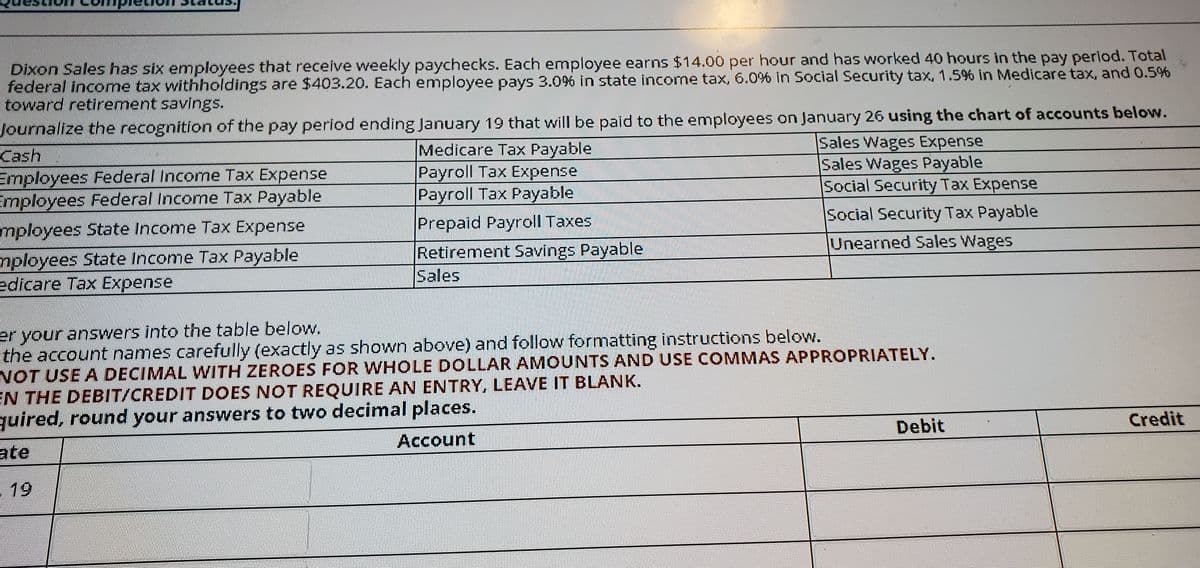

Dixon Sales has six employees that receive weekly paychecks. Each employee earns $14.00 per hour and has worked 40 hours in the pay period. Total federal income tax withholdings are $403.20. Each employee pays 3.09% in state income tax, 6.0% in Social Security tax, 1.5% in Medicare tax, and 0.5% toward retirement savings. Journalize the recognition of the pay period ending January 19 that will be paid to the employees on January 26 using the chart of accounts below. Cash Employees Federal Income Tax Expense Employees Federal Income Tax Payable Sales Wages Expense Sales Wages Payable Social Security Tax Expense Medicare Tax Payable Payroll Tax Expense Payroll Tax Payable Prepaid Payroll Taxes Retirement Savings Payable Sales Social Security Tax Payable Unearned Sales Wages mployees State Income Tax Expense mployees State Income Tax Payable edicare Tax Expense er your answers into the table below. the account names carefully (exactly as shown above) and follow formatting instructions below. VOT USE A DECIMAL WITH ZEROES FOR WHOLE DOLLAR AMOUNTS AND USE COMMAS APPROPRIATELY. EN THE DEBIT/CREDIT DOES NOT REQUIRE AN ENTRY, LEAVE IT BLANK. quired, round your answers to two decimal places. Debit Credit Account ate

Dixon Sales has six employees that receive weekly paychecks. Each employee earns $14.00 per hour and has worked 40 hours in the pay period. Total federal income tax withholdings are $403.20. Each employee pays 3.09% in state income tax, 6.0% in Social Security tax, 1.5% in Medicare tax, and 0.5% toward retirement savings. Journalize the recognition of the pay period ending January 19 that will be paid to the employees on January 26 using the chart of accounts below. Cash Employees Federal Income Tax Expense Employees Federal Income Tax Payable Sales Wages Expense Sales Wages Payable Social Security Tax Expense Medicare Tax Payable Payroll Tax Expense Payroll Tax Payable Prepaid Payroll Taxes Retirement Savings Payable Sales Social Security Tax Payable Unearned Sales Wages mployees State Income Tax Expense mployees State Income Tax Payable edicare Tax Expense er your answers into the table below. the account names carefully (exactly as shown above) and follow formatting instructions below. VOT USE A DECIMAL WITH ZEROES FOR WHOLE DOLLAR AMOUNTS AND USE COMMAS APPROPRIATELY. EN THE DEBIT/CREDIT DOES NOT REQUIRE AN ENTRY, LEAVE IT BLANK. quired, round your answers to two decimal places. Debit Credit Account ate

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter9: Payroll Accounting: Employer Taxes And Reports

Section: Chapter Questions

Problem 1CP

Related questions

Question

Transcribed Image Text:Dixon Sales has six employees that receive weekly paychecks. Each employee earns $14.00 per hour and has worked 40 hours in the pay period. Total

federal income tax withholdings are $403.20. Each employee pays 3.0% in state income tax, 6.0%% in Social Security tax, 1.5% in Medicare tax, and 0.5%

toward retirement savings.

Journalize the recognition of the pay period ending January 19 that will be paid to the employees on January 26 using the chart of accounts below.

Medicare Tax Payable

Payroll Tax Expense

Payroll Tax Payable

Sales Wages Expense

Sales Wages Payable

Social Security Tax Expense

Cash

Employees Federal Income Tax Expense

Employees Federal Income Tax Payable

Social Security Tax Payable

mployees State Income Tax Expense

Prepaid Payroll Taxes

Unearned Sales Wages

nployees State Income Tax Payable

edicare Tax Expense

Retirement Savings Payable

Sales

er your answers into the table below.

the account names carefully (exactly as shown above) and follow formatting instructions below.

NOT USE A DECIMAL WITH ZEROES FOR WHOLE DOLLAR AMOUNTS AND USE COMMAS APPROPRIATELY.

EN THE DEBIT/CREDIT DOES NOT REQUIRE AN ENTRY, LEAVE IT BLANK.

quired, round your answers to two decimal places.

Debit

Credit

Account

ate

- 19

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College