An American exports 10 LinaBell plushies to a collector in Shanghai for a total cost of 23,000 RMB. If you opt to buy Chinese bonds worth 23,000 with the money, then the U.S. current account deficit: a. falls by 23,000 RMB (equivalent), but the U.S. financial account surplus also falls by 23,000 RMB (equivalent). b. falls by 23,000 RMB (equivalent), but the U.S. financial account surplus rises by 23,000 RMB (equivalent). c. remain unchanged. d. rises by 23,000 RMB (equivalent), but the U.S. financial account surplus also rises by 23,000 RMB (equivalent).

An American exports 10 LinaBell plushies to a collector in Shanghai for a total cost of 23,000 RMB. If you opt to buy Chinese bonds worth 23,000 with the money, then the U.S. current account deficit: a. falls by 23,000 RMB (equivalent), but the U.S. financial account surplus also falls by 23,000 RMB (equivalent). b. falls by 23,000 RMB (equivalent), but the U.S. financial account surplus rises by 23,000 RMB (equivalent). c. remain unchanged. d. rises by 23,000 RMB (equivalent), but the U.S. financial account surplus also rises by 23,000 RMB (equivalent).

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter11: Foreign Exchange, Trade, And Bubbles

Section: Chapter Questions

Problem 9MC

Related questions

Question

10

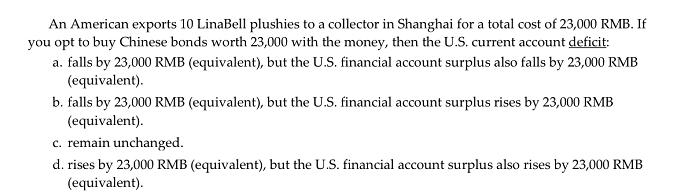

Transcribed Image Text:An American exports 10 LinaBell plushies to a collector in Shanghai for a total cost of 23,000 RMB. If

you opt to buy Chinese bonds worth 23,000 with the money, then the U.S. current account deficit:

a. falls by 23,000 RMB (equivalent), but the U.S. financial account surplus also falls by 23,000 RMB

(equivalent).

b. falls by 23,000 RMB (equivalent), but the U.S. financial account surplus rises by 23,000 RMB

(equivalent).

c. remain unchanged.

d. rises by 23,000 RMB (equivalent), but the U.S. financial account surplus also rises by 23,000 RMB

(equivalent).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning