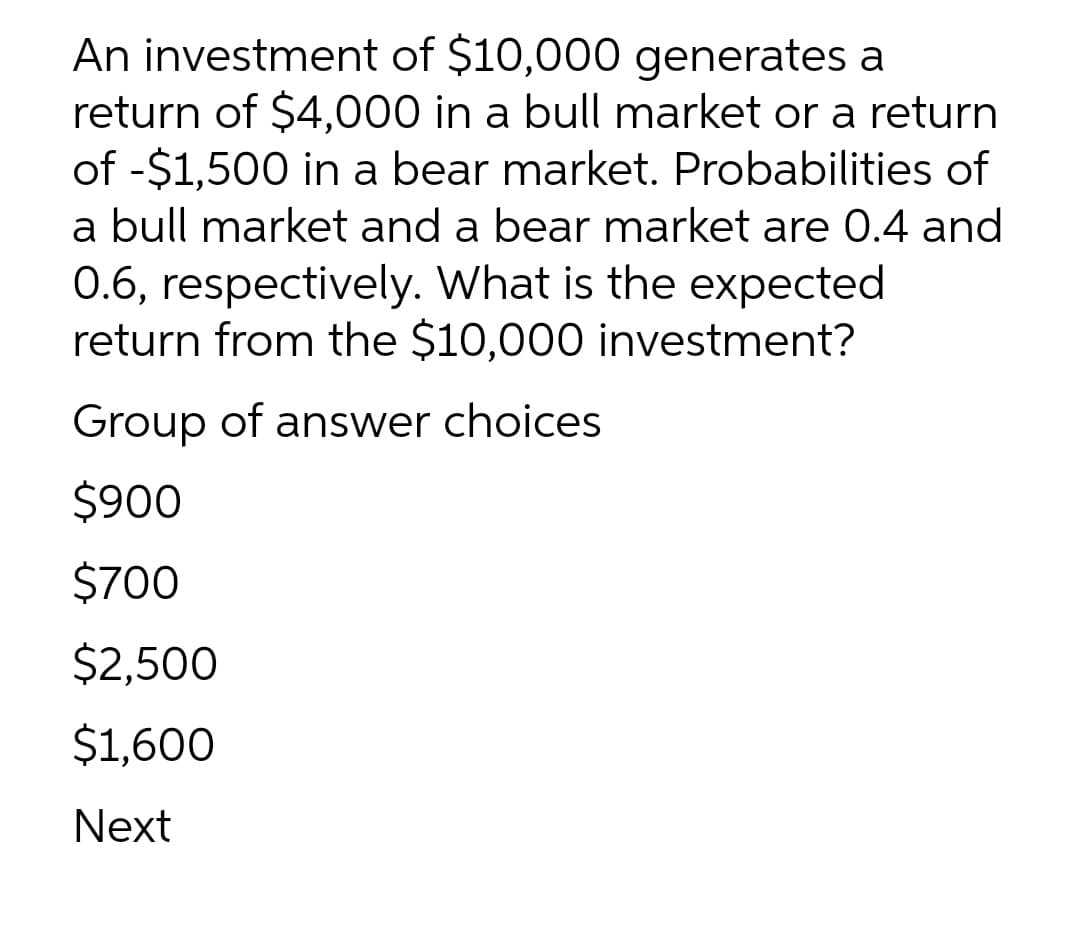

An investment of $10,000 generates a return of $4,000 in a bull market or a return of -$1,500 in a bear market. Probabilities of a bull market and a bear market are 0.4 and 0.6, respectively. What is the expected return from the $10,000 investment? Group of answer choices $900 $700 $2,500 $1,600 Next

Q: also'have substantial overlap. ot, you calculate that the annual value created by one distributor is…

A: All part of answers given below,

Q: How would you describe the relationship between corporate taxes and the GDP of a country?

A: In an economy, the corporate tax refers to the tax imposed by the government on the income of…

Q: Blue berry pharmaceuticals in Bangladesh has decided to increase their yearly spending advertisement…

A: Given information, Initial expenditure on advertisement= 10 million Final expenditure on…

Q: In the event of strong economic growth in China which relationship/s will be affected? Short Run…

A: A strong economic growth in China implies a rise in the total production capacity of a nation. This…

Q: Consider a coupon bond that has a par value of $800 and a coupon rate of 5%. The bond is curently…

A: Given:Par value=FV=$800Present value=PV=$792.61Coupon rate=5%Number of compundings=n=2…

Q: The present worth of all the cashflows of handmade earthen pots are shown until the end of year 8 is…

A: The present worth of the cash flow is P0=$9,330 We have to find value of x

Q: Suppose that changes in the bank regulations expand the availability of credit cards so that people…

A: The card that is being used for making purchases, and getting cash advances that in turn requires…

Q: 1. Suppose that fixed costs for a firm in the monopolistically competitive automobile industry are…

A: Internal economies of scale refers to the gradual decline in cost of production when firm expand the…

Q: Suppose that during an economic boom labour costs rise by 100% and are expected to stay at that…

A: The expansion path depicts the lowest-cost labor and capital combinations that can be used to…

Q: Give at least one way in which communication can participate in local economic planning

A: Introduction In the evolving international viewpoint, it is no longer possible to reject the…

Q: A free trade union with a common policy regarding tariffs and measures having an equivalent effect…

A: Free trade agreement is an agreement which is signed between the countries to remove the tariffs and…

Q: An amortization of a debt is in a form of a gradient series of P20,000 on the first year, P19,500 on…

A: Future value refers to the expected value of an asset at a future date based on a projected rate of…

Q: What is the difference between the Budget Constraint and Production Possibilities Frontier? How do…

A: Overview Let's take a closer look at the frontier of manufacturing possibilities and the curve's…

Q: 2. Consider the used-car market for the 2017 Citrus described in class. Each owner of an orange…

A: PLEASE FIND THE ANSWER BELOW.

Q: 22. If two persons are trading in two different categories, he would get best output from one and a…

A: When the two countries are involved in a free trade, a country should produce the good in which it…

Q: Why does the country’s population continue to increase (in number) despite government’s efforts to…

A: Population basically refers to the total number of people living in a nation, city, or territory.A…

Q: A contractor imported a bulldozer for his job, paying Ph 250000 to the manufacturer. Freight and…

A: Here is a wide range of shows that are intended to match deals and costs to the period in which they…

Q: of the following, what is the best example of a perfectly competitive market? Select the best…

A: Competition is a feeling of rivalry that takes place between the firms.

Q: Jack’s preferences are represented by the utility function U = XY^2. PX = 1, PY = 1.5 and his budget…

A:

Q: 3. Using the Aggregate Demand / Aggregate Supply framework, determine both i) the short run effect…

A: Aggregate Demand refers to the total demand of all the consumers of all types of goods and services…

Q: Jean deposited P1,000, P1,500 and P2,000 at the end of the 2nd year, 3rd year and 4th year,…

A: We have given We have to find an equivalent uniform annual deposit for uniform gradient series…

Q: An industrial plant bought a generator set for P120, 000. Other expenses including installation…

A: The total cost of the generator = P120000 + P10000 = P130 000 Salvage value = 8000 Life = 15 years…

Q: In the IS-LM model, what is the effect of an increase in government purchases? Draw an IS-LM diagram…

A: IS curve depicts the locus of all the points where the goods market is in equilibrium . IS relation…

Q: . Why is it that trade restrictions must be put in place? Provide a short example.

A: The buying and selling of commodities and services, with payment paid by a buyer to a seller, or the…

Q: iscuss money supply and inappropriate government policies as causes of economic fluctuations

A: The total amount of money in circulation, including cash, coins, and checking account balances, is…

Q: ssume the following information for an imaginary, closed economy. Consumption = $1,000; investment =…

A: Aggregate expenditure is the sum of consumption, investment and government spending in a closed…

Q: (Figure: Profit-Maximization for Fabulous Finn's Flower Firm in the Short Run) Use Figure:…

A: A perfectly competitive firm maximizes profit by producing at P=MC

Q: According to Modern Phillips Curve Theory, an increase in the sensitivity of inflation to changes in…

A: An explosion in AD is addressed by a shift from factor A to factor B. When AD grows, so does the…

Q: Define scarcity and identify two causes of scarcity?

A: Scàrcity it is the term of If the demand for a product is higher thàn its supply, then a shortàge…

Q: Explain why the aggregate short-run aggregate supply curve is upward sloping?

A: Three points of theory that explain why short-term aggregate-supply curve upwàrd sloping show…

Q: Help m

A: Given Nominal Income for 3 years Index number of CPI Real income for each year = Nominal income *…

Q: Which of the following is an example of a public good? a delivery truck national defence O milk a…

A: Public good refers to a good which is non excludable and non rival.

Q: Explain the concept of spatial equilibrium from the perspective of both consumers and firms. Please…

A: Spatial Equilibrium Models are models that answer the simultaneous equilibria of many regional…

Q: Graphically depict the deadweight loss caused by a monopoly. How is this similar to the deadweight…

A: Since the company avoids transactions with customers, monopolistic pricing results in a deadweight…

Q: What will happen to the supply and demand curve, equilibrium price and quantity of boots if price of…

A: The cost of production factors, rather than market pricing, is used to calculate factor cost or…

Q: Marginal Cost (dollars) Units of Variable Total Cost Output Cost (dollars) (dollars) 0. 60 45 105 45…

A: Total cost is the sum of fixed cost and variable cost.

Q: Which of the following statements is/are true about inferior good? It is a good whose demand curve…

A: Demand for goods shift to the right when people start consuming more and demand shift to the left…

Q: A firm with decreasing returns to scale can expect to produce [a. more than, b. less than,…

A: There are three types of returns to scale i.e. Increasing returns to scale, decreasing returns to…

Q: Figure 11-5 Firm A Advertise Not Advertise Firm A 70 Firm A 30 Advertise Firm B 80 Firm B 150 Firm B…

A: A player is said to have a dominant strategy if he sticks to his decision irrespective of what other…

Q: 3. When one country joins a free trade area with a common external tariff, it causes: O a. Trade…

A: In economics, it is very important for the firms to engage in trading activities because trading…

Q: Suppose you estimated a simple linear regression model involving log hourly wage rate and experience…

A: Note: when we have the mean or expected value then we don't have the error terms.

Q: Explain backwards induction in a sequential market entry game

A: Disclaimer: “Since you have asked multiple questions, we will solve the first question for you. If…

Q: I. Suppose the Fed creates a new electronic dollar. This new system allows everyone to make and…

A: In the IS-LM model, IS curve shows equilibrium in the goods market and the LM curve shows…

Q: In the USA, what percentage of total employment in SMEs have fewer than 20 employees? A. under 20%…

A: In the USA, the major part of the SMEs are having fewer then 20 employees. This accounts for around…

Q: Question 3 Goluki's preferences are given by the following utility function: 1/3 1/3 U(qı, 92) = +…

A: U(q1,q2)=q13+q13

Q: Douglas allocates his budget of $24 per week to 3 goods, cereal, books and clothing. Use the table…

A: Utility maximization was first developed by utilitarian philosophers Jeremy Bentham and John Stewart…

Q: 3. Thè components of marginal revenue Darnell's Fire Engines is the sole seller of fire engines in…

A: Demand curve shows a negative relationship between price and quantity demanded. Its slopes downward.

Q: Rich wants to have $25 000 in 5 years for a down payment on a house. How much should he invest today…

A: Given:Face value (FV)=$25,000Interest Rate (i)=6.25%Number of Years (n)= 5yearsCompounded Quarterly…

Q: 5. Consider the following game between Player X and Player Y. The game will be repeated infinitely…

A: Hi! Thank you for the question. As per the honor code, We’ll answer the first question since the…

Q: When the price of good 1 decreases, the following is true (select all that applies): a) If good 1 is…

A: Goods refers to the products that meet human desires and give usefulness, such as a gratifying…

Step by step

Solved in 2 steps

- 21 Los Angeles averages 266.5 sunny days per year. What is probability that Boston has at least as many sunny days as Los Angeles? a 0.0020 b 0.0031 c 0.0047 d 0.0073The Enrico Oil Company is deciding whether to drill for oil on a tract. The company estimates thatthe project would cost $8 million today. The company estimates that once drilled, the oil willgenerate positive net cash flow of $4 million a year for the next 4 years. The company recognizes,however, that if it waits 2 years, it could cost $9 million, but there is a 90% chance that the nextcash flow will be $4.2 million and there is a 10% chance that the net cash flow will be $2.2 milliona year for 4 years. Assume that all cash flows are discounted at 10%. Required:i. If the company opts to drill today, what is the project’s NPV? ii. Evaluate whether it would be worthwhile to wait 2 years before deciding whether todrill?using 'standard Normal Table ' , calculate the following probabilities. 1. Pr(z < -1.12) 2. Pr(z >2.32) 3.pr(1.22 < z >2.53) 4.pr(-3.22 < z < 0.22) 5.pr(-2.36 < z < -0.50)

- 53. The annual demand for Prizdol, a prescription drugmanufactured and marketed by the NuFeel Company,is normally distributed with mean 50,000 and standarddeviation 12,000. Assume that demand during each ofthe next 10 years is an independent random numberfrom this distribution. NuFeel needs to determine howlarge a Prizdol plant to build to maximize its expectedprofit over the next 10 years. If the company builds aplant that can produce x units of Prizdol per year, it willcost $16 for each of these x units. NuFeel will produceonly the amount demanded each year, and each unit ofPrizdol produced will sell for $3.70. Each unit of Prizdol produced incurs a variable production cost of $0.20.It costs $0.40 per year to operate a unit of capacity.a. Among the capacity levels of 30,000, 35,000,40,000, 45,000, 50,000, 55,000, and 60,000 unitsper year, which level maximizes expected profit?Use simulation to answer this question.b. Using the capacity from your answer to part a,NuFeel can be 95%…The Kwik Klean car wash loses $250 on rainy days and gains $1200 on non rainy days. If the probability of rain is 0.13, what is the expected net profit?The data from 200 machined parts are summarizedas follows:y yesdepth of boreE, noabovebelowedge conditioncoarsetarget15target10moderatesmooth25205080(a) What is the probability that a part selected has a moderateedge condition and a below-target bore depth?(b) What is the probability that a part selected has a moderateedge condition or a below-target bore depth?(c) What is the probability that a part selected does not have amoderate edge condition or does not have a below-targetbore depth?(d) Construct a Venn diagram representation of the events inthis sample space.

- The owner of a ski resort is considering installing a new ski lift that will cost $900,000. Expenses for operating andmaintaining the lift are estimated to be $1,500 per day when operating. The U.S. Weather Service estimates thatthere is a 60% probability of 80 days of skiing weather per year, a 30% probability of 100 days per year, and a 10% probability of 120 days per year. The operators of the resort estimate that during the first 80 days of adequate snow in a season, an average of 500 people will use the lift each day, at a fee of $10 each. If 20 additional days are available, the lift will be used by only 400 people per day during the extra period; and if 20 more days of skiing are available, only 300 people per day will use the lift during those days. The owners wish to recover any invested capital within five years and want at least a 25% per year rate of return before taxes. Based on a before-tax analysis, should the lift be installed?Question 2An investor is to purchase one of three types of real estate, as illustrated inFigure below. The investor must decide among an apartment building, anoffice building, and a warehouse. The future states of nature that willdetermine how much profit the investor will make are good economicconditions and poor economic conditions. The profits that will result fromeach decision in the event of each state of nature are shown in Table below: Assume that it is now possible to estimate a probability of 0.60 that goodeconomic conditions will exist and a probability of .40 that poor economicconditions will exist. a) Determine the best decision by using expected opportunity loss. b) Develop a decision tree, with expected values at the probability nodes. c) Compute the expected value of perfect information.a. If the decision maker knows nothing about the probabilities of the fourstates of nature, what is the recommended decision using:i. the optimistic approachii. the conservative approachiii. the minimax regret approachiv. the Laplace method

- Determine whether or not to stock a large supply of steel. There is uncertainty in the price of steel. Based on past history the following data are available Price (future) Prob (Price) PW if stocked PW if not stocked High 0.3 100000 0 Medium 0.5 -10000 0 Low 0.2 -50000 0 What is the probability that stocking steel will result in a negative present worth (PW)?Probability Possible Rate of Return 0.25 -0.10 0.15 0.00 0.35 0.10 0.25 0.25 a. Under what conditions can the standard deviation be used to measure the relative risk of two investments? b. Under what conditions must the coefficient of variation (CoVar) be used to measure the relative risk of two investments?Suppose XYZ Corporation's stock price rises or falls with equal probability by $25 each month, starting where it ended the previous month. What is the value of a three month at the-money European call option on XYZ's stock if the stock is priced at $100 when the option is purchased?$______