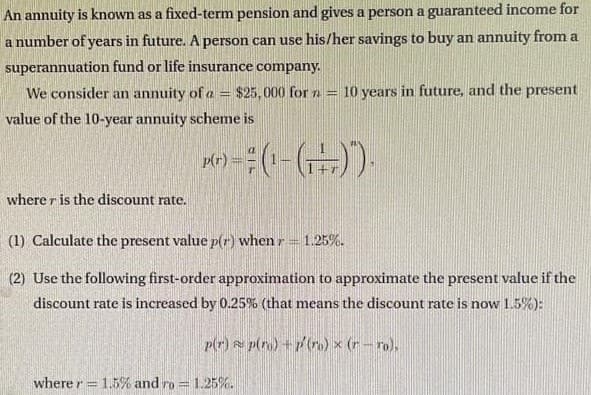

An annuity is known as a fixed-term pension and gives a person a guaranteed income for a number of years in future. A person can use his/her savings to buy an annuity from a superannuation fund or life insurance company. We consider an annuity of a $25,000 for n = 10 years in future, and the present value of the 10-year annuity scheme is p(r) = (¹ - (,)"). wherer is the discount rate. (1) Calculate the present value p(r) when r = 1.25%. (2) Use the following first-order approximation to approximate the present value if the discount rate is increased by 0.25% (that means the discount rate is now 1.5%): p(r) p(ro) + p'(ro) x (r-ro). where r= 1.5% and ro 1.25%. Sel

An annuity is known as a fixed-term pension and gives a person a guaranteed income for a number of years in future. A person can use his/her savings to buy an annuity from a superannuation fund or life insurance company. We consider an annuity of a $25,000 for n = 10 years in future, and the present value of the 10-year annuity scheme is p(r) = (¹ - (,)"). wherer is the discount rate. (1) Calculate the present value p(r) when r = 1.25%. (2) Use the following first-order approximation to approximate the present value if the discount rate is increased by 0.25% (that means the discount rate is now 1.5%): p(r) p(ro) + p'(ro) x (r-ro). where r= 1.5% and ro 1.25%. Sel

College Algebra

7th Edition

ISBN:9781305115545

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter8: Sequences And Series

Section8.4: Mathematics Of Finance

Problem 2E

Related questions

Question

Transcribed Image Text:An annuity is known as a fixed-term pension and gives a person a guaranteed income for

a number of years in future. A person can use his/her savings to buy an annuity from a

superannuation fund or life insurance company.

S

We consider an annuity of a $25,000 for n = 10 years in future, and the present

value of the 10-year annuity scheme is

p(r) = (¹ - (,)").

wherer is the discount rate.

(1) Calculate the present value p(r) when r = 1.25%.

(2) Use the following first-order approximation to approximate the present value if the

discount rate is increased by 0.25% (that means the discount rate is now 1.5%):

p(r)

p(ro) + p'(ro) x (r-ro).

where r= 1.5% and ro

1.25%.

Sel

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning