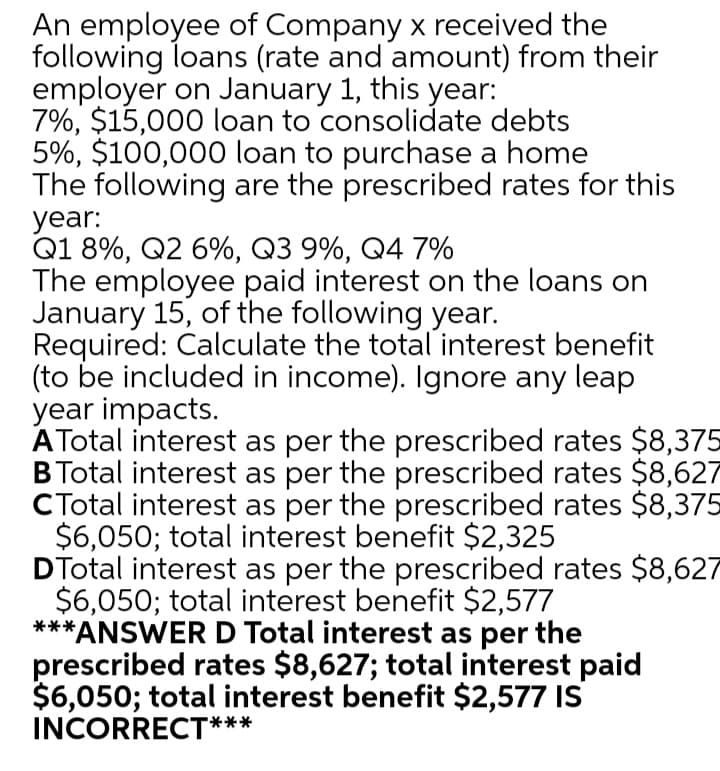

An employee of Company x received the following loans (rate and amount) from their employer on January 1, this year: 7%, $15,000 loan to consolidate debts 5%, $100,000 loan to purchase a home The following are the prescribed rates for this year: Q1 8%, Q2 6%, Q3 9%, Q4 7% The employee paid interest on the loans on January 15, of the following year. Required: Calculate the total interest benefit (to be included in income). Ignore any leap year impacts. ATotal interest as per the prescribed rates $8,375 B Total interest as per the prescribed rates $8,627 CTotal interest as per the prescribed rates $8,375 $6,050; total interest benefit $2,325 DTotal interest as per the prescribed rates $8,627 $6,050; total interest benefit $2,577 ***ANSWERD Total interest as per the prescribed rates $8,627; total interest paid $6,050; total interest benefit $2,577 IS INCORRECT***

An employee of Company x received the following loans (rate and amount) from their employer on January 1, this year: 7%, $15,000 loan to consolidate debts 5%, $100,000 loan to purchase a home The following are the prescribed rates for this year: Q1 8%, Q2 6%, Q3 9%, Q4 7% The employee paid interest on the loans on January 15, of the following year. Required: Calculate the total interest benefit (to be included in income). Ignore any leap year impacts. ATotal interest as per the prescribed rates $8,375 B Total interest as per the prescribed rates $8,627 CTotal interest as per the prescribed rates $8,375 $6,050; total interest benefit $2,325 DTotal interest as per the prescribed rates $8,627 $6,050; total interest benefit $2,577 ***ANSWERD Total interest as per the prescribed rates $8,627; total interest paid $6,050; total interest benefit $2,577 IS INCORRECT***

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 11EB: Whole Leaves wants to upgrade their equipment, and on January 24 the company takes out a loan from...

Related questions

Question

Transcribed Image Text:An employee of Company x received the

following loans (rate and amount) from their

employer on January 1, this year:

7%, $15,000 loan to consolidate debts

5%, $100,000 loan to purchase a home

The following are the prescribed rates for this

year:

Q1 8%, Q2 6%, Q3 9%, Q4 7%

The employee paid interest on the loans on

January 15, of the following year.

Required: Calculate the total interest benefit

(to be included in income). Ignore any leap

year impacts.

ATotal interest as per the prescribed rates $8,375

BTotal interest as per the prescribed rates $8,627

CTotal interest as per the prescribed rates $8,375

$6,050; total interest benefit $2,325

DTotal interest as per the prescribed rates $8,627

$6,050; total interest benefit $2,577

**ANSWER D Total interest as per the

prescribed rates $8,627; total interest paid

$6,050; total interest benefit $2,577 IS

INCORRECT***

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT