An all-equity firm is considering the following projects: Project W X Y Z Beta .54 .91 1.09 1.83 IRR 10.1% 10.6 14.1 17.1 The T-bill rate is 5.1 percent, and the expected return on the market is 12.1 percent. a. Which projects have a higher/lower expected return than the firm's 12.1 percent cost of capital?

An all-equity firm is considering the following projects: Project W X Y Z Beta .54 .91 1.09 1.83 IRR 10.1% 10.6 14.1 17.1 The T-bill rate is 5.1 percent, and the expected return on the market is 12.1 percent. a. Which projects have a higher/lower expected return than the firm's 12.1 percent cost of capital?

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 20PROB

Related questions

Question

can i have help solving this using Excel pls?

![Problem 12-16 SML and WACC [LO 4]

An all-equity firm is considering the following projects:

Project

W

X

Y

Z

Beta

.54

.91

1.09

1.83

IRR

Project W has a

expected return, and Project Z has a

10.1%

10.6

14.1

17.1

The T-bill rate is 5.1 percent, and the expected return on the market is 12.1 percent.

a. Which projects have a higher/lower expected return than the firm's 12.1 percent cost of capital?

expected return, Project X has a

expected return.

expected return, Project Y has a](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F483c3d17-1621-47af-bfd2-86acecf64938%2Fb23581bf-beff-4cdb-a6b8-e7a2c50326aa%2F5ko988_processed.png&w=3840&q=75)

Transcribed Image Text:Problem 12-16 SML and WACC [LO 4]

An all-equity firm is considering the following projects:

Project

W

X

Y

Z

Beta

.54

.91

1.09

1.83

IRR

Project W has a

expected return, and Project Z has a

10.1%

10.6

14.1

17.1

The T-bill rate is 5.1 percent, and the expected return on the market is 12.1 percent.

a. Which projects have a higher/lower expected return than the firm's 12.1 percent cost of capital?

expected return, Project X has a

expected return.

expected return, Project Y has a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I forgot to include the other two questions. This question has a B & C. Please help me solve those in excel as well. I have provided original question and additional questions

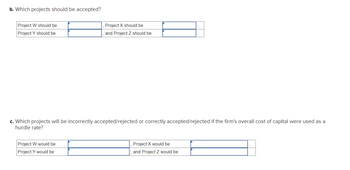

Transcribed Image Text:b. Which projects should be accepted?

Project W should be

Project Y should be

Project X should be

and Project Z should be

c. Which projects will be incorrectly accepted/rejected or correctly accepted/rejected if the firm's overall cost of capital were used as a

hurdle rate?

Project W would be

Project Y would be

Project X would be

and Project Z would be

![Problem 12-16 SML and WACC [LO 4]

An all-equity firm is considering the following projects:

Project

W

X

Y

Z

Beta

.54

.91

1.09

1.83

IRR

10.1%

10.6

14.1

17.1

The T-bill rate is 5.1 percent, and the expected return on the market is 12.1 percent.](https://content.bartleby.com/qna-images/question/483c3d17-1621-47af-bfd2-86acecf64938/b421a828-e7d8-45c9-a557-bb780fd4b0c8/xlycztr_thumbnail.png)

Transcribed Image Text:Problem 12-16 SML and WACC [LO 4]

An all-equity firm is considering the following projects:

Project

W

X

Y

Z

Beta

.54

.91

1.09

1.83

IRR

10.1%

10.6

14.1

17.1

The T-bill rate is 5.1 percent, and the expected return on the market is 12.1 percent.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning