An airline decided to offer direct service from City A to City B. Management must decide between a full price service using the company's new fleet of jet aircraft and a discount service using smaller capacity commuter planes. It is clear that the best choice depends on the market reaction to the service the airline offers. Management developed estimates of the contribution to profit for each type of service based upon two possible levels of demand for service to the airline: strong and weak. The following table shows the estimated quarterly profits (in thousands of dollars). Demand for Service Service Strong Weak Full price $950 -$510 Discount $660 $330 (a) What is the decision to be made, what is the chance event, and what is the consequence for this problem? The decision to be made is --Select-- v. The chance event is -Select-- v. The consequence is -Select--- How many decision alternatives are there? How many outcomes are there for the chance event? (b) If nothing is known about the probabilities of the chance outcomes, what is the recommended decision using the optimistic, conservative, and minimax regret approaches? The recommended decision using the optimistic approach is the -Select--- v service. The recommended decision using the conservative approach is the -Select-. V service. The recommended decision using the minimax regret approach is the -Select-- v service. (c) Suppose that management of the airline believes that the probability of strong demand is 0.7 and the probability of weak demand is 0.3. Use the expected value approach to determine an optimal decision. (Enter your answers in thousands of dollars.) EV(full) thousands EV(discount) 24 thousands The optimal decision is the --Select--- v service.

An airline decided to offer direct service from City A to City B. Management must decide between a full price service using the company's new fleet of jet aircraft and a discount service using smaller capacity commuter planes. It is clear that the best choice depends on the market reaction to the service the airline offers. Management developed estimates of the contribution to profit for each type of service based upon two possible levels of demand for service to the airline: strong and weak. The following table shows the estimated quarterly profits (in thousands of dollars). Demand for Service Service Strong Weak Full price $950 -$510 Discount $660 $330 (a) What is the decision to be made, what is the chance event, and what is the consequence for this problem? The decision to be made is --Select-- v. The chance event is -Select-- v. The consequence is -Select--- How many decision alternatives are there? How many outcomes are there for the chance event? (b) If nothing is known about the probabilities of the chance outcomes, what is the recommended decision using the optimistic, conservative, and minimax regret approaches? The recommended decision using the optimistic approach is the -Select--- v service. The recommended decision using the conservative approach is the -Select-. V service. The recommended decision using the minimax regret approach is the -Select-- v service. (c) Suppose that management of the airline believes that the probability of strong demand is 0.7 and the probability of weak demand is 0.3. Use the expected value approach to determine an optimal decision. (Enter your answers in thousands of dollars.) EV(full) thousands EV(discount) 24 thousands The optimal decision is the --Select--- v service.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter11: Simulation Models

Section11.4: Marketing Models

Problem 30P: Seas Beginning sells clothing by mail order. An important question is when to strike a customer from...

Related questions

Question

100%

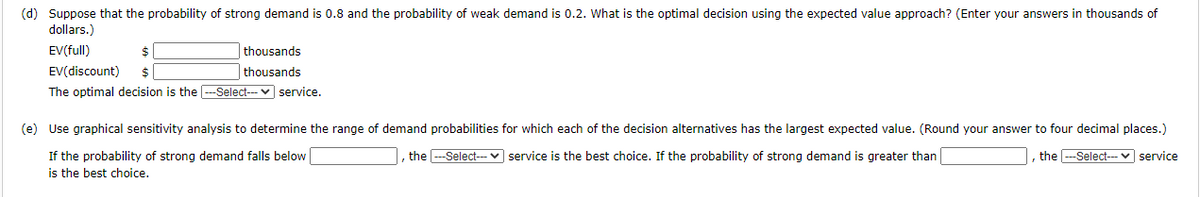

Transcribed Image Text:(d) Suppose that the probability of strong demand is 0.8 and the probability of weak demand is 0.2. What is the optimal decision using the expected value approach? (Enter your answers in thousands of

dollars.)

EV(full)

$

thousands

thousands

EV(discount)

The optimal decision is the -Select-- v service.

2$

(e) Use graphical sensitivity analysis to determine the range of demand probabilities for which each of the decision alternatives has the largest expected value. (Round your answer to four decimal places.)

I, the -Select--- v service is the best choice. If the probability of strong demand is greater than

, the -Select--- ♥ service

If the probability of strong demand falls below

is the best choice.

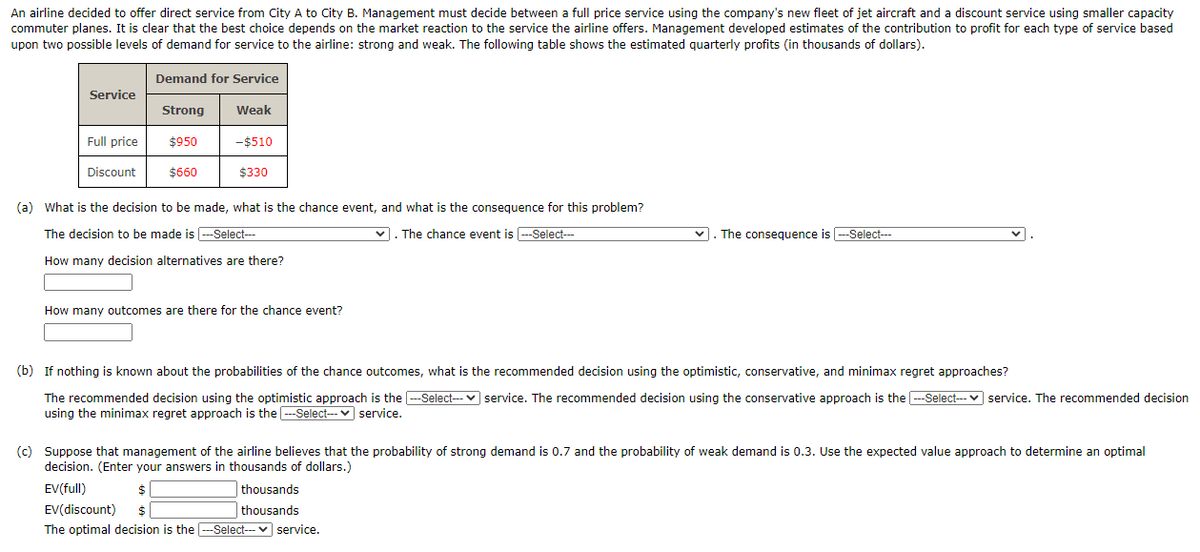

Transcribed Image Text:An airline decided to offer direct service from City A to City B. Management must decide between a full price service using the company's new fleet of jet aircraft and a discount service using smaller capacity

commuter planes. It is clear that the best choice depends on the market reaction to the service the airline offers. Management developed estimates of the contribution to profit for each type of service based

upon two possible levels of demand for service to the airline: strong and weak. The following table shows the estimated quarterly profits (in thousands of dollars).

Demand for Service

Service

Strong

Weak

Full price

$950

-$510

Discount

$660

$330

(a) What is the decision to be made, what is the chance event, and what is the consequence for this problem?

The decision to be made is --Select--

v. The chance event is --Select---

v. The consequence is -Select---

How many decision alternatives are there?

How many outcomes are there for the chance event?

(b) If nothing is known about the probabilities of the chance outcomes, what is the recommended decision using the optimistic, conservative, and minimax regret approaches?

The recommended decision using the optimistic approach is the -Select- v service. The recommended decision using the conservative approach is the --Select--- v service. The recommended decision

using the minimax regret approach is the -Select--- v service.

(c) Suppose that management of the airline believes that the probability of strong demand is 0.7 and the probability of weak demand is 0.3. Use the expected value approach to determine an optimal

decision. (Enter your answers in thousands of dollars.)

EV(full)

$

thousands

EV(discount)

thousands

The optimal decision is the ---Select-- v service.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,