Analysis Component: The gross profit realized on the sale of Product W506 during February 2020 was 36.16%. The selling price was $148 during both February and March. Calculate the gross profit ratio for Product W506 for March 2020 and determine whether the change is favoral or unfavorable from February. (Round your Intermedlate calculations and final answer to 2 decimal pleces.) Gross profit ratio

Analysis Component: The gross profit realized on the sale of Product W506 during February 2020 was 36.16%. The selling price was $148 during both February and March. Calculate the gross profit ratio for Product W506 for March 2020 and determine whether the change is favoral or unfavorable from February. (Round your Intermedlate calculations and final answer to 2 decimal pleces.) Gross profit ratio

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 2MC: Moore Company uses the LIFO cost flow assumption and carries Product A in inventory on December 31,...

Related questions

Question

Only 4b thanks!

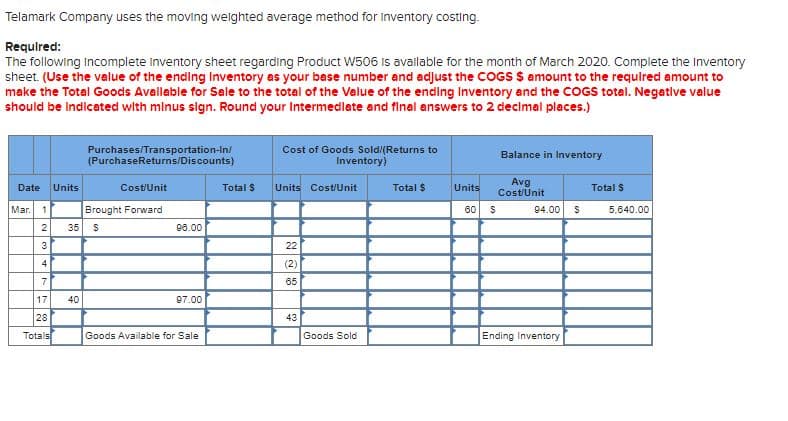

Transcribed Image Text:Telamark Company uses the moving welghted average method for Inventory costing.

Required:

The following Incomplete inventory sheet regarding Product W506 Is avallable for the month of March 2020. Complete the Inventory

sheet. (Use the value of the ending Inventory as your base number and adjust the COGS $ amount to the required amount to

make the Total Goods Avallable for Sale to the total of the Value of the ending Inventory and the COGS total. Negative value

should be indicated with minus sign. Round your Intermedilate and final answers to 2 decimal places.)

Purchases/Transportation-In/

(PurchaseReturns/Discounts)

Cost of Goods Sold/(Returns to

Inventory)

Balance in Inventory

Avg

Cost/Unit

Date

Units

Cost/Unit

Total S

Units Cost/Unit

Total $

Units

Total S

Mar. 1

Brought Forward

5.640.00

60

94.00

2

35

96.00

3

22

4

(2)

7

65

17

40

97.00

28

43

Totals

Ending Inventory

Goods Available for Sale

Goods Sold

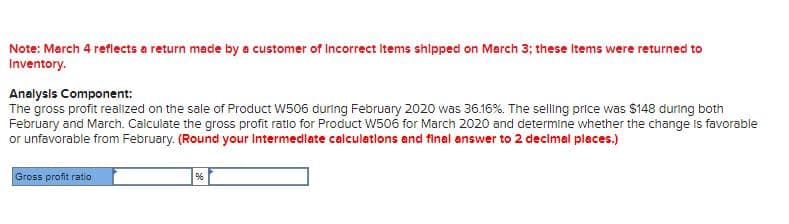

Transcribed Image Text:Note: March 4 reflects a return made by a customer of Incorrect items shipped on March 3; these items were returned to

Inventory.

Analysis Component:

The gross profit realized on the sale of Product W506 during February 2020 was 36.16%. The selling price was $148 during both

February and March. Calculate the gross profit ratio for Product W506 for March 2020 and determine whether the change Is favorable

or unfavorable from February. (Round your Intermedlate calculations and final answer to 2 decimal places.)

Gross profit ratio

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning