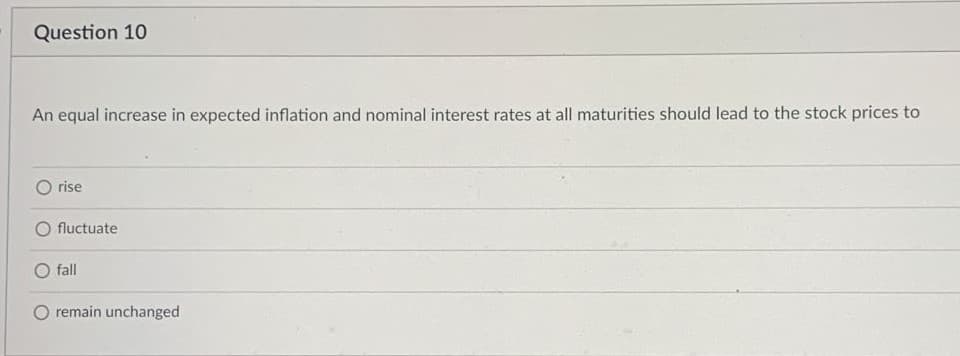

An equal increase in expected inflation and nominal interest rates at all maturities should lead to the stock prices to rise fluctuate O fall O remain unchanged

Q: 3. You are given the desired capital stock as: OY K rc where: 0=0.4 Y = RM8 billion rc = 0.15 Based…

A: The desired capital stock refers to the number of capital goods the company would like to have to…

Q: the change in stock if:- Closing stock = $3200 Opening stock = $1300

A: A stock or equity is a security that addresses the responsibility for part of an organization. This…

Q: Which of the following is NOT represented in a stock and flow diagra O a. Levels b. Rates c.…

A: As economies emerged, goods and services were produced that required machinery and labour. With time…

Q: Choose the correct answer and write only the corresponding letter 1.3 The distinction between a…

A: Answer: (1.3)=d Explanation: A flow variable refers to the variable that is measured over a period…

Q: Suppose that people in France decide to permanentlyincrease their savings rate. Predict what will…

A: ANS If the demand (DD) for bonds decreases then more interest will be offered so that the DD for…

Q: An insurance company invests in two $100 par value bonds with 5% annual coupons and each maturing at…

A: Given : Par Value=$100 Annual coupon=5% Bond 1 : price =$103.87,Term=2 years Bond 2 :…

Q: xplain why when the spread between government bonds rate and corporate bond rates of the same…

A: Bonds are basically debt securities issued by governments, corporations, organizations which are…

Q: 1 Consider a two period realistic "perfect capital market" (namely there is uncertainty regarding…

A: In the this question we have to find out the profitable arbitrage.

Q: Many Exchange Traded Funds (ETFs) use indexes as their underlying benchmarks, so it is equally…

A: Weighted index method : In this type of method different types of items given weight , and weighted…

Q: Answer the attached question

A: An incorporated entity formed to limit liabilities of the owners/stockholders is a corporation.…

Q: 19 of 38 All eise equal, an increase in the interest rate should result in OA higher bond prices OB…

A: NOTE: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: If monetary policy becomes more transparent about thefuture course of interest rates, how will stock…

A: Monetary policy refers to the credit-control system adopted by the central bank of a country to…

Q: explain the depth in the global bond markets, mention atleast 3 varieties of bonds from various…

A: Bonds is defined as a form of financial asset which is issued by various companies or government to…

Q: TSC, Inc. sells for $23 and pays an annual per share dividend of $2.50, which you expect to grow at…

A: Price per share= $23 Annual dividend per share= $2.50 Growth rate= 7% Expected…

Q: An FI has purchased a $201 million cap of 8 percent at a premium of 0.70 percent of face value. A…

A: Income is divided into two parts , one is income and other is saving and the net saving is the…

Q: uppose that a risk-free investment will make three future payments of $500 in 1 year, $500 in 2…

A: Formula to calculate present value of single future value is PV = FV (1+ C)-N Here,PV= Present…

Q: If interest rates in the economy are high, then a firm would use a MARR higher than current interest…

A: "Since you have asked multiple questions, we will solve first question for you .. If you want any…

Q: 4. The purpose of the economic reorder point is to tell you: A. how much to order B. when to order…

A: An economic reorder point in inventory is a point that determines a stock level where stock needs to…

Q: Obtain weekly data from Refinitiv Eikon and plot the interest rates (bid and ask mid- rate) on…

A: Interest rate theory Interest rate theory is the hypothesis that may represent the Time value of…

Q: Supposé earlier this morning, your broker recommended you sell German federal government bonds from…

A: Bonds are debt instruments, which are floated for a period of time in which the borrower agree to…

Q: $ 2.9 (b) How large is its dividend? Instructions: Enter your response rounded to two decimal…

A: The implied rate is an interest rate equal to the difference between the spot rate and the forward…

Q: Describe the following term in your own words. Q.2.1 Investment

A: Economic Investments: Economic growth is linked to investments within a country or nation. Economic…

Q: Assume that securitization combined with borrowing and irrational exuberance in Hyperville have…

A: Here it is clearly evident that the difference for the arithmetic series of the underlying assets…

Q: Suppose that a firm begins at time t=1 with a capital stock of K(1)= 200,000 and, in addition to…

A: * Solution :- Given that , Suppose that a firm begins at time t=1 capital stock of K(1)= 200,000…

Q: Stock Market Futures Market January KLSE composite index stands at 1162. Investor expects to…

A: Question- Stock Market Futures Market January KLSE composite index stands at 1162.…

Q: A consol is a bond that pays a fixed nominal payment each year forever. Let's assume that payments…

A: The formula is: Price=Annual paymentInterest rate=10000.05=20000 The price is $20000

Q: Suppose that all the long-term securities that the bank holds mature in 10 years and their interest…

A: n = 10 years r = 5%

Q: When land prices become more volatile, the demand curve for bonds shifts to the and the interest…

A: Factors resulting in a shift in the demand curve for bonds include changes in wealth, liquidity,…

Q: With reference to the discounted cash flow model for determining stock prices, cafrefully explain…

A: Discounted Cash Flow DCF=CF11+r+CF21+r2 + ......+ CFn(1+r)n DCF= Discounted cash flow CF= Cash flow…

Q: In early 2016 as the Bank of Japan began to push policyinterest rates negative, there was a sharp…

A: The monetary policy is used by the central bank of the economy for changing the interest rate in the…

Q: Suppose that if you purchase a share of SuperCo, you will receive an annual dividend of $2.59 next…

A: Answer; Given Annual Dividend= $ 2.59 Approprate Discount Rate = 6.75% 0r 0.0675…

Q: Explain the specific risk and market risk affecting a company or a group of companies that represent…

A: The following problem has been answered as follows:

Q: Suppose that in a given bond market, there is currentlyno information that can help potential bond…

A:

Q: A company has no preferred stock outstanding and has 15,000,000 common shares outstanding. The…

A: EPS = (net income - preferred dividends)/ average shares EPS = (30,000,000 - 7,500,000)/15,000,000 =…

Q: FarCry Industries, a maker of telecommunications equipment, has 2 million shares of common stock…

A: A share is the basic unit in which the capital of a company is divided. The people who hold shares…

Q: nsider the structure of FEDIs shown in the table. Build the Project Balance (graph) on a sheet of…

A: Year Cash Flow 0 -1000 1 500 2 482 3 -250 4 482 5 482

Q: Assume the following information about the market and JumpMaster's stock. JumpMaster's beta = 1.50,…

A: The value of beta = 1.50 Risk free rate = 2% Market risk premium = 10%

Q: 49) Everything else held constant, an increase in the riskiness of bonds relative to alternative…

A: Equilibrium in the bonds market occurs at the intersection of demand and supply curves of bonds.

Q: Economists argue that bond prices and interest rates are inversely related. On a piece of notebook…

A: Solution:- Given Data: Government offers a $1,000.00 bond, paying 10% interest for a period of 1…

Q: What is the relation between Cash Flow Risk and Interest Rate Risk in the Bond Market? Please…

A: Cash Flow Risk is that the term wont to describe the potential danger of falling short created by…

Q: lculate the value of a stock that is expected to pay a constant dividend of $1.05 per year if the…

A: Given Dividend = 1.05 $ constant rate Required return = 11 %

Q: Stock market bubbles are welfare enhancing since they relax financial constraints and allows…

A: Stock market bubbles would increase the prices of stocks,which would give boost for future…

Step by step

Solved in 2 steps

- After careful analysis, you have determined that a firm’s dividends should grow at 15%, on average, in the foreseeable future. The firm’s last dividend was $1.5. Compute the current price of this stock, assuming the required return is 20%Which bonds are acceptable for investment? Justify your response with suitable computations. 2. What will be the total cost of investment in bonds? 3. Do the stock and bond investments fall within Stephanie’s investment guidelines? Show appropriate computations in support of your response.Carnes Cosmetics Co.'s stock price is $60, and it recently paid a $1.25 dividend. This dividend is expected to grow by 27% for the next 3 years, then grow forever at a constant rate, g; and rs = 14%. At what constant rate is the stock expected to grow after Year 3? Do not round intermediate calculations. Round your answer to two decimal places.

- Calculate the value of a stock that is expected to pay a constant dividend of $1.05per year if the required return is 11%.A company has no preferred stock outstanding and has 15,000,000 common shares outstanding. The company’s Net income is $30,000,000 and it pays a total of $7,500,000 in common dividends. Currently the shares trade for $20 per share. For this company, what is: (Round your answer to two decimal places, if necessary) EPS? $ DPS? $ Dividend yield? % Dividend payout rate? % Retention rate? %You expect KT Industries (KTI) will have earnings per share of $4.6 this year and expect that they will pay out $1.66 of these earnings to shareholders in the form of a dividend. KTI's return on new investments is 11% and their equity cost of capital is 16%. KTI's dividend growth rate is _________ (Round to two decimal places) If KTI's dividend growth rate will remain constant, and KTI's next year dividend is $1.78, then KTI's current stock price should be ________ (Round to two decimal places)

- 9 A program, if implemented, will operate for 10 years for certain. Your best guess is that after year 10 and following each year thereafter there will be a 0.02 probability the program will end. Real net benefits are $25 the first year and are expected to grow 1% per year as long as the program is in operation. Benefits accrue at the end of the year. The real discount rate is 3.5%. What is the NPV of the horizon value of net benefits following year 10, as seen from time 0, the beginning of the first yearAssume that ToolCo's current stock price is $100. If the company has promised a $1.99 annual dividend, what this the predicted stock price in one year according to the rational expectations pricing formula? Assume a discount rate of 6.9% and round your answer to two decimal points while omitting any units (e.g., 1.23 not $1.23).Which of the following is NOT TRUE about security/bond valuation? *a. The valuation concept is only applicable to the most common financial securities, the stocks and bonds.b. There are different methods of analysis in valuing bonds which includes getting it present values of future cash flowsc. Regardless of their differences in attributes, other financial securities have essentially the same valuation concept.d. None of the choices.

- Assume the following information about the market and JumpMaster's stock. JumpMaster's beta = 1.50, the risk free rate 2%, the market risk premium is 10.0%. Using CAPM, what is the expected return for JumpMaster's stock?Give correct typing answer with explanation and conclusion What are the strengths and weaknesses of investment performance of Foreign & Colonial Investment Trust PLC for 2019 to 2021.A stock price is currently $100 and at the end of four months it will be ST . A derivative written on this stock pays off expST1/3 in four months. Given that u = 1.15, d = 0.87, and that the risk-free interest rate is 10% p.a. (continuously compounded), answer the following questions using a one-period binomial model (show all the details of your calculations and display the results with four decimal places): Calculate the value of ∆ Calculate the current value of the derivative.