment costing 2.000 with a book value rs6.250 was sold for S7.500 3 ssued % bonds at face value for s23se.000 4 Purchased new equipment for SIN1250 and paid cash. S) Paid casb dividends of s25.000. Net income was 562.500. What is the gain on sale of investments? O 12s00 O se25

soditonal intormation Soe Year 2 n Seld vallable for ade securities costing TS for s500 Equipment costing 2.000 with a book value rs6.250 was sold for S7.500 3 ssued % bonds at face value for s23se.000 4 Purchased new equipment for SIN1250 and paid cash. S) Paid casb dividends of s25.000. Net income was 562.500. What is the gain on sale of investments? O 12s00 O se25

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter1: Introduction To Business Activities And Overview Of Financial Statements And The Reporting Process

Section: Chapter Questions

Problem 38P

Related questions

Question

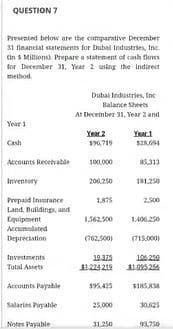

Transcribed Image Text:QUESTION 7

Presented below are the comparative December

31 financial statemenes for Dubai Industries, Inc.

tin s Millions). Prepare a statement of cash flows

for December 31, Year 2 uning the indirect

method.

Dubai Iedustries, Inc

Balance Sheets

A: December 31, Year 2 and

Year 1

Year 2

Year1

Cash

S96,719

Accounts Recetvable

100,000

85.313

Inventory

206.250

181.250

Prepaid Imsurance

Land. Buildings, and

Equipment

2.500

1.562.300

1406.250

Accumulated

Depreciation

(762,500)

(715.000

Investments

10.20

Total Assets

1225 219

Accounts Payable

Salartes Piryahle

25.000

3025

Notes Payable

31.250

第750

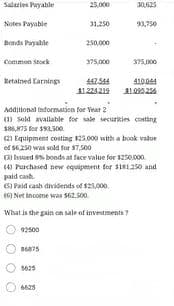

Transcribed Image Text:Salazies Payable

25,000

30,625

Notes Payable

31.250

93,750

Bonds Payable

250.000

Common Stock

375.000

375,000

Retalned Earning

41004

1224 219

110524

Additional information for Year 2

(1) sold avallable tor ale securikies costing

s86,875 for $93,500.

(21 Equipment costing s25.000 with a book value

ef $6.250 was sold for S7,500

(3 Isssed S% bonds at face value for $250,c00

(4) Purchased new equipetent for $181.250 and

paid cast.

(5) Paid cash dividends of $25,000.

(6) Net income was S62.500.

What is the gain on sale of investments ?

92500

5625

6625

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning