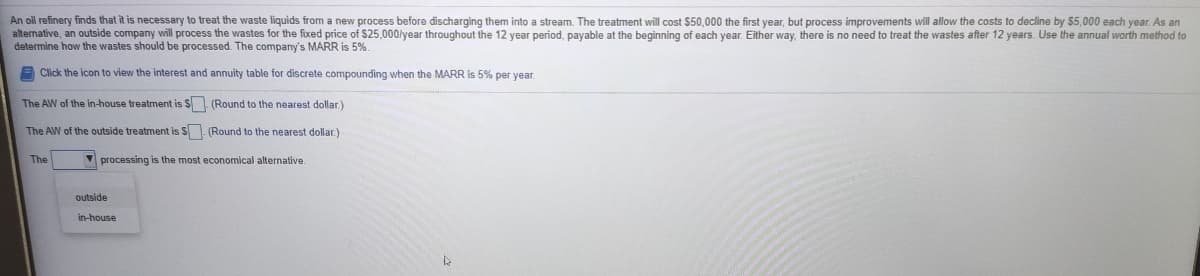

An oil refinery finds that it is necessary to treat the waste liquids from a new process before discharging them into a stream. The treatment will cost $50,000 the first year, but process improvements will allow the costs to decline by 55,000 each year. As an alternative, an outside company will process the wastes for the fixed price of $25,000/year throughout the 12 year period, payable at the beginning of each year. Either way, there is no need to treat the wastes after 12 years. Use the annual worth method to determine how the wastes should be processed. The company's MARR is 5%. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 5% per year. The AW of the in-house treatment is S (Round to the nearest dollar.) The AW of the outside treatment is S (Round to the nearest dollar) The processing is the most economical alternative outside in-house

An oil refinery finds that it is necessary to treat the waste liquids from a new process before discharging them into a stream. The treatment will cost $50,000 the first year, but process improvements will allow the costs to decline by 55,000 each year. As an alternative, an outside company will process the wastes for the fixed price of $25,000/year throughout the 12 year period, payable at the beginning of each year. Either way, there is no need to treat the wastes after 12 years. Use the annual worth method to determine how the wastes should be processed. The company's MARR is 5%. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 5% per year. The AW of the in-house treatment is S (Round to the nearest dollar.) The AW of the outside treatment is S (Round to the nearest dollar) The processing is the most economical alternative outside in-house

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

100%

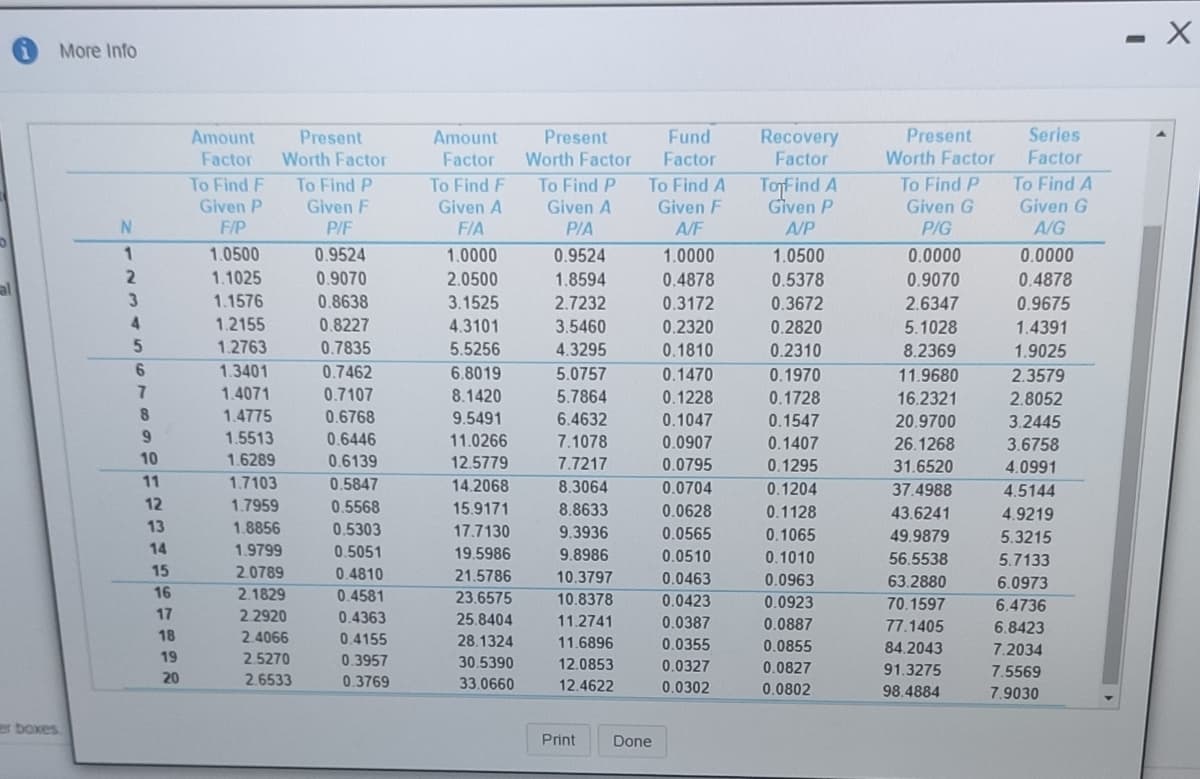

Transcribed Image Text:More Info

Fund

Series

Amount

Factor

Recovery

Factor

Present

Amount

Factor

Present

Worth Factor

Present

Worth Factor

Factor

Worth Factor

Factor

ToFind A

Given P

To Find F

To Find P

Given G

P/G

To Find A

Given G

To Find F

To Find A

Given F

To Find P

To Find P

Given P

Given F

Given A

Given A

F/P

P/F

FIA

PIA

A/F

A/P

A/G

1.0500

0.9524

1.0000

0.9524

1.0000

1.0500

0.0000

0.0000

1.1025

0.9070

2.0500

0.4878

0.3172

1.8594

0.5378

0.9070

0.4878

al

3

1.1576

0.8638

3.1525

2.7232

0.3672

2.6347

0.9675

4.

1.2155

0.8227

4.3101

3.5460

0.2320

0.2820

5.1028

1.4391

1.2763

0.7835

5.5256

4.3295

0.1810

0.2310

8.2369

1.9025

6.

1.3401

0.7462

6.8019

5.0757

0.1470

0.1970

11.9680

2.3579

1.4071

0.7107

8.1420

5.7864

0.1228

0.1728

16.2321

2.8052

8.

1.4775

0.6768

9.5491

6.4632

0.1047

0.1547

20.9700

3.2445

1.5513

0.6446

11.0266

7.1078

0.0907

0.1407

26.1268

3.6758

10

1.6289

0.6139

12.5779

7.7217

0.0795

0.1295

31.6520

4.0991

11

1.7103

0.5847

14.2068

8.3064

0.0704

0.1204

37.4988

4.5144

12

1.7959

0.5568

15.9171

8.8633

0.0628

0.1128

43.6241

4.9219

13

1.8856

0.5303

17.7130

9.3936

0.0565

0.1065

49.9879

5.3215

14

1.9799

0.5051

19.5986

9.8986

0.0510

0.1010

56.5538

5.7133

15

2.0789

0.4810

21.5786

10.3797

0.0463

0.0963

63.2880

6.0973

16

2.1829

0.4581

23.6575

10.8378

0.0423

0.0923

70.1597

6.4736

17

2.2920

0.4363

25.8404

11.2741

0.0387

0.0887

77.1405

6.8423

18

2.4066

0.4155

28.1324

11.6896

0.0355

0.0855

84.2043

7.2034

19

2.5270

0.3957

30.5390

12.0853

0.0827

0.0327

91.3275

7.5569

20

2.6533

0.3769

33.0660

12.4622

0.0302

0.0802

98.4884

7.9030

er boxes

Print

Done

Transcribed Image Text:An oil refinery finds that it is necessary to treat the waste liquids from a new process before discharging them into a stream. The treatment will cost $50,000 the first year, but process improvements will allow the costs to decline by 5,000 each year. As an

alternative, an outside company will process the wastes for the fixed price of $25,000/year throughout the 12 year period, payable at the beginning of each year. Either way, there is no need to treat the wastes after 12 years. Use the annual worth method to

determine how the wastes should be processed. The company's MARR is 5%.

E Click the icon to view the interest and annuity table for discrete compounding when the MARR is 5% per vear.

The AW of the in-house treatment is $ (Round to the nearest dollar.)

The AW of the outside treatment is S. (Round to the nearest dollar)

The

V processing is the most economical alternative.

outside

in-house

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education