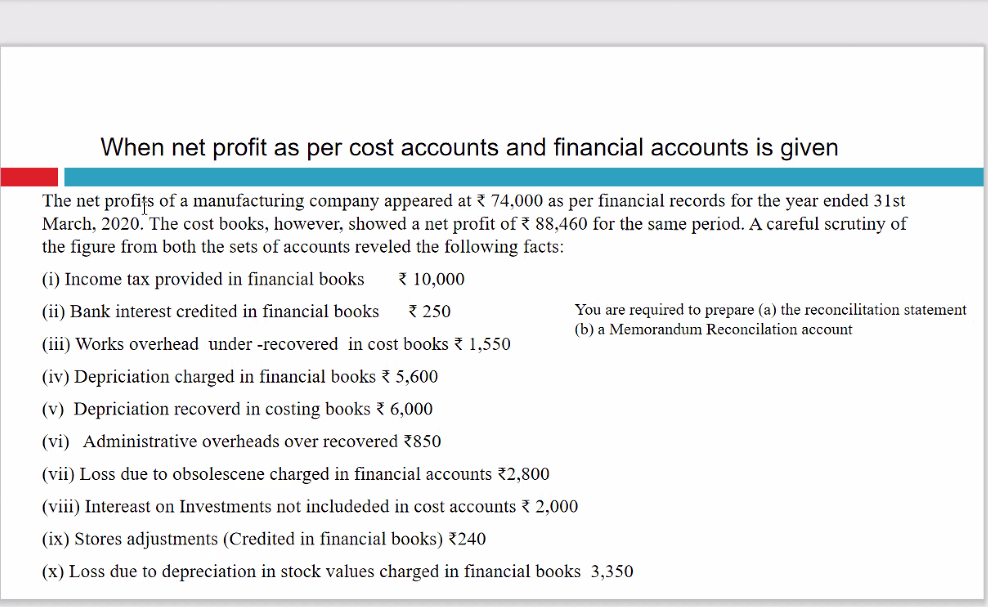

When net profit as per cost accounts and financial accounts is given The net profițs of a manufacturing company appeared at ? 74,000 as per financial records for the year ended 31st March, 2020. The cost books, however, showed a net profit of 88,460 for the same period. A careful scrutiny of the figure from both the sets of accounts reveled the following facts: (i) Income tax provided in financial books 3 10,000 3 250 You are required to prepare (a) the reconcilitation statement (b) a Memorandum Reconcilation account (ii) Bank interest credited in financial books (iii) Works overhead under -recovered in cost books { 1,550 (iv) Depriciation charged in financial books { 5,600 (v) Depriciation recoverd in costing books 6,000 (vi) Administrative overheads over recovered 7850 (vii) Loss due to obsolescene charged in financial accounts 2,800 (viii) Intereast on Investments not includeded in cost accounts { 2,000 (ix) Stores adjustments (Credited in financial books) 3240 (x) Loss due to depreciation in stock values charged in financial books 3,350

When net profit as per cost accounts and financial accounts is given The net profițs of a manufacturing company appeared at ? 74,000 as per financial records for the year ended 31st March, 2020. The cost books, however, showed a net profit of 88,460 for the same period. A careful scrutiny of the figure from both the sets of accounts reveled the following facts: (i) Income tax provided in financial books 3 10,000 3 250 You are required to prepare (a) the reconcilitation statement (b) a Memorandum Reconcilation account (ii) Bank interest credited in financial books (iii) Works overhead under -recovered in cost books { 1,550 (iv) Depriciation charged in financial books { 5,600 (v) Depriciation recoverd in costing books 6,000 (vi) Administrative overheads over recovered 7850 (vii) Loss due to obsolescene charged in financial accounts 2,800 (viii) Intereast on Investments not includeded in cost accounts { 2,000 (ix) Stores adjustments (Credited in financial books) 3240 (x) Loss due to depreciation in stock values charged in financial books 3,350

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 5P: Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of...

Related questions

Question

Transcribed Image Text:When net profit as per cost accounts and financial accounts is given

The net profițs of a manufacturing company appeared at 74,000 as per financial records for the year ended 31st

March, 2020. The cost books, however, showed a net profit of 88,460 for the same period. A careful scrutiny of

the figure from both the sets of accounts reveled the following facts:

(i) Income tax provided in financial books

{ 10,000

{ 250

You are required to prepare (a) the reconcilitation statement

(b) a Memorandum Reconcilation account

(ii) Bank interest credited in financial books

(iii) Works overhead under -recovered in cost books { 1,550

(iv) Depriciation charged in financial books { 5,600

(v) Depriciation recoverd in costing books { 6,000

(vi) Administrative overheads over recovered 7850

(vii) Loss due to obsolescene charged in financial accounts 32,800

(viii) Intereast on Investments not includeded in cost accounts { 2,000

(ix) Stores adjustments (Credited in financial books) 3240

(x) Loss due to depreciation in stock values charged in financial books 3,350

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning