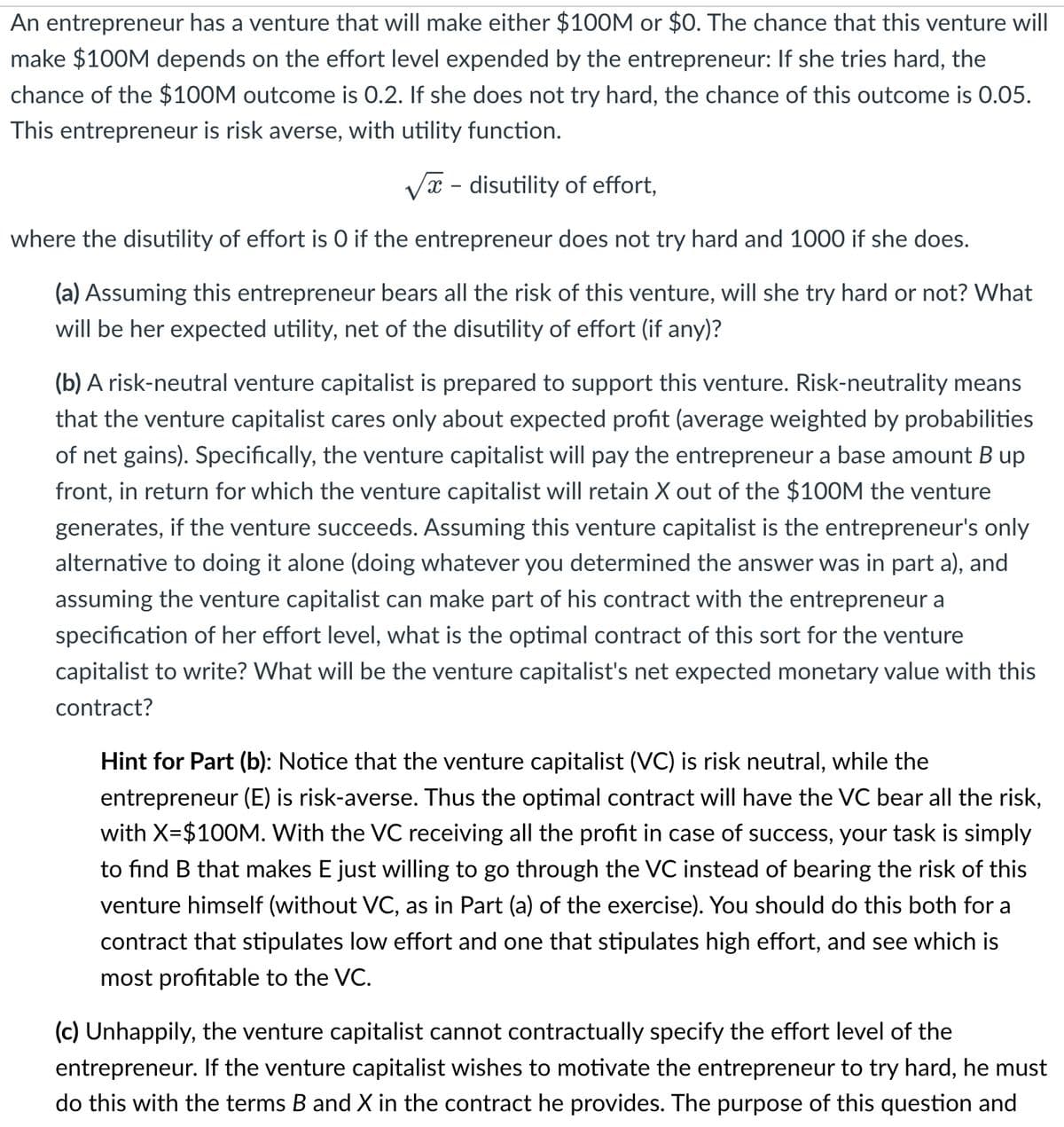

An entrepreneur has a venture that will make either $100M or $0. The chance that this venture will make $100M depends on the effort level expended by the entrepreneur: If she tries hard, the chance of the $100M outcome is 0.2. If she does not try hard, the chance of this outcome is 0.05. This entrepreneur is risk averse, with utility function. √x - disutility of effort, where the disutility of effort is O if the entrepreneur does not try hard and 1000 if she does. (a) Assuming this entrepreneur bears all the risk of this venture, will she try hard or not? What will be her expected utility, net of the disutility of effort (if any)? (b) A risk-neutral venture capitalist is prepared to support this venture. Risk-neutrality means that the venture capitalist cares only about expected profit (average weighted by probabilities of net gains). Specifically, the venture capitalist will pay the entrepreneur a base amount B up front, in return for which the venture capitalist will retain X out of the $100M the venture generates, if the venture succeeds. Assuming this venture capitalist is the entrepreneur's only alternative to doing it alone (doing whatever you determined the answer was in part a), and assuming the venture capitalist can make part of his contract with the entrepreneur a specification of her effort level, what is the optimal contract of this sort for the venture capitalist to write? What will be the venture capitalist's net expected monetary value with this contract? Hint for Part (b): Notice that the venture capitalist (VC) is risk neutral, while the entrepreneur (E) is risk-averse. Thus the optimal contract will have the VC bear all the risk, with X=$100M. With the VC receiving all the profit in case of success, your task is simply to find B that makes E just willing to go through the VC instead of bearing the risk of this venture himself (without VC, as in Part (a) of the exercise). You should do this both for a contract that stipulates low effort and one that stipulates high effort, and see which is most profitable to the VC. (c) Unhappily, the venture capitalist cannot contractually specify the effort level of the entrepreneur. If the venture capitalist wishes to motivate the entrepreneur to try hard, he must do this with the terms B and X in the contract he provides. The purpose of this question and

An entrepreneur has a venture that will make either $100M or $0. The chance that this venture will make $100M depends on the effort level expended by the entrepreneur: If she tries hard, the chance of the $100M outcome is 0.2. If she does not try hard, the chance of this outcome is 0.05. This entrepreneur is risk averse, with utility function. √x - disutility of effort, where the disutility of effort is O if the entrepreneur does not try hard and 1000 if she does. (a) Assuming this entrepreneur bears all the risk of this venture, will she try hard or not? What will be her expected utility, net of the disutility of effort (if any)? (b) A risk-neutral venture capitalist is prepared to support this venture. Risk-neutrality means that the venture capitalist cares only about expected profit (average weighted by probabilities of net gains). Specifically, the venture capitalist will pay the entrepreneur a base amount B up front, in return for which the venture capitalist will retain X out of the $100M the venture generates, if the venture succeeds. Assuming this venture capitalist is the entrepreneur's only alternative to doing it alone (doing whatever you determined the answer was in part a), and assuming the venture capitalist can make part of his contract with the entrepreneur a specification of her effort level, what is the optimal contract of this sort for the venture capitalist to write? What will be the venture capitalist's net expected monetary value with this contract? Hint for Part (b): Notice that the venture capitalist (VC) is risk neutral, while the entrepreneur (E) is risk-averse. Thus the optimal contract will have the VC bear all the risk, with X=$100M. With the VC receiving all the profit in case of success, your task is simply to find B that makes E just willing to go through the VC instead of bearing the risk of this venture himself (without VC, as in Part (a) of the exercise). You should do this both for a contract that stipulates low effort and one that stipulates high effort, and see which is most profitable to the VC. (c) Unhappily, the venture capitalist cannot contractually specify the effort level of the entrepreneur. If the venture capitalist wishes to motivate the entrepreneur to try hard, he must do this with the terms B and X in the contract he provides. The purpose of this question and

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.5P

Related questions

Question

Transcribed Image Text:An entrepreneur has a venture that will make either $100M or $0. The chance that this venture will

make $100M depends on the effort level expended by the entrepreneur: If she tries hard, the

chance of the $100M outcome is 0.2. If she does not try hard, the chance of this outcome is 0.05.

This entrepreneur is risk averse, with utility function.

- disutility of effort,

where the disutility of effort is O if the entrepreneur does not try hard and 1000 if she does.

(a) Assuming this entrepreneur bears all the risk of this venture, will she try hard or not? What

will be her expected utility, net of the disutility of effort (if any)?

(b) A risk-neutral venture capitalist is prepared to support this venture. Risk-neutrality means

that the venture capitalist cares only about expected profit (average weighted by probabilities

of net gains). Specifically, the venture capitalist will pay the entrepreneur a base amount B up

front, in return for which the venture capitalist will retain X out of the $100M the venture

generates, if the venture succeeds. Assuming this venture capitalist is the entrepreneur's only

alternative to doing it alone (doing whatever you determined the answer was in part a), and

assuming the venture capitalist can make part of his contract with the entrepreneur a

specification of her effort level, what is the optimal contract of this sort for the venture

capitalist to write? What will be the venture capitalist's net expected monetary value with this

contract?

Hint for Part (b): Notice that the venture capitalist (VC) is risk neutral, while the

entrepreneur (E) is risk-averse. Thus the optimal contract will have the VC bear all the risk,

with X=$100M. With the VC receiving all the profit in case of success, your task is simply

to find B that makes E just willing to go through the VC instead of bearing the risk of this

venture himself (without VC, as in Part (a) of the exercise). You should do this both for a

contract that stipulates low effort and one that stipulates high effort, and see which is

most profitable to the VC.

(c) Unhappily, the venture capitalist cannot contractually specify the effort level of the

entrepreneur. If the venture capitalist wishes to motivate the entrepreneur to try hard, he must

do this with the terms B and X in the contract he provides. The purpose of this question and

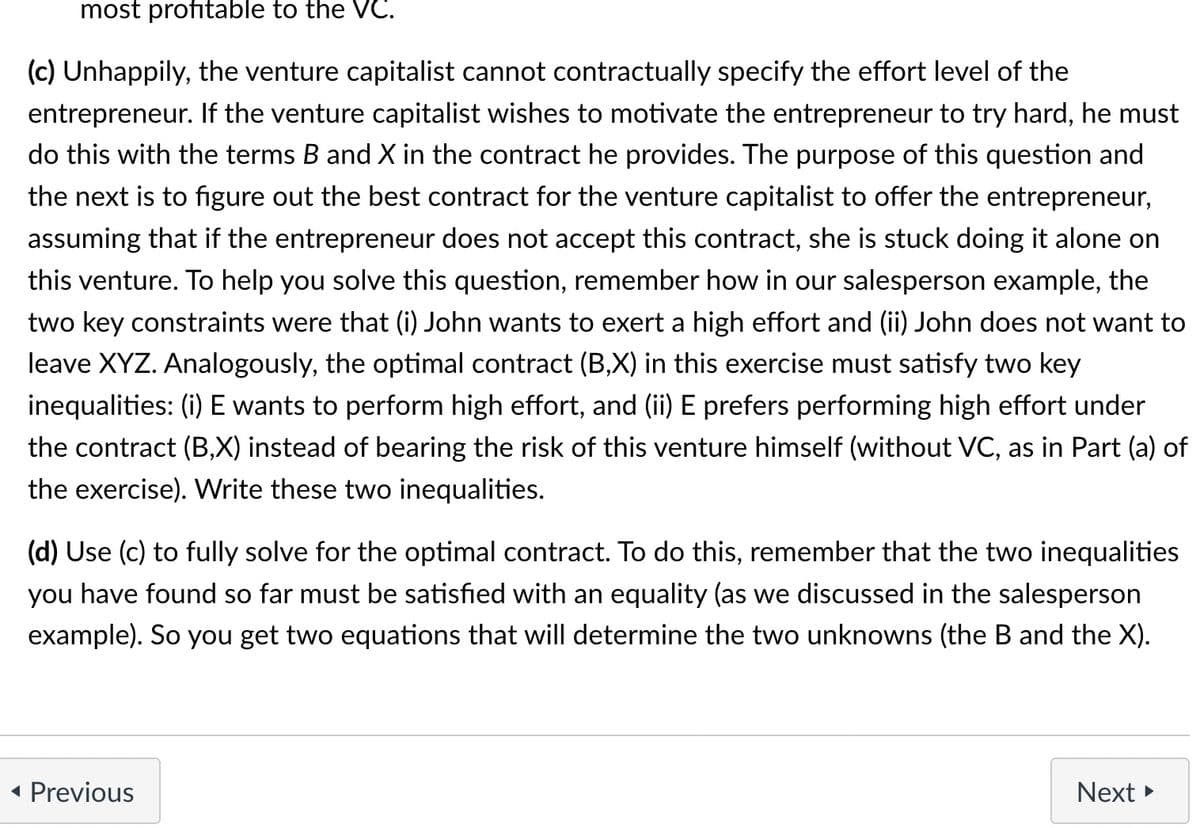

Transcribed Image Text:most profitable to the VC.

(c) Unhappily, the venture capitalist cannot contractually specify the effort level of the

entrepreneur. If the venture capitalist wishes to motivate the entrepreneur to try hard, he must

do this with the terms B and X in the contract he provides. The purpose of this question and

the next is to figure out the best contract for the venture capitalist to offer the entrepreneur,

assuming that if the entrepreneur does not accept this contract, she is stuck doing it alone on

this venture. To help you solve this question, remember how in our salesperson example, the

two key constraints were that (i) John wants to exert a high effort and (ii) John does not want to

leave XYZ. Analogously, the optimal contract (B,X) in this exercise must satisfy two key

inequalities: (i) E wants to perform high effort, and (ii) E prefers performing high effort under

the contract (B,X) instead of bearing the risk of this venture himself (without VC, as in Part (a) of

the exercise). Write these two inequalities.

(d) Use (c) to fully solve for the optimal contract. To do this, remember that the two inequalities

you have found so far must be satisfied with an equality (as we discussed in the salesperson

example). So you get two equations that will determine the two unknowns (the B and the X).

◄ Previous

Next ►

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning