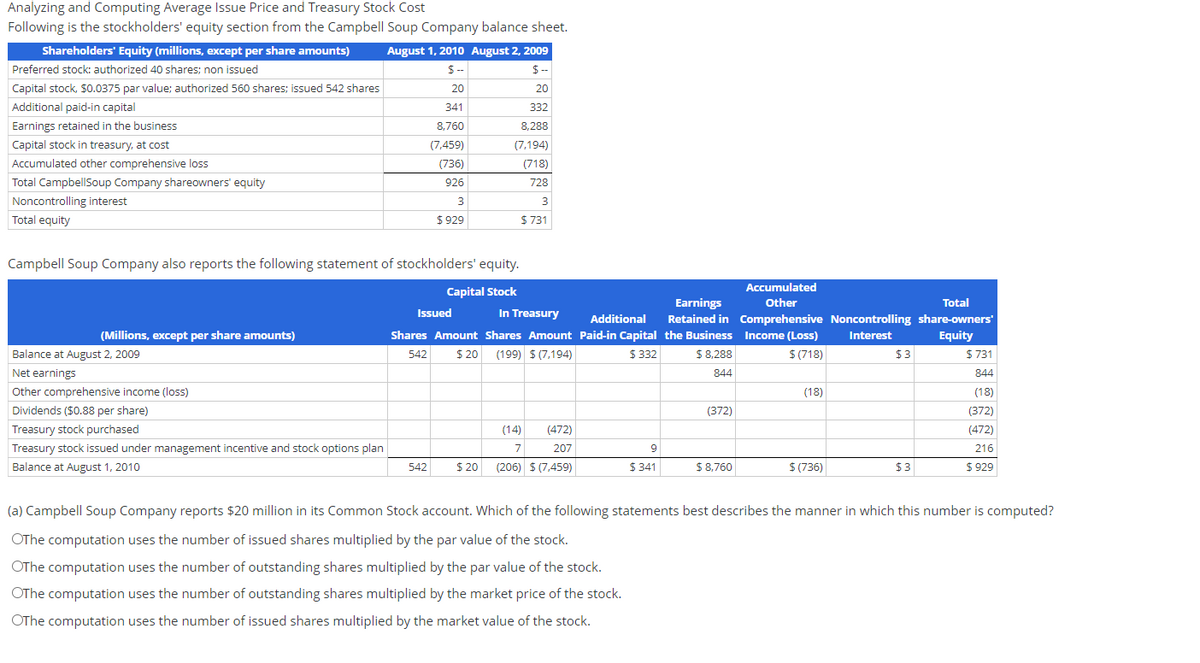

Analyzing and Computing Average Issue Price and Treasury Stock Cost Following is the stockholders' equity section from the Campbell Soup Company balance sheet. Shareholders' Equity (millions, except per share amounts) Preferred stock: authorized 40 shares: non issued Capital stock, $0.0375 par value: authorized 560 shares: issued 542 shares Additional paid-in capital Earnings retained in the business Capital stock in treasury, at cost Accumulated other comprehensive loss Total CampbellSoup Company shareowners' equity Noncontrolling interest Total equity (Millions, except per share amounts) Balance at August 2, 2009 Net earnings Other comprehensive income (loss) Dividends ($0.88 per share) Treasury stock purchased August 1, 2010 August 2, 2009 S- S- 20 341 8,760 (7,459) (736) 926 Treasury stock issued under management incentive and stock options plan Balance at August 1, 2010 Campbell Soup Company also reports the following statement of stockholders' equity. Capital Stock Earnings In Treasury Additional Retained in Shares Amount Shares Amount Paid-in Capital the Business 542 $20 (199) $ (7,194) $ 332 $8,288 844 3 $929 Issued 542 20 332 8,288 (7.194) (718) 728 3 $731 (14) 7 (472) 207 $20 (206) $ (7,459) 9 $ 341 (372) $8,760 Total Accumulated Other Comprehensive Noncontrolling share-owners Income (Loss) Interest Equity $(718) (18) $(736) $3 $3 $731 844 (18) (372) (472) 216 $929 (a) Campbell Soup Company reports $20 million in its Common Stock account. Which of the following statements best describes the manner in which this number is computed? OThe computation uses the number of issued shares multiplied by the par value of the stock. OThe computation uses the number of outstanding shares multiplied by the par value of the stock. OThe computation uses the number of outstanding shares multiplied by the market price of the stock. OThe computation uses the number of issued shares multiplied by the market value of the stock.

Analyzing and Computing Average Issue Price and Treasury Stock Cost Following is the stockholders' equity section from the Campbell Soup Company balance sheet. Shareholders' Equity (millions, except per share amounts) Preferred stock: authorized 40 shares: non issued Capital stock, $0.0375 par value: authorized 560 shares: issued 542 shares Additional paid-in capital Earnings retained in the business Capital stock in treasury, at cost Accumulated other comprehensive loss Total CampbellSoup Company shareowners' equity Noncontrolling interest Total equity (Millions, except per share amounts) Balance at August 2, 2009 Net earnings Other comprehensive income (loss) Dividends ($0.88 per share) Treasury stock purchased August 1, 2010 August 2, 2009 S- S- 20 341 8,760 (7,459) (736) 926 Treasury stock issued under management incentive and stock options plan Balance at August 1, 2010 Campbell Soup Company also reports the following statement of stockholders' equity. Capital Stock Earnings In Treasury Additional Retained in Shares Amount Shares Amount Paid-in Capital the Business 542 $20 (199) $ (7,194) $ 332 $8,288 844 3 $929 Issued 542 20 332 8,288 (7.194) (718) 728 3 $731 (14) 7 (472) 207 $20 (206) $ (7,459) 9 $ 341 (372) $8,760 Total Accumulated Other Comprehensive Noncontrolling share-owners Income (Loss) Interest Equity $(718) (18) $(736) $3 $3 $731 844 (18) (372) (472) 216 $929 (a) Campbell Soup Company reports $20 million in its Common Stock account. Which of the following statements best describes the manner in which this number is computed? OThe computation uses the number of issued shares multiplied by the par value of the stock. OThe computation uses the number of outstanding shares multiplied by the par value of the stock. OThe computation uses the number of outstanding shares multiplied by the market price of the stock. OThe computation uses the number of issued shares multiplied by the market value of the stock.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 57E: Outstanding Stock Lars Corporation shows the following information in the stockholders equity...

Related questions

Question

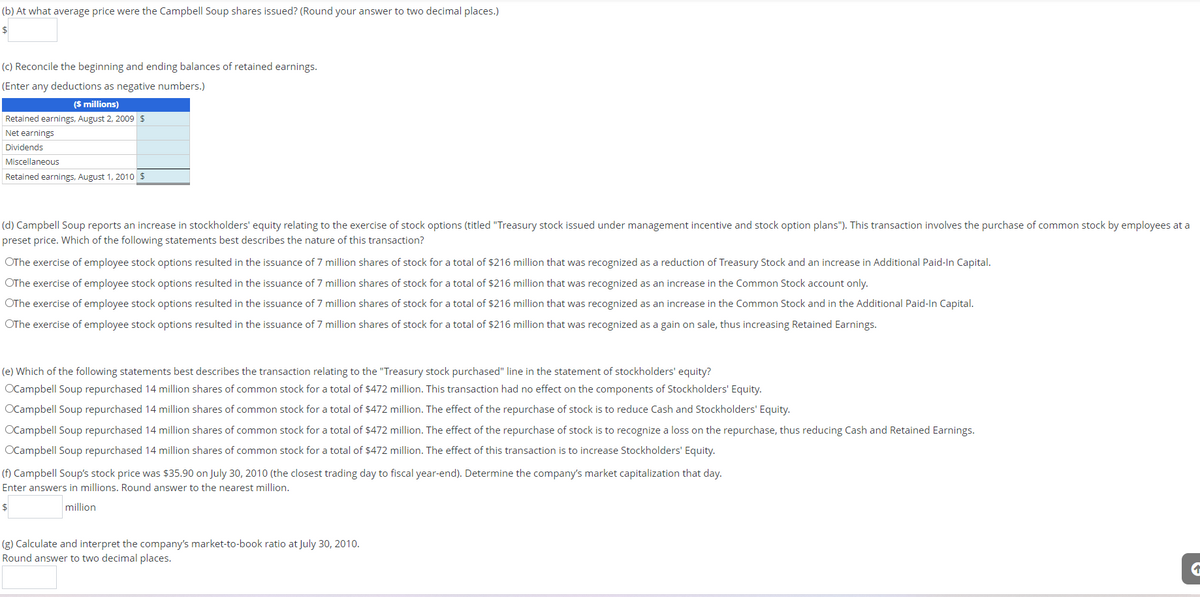

Transcribed Image Text:(b) At what average price were the Campbell Soup shares issued? (Round your answer to two decimal places.)

$

(c) Reconcile the beginning and ending balances of retained earnings.

(Enter any deductions as negative numbers.)

($ millions)

Retained earnings, August 2, 2009 $

Net earnings

Dividends

Miscellaneous

Retained earnings, August 1, 2010 $

(d) Campbell Soup reports an increase in stockholders' equity relating to the exercise of stock options (titled "Treasury stock issued under management incentive and stock option plans"). This transaction involves the purchase of common stock by employees at a

preset price. Which of the following statements best describes the nature of this transaction?

OThe exercise of employee stock options resulted in the issuance of 7 million shares of stock for a total of $216 million that was recognized as a reduction of Treasury Stock and an increase in Additional Paid-In Capital.

OThe exercise of employee stock options resulted in the issuance of 7 million shares of stock for a total of $216 million that was recognized as an increase in the Common Stock account only.

OThe exercise of employee stock options resulted in the issuance of 7 million shares of stock for a total of $216 million that was recognized as an increase in the Common Stock and in the Additional Paid-In Capital.

OThe exercise of employee stock options resulted in the issuance of 7 million shares of stock for a total of $216 million that was recognized as a gain on sale, thus increasing Retained Earnings.

(e) Which of the following statements best describes the transaction relating to the "Treasury stock purchased" line in the statement of stockholders' equity?

OCampbell Soup repurchased 14 million shares of common stock for a total of $472 million. This transaction had no effect on the components of Stockholders' Equity.

OCampbell Soup repurchased 14 million shares of common stock for a total of $472 million. The effect of the repurchase of stock is to reduce Cash and Stockholders' Equity.

OCampbell Soup repurchased 14 million shares of common stock for a total of $472 million. The effect of the repurchase of stock is to recognize a loss on the repurchase, thus reducing Cash and Retained Earnings.

OCampbell Soup repurchased 14 million shares of common stock for a total of $472 million. The effect of this transaction is to increase Stockholders' Equity.

(f) Campbell Soup's stock price was $35.90 on July 30, 2010 (the closest trading day to fiscal year-end). Determine the company's market capitalization that day.

Enter answers in millions. Round answer to the nearest million.

$

million

(g) Calculate and interpret the company's market-to-book ratio at July 30, 2010.

Round answer to two decimal places.

Transcribed Image Text:Analyzing and Computing Average Issue Price and Treasury Stock Cost

Following is the stockholders' equity section from the Campbell Soup Company balance sheet.

Shareholders' Equity (millions, except per share amounts)

Preferred stock: authorized 40 shares; non issued

Capital stock, $0.0375 par value; authorized 560 shares; issued 542 shares

Additional paid-in capital

Earnings retained in the business

Capital stock in treasury, at cost

Accumulated other comprehensive loss

Total CampbellSoup Company shareowners' equity

Noncontrolling interest

Total equity

(Millions, except per share amounts)

Campbell Soup Company also reports the following statement of stockholders' equity.

Capital Stock

Earnings

In Treasury

Additional Retained in

Shares Amount Shares Amount Paid-in Capital the Business

542 $20 (199) $(7,194)

$ 332 $8,288

844

Balance at August 2, 2009

Net earnings

Other comprehensive income (loss)

Dividends ($0.88 per share)

August 1, 2010 August 2, 2009

$--

$--

20

20

341

332

8,760

(7,459)

(736)

926

3

$ 929

Treasury stock purchased

Treasury stock issued under management incentive and stock options plan

Balance at August 1, 2010

Issued

8,288

(7,194)

(718)

728

3

$ 731

542

(14) (472)

7 207

$20 (206) $ (7,459)

9

$341

(372)

$8,760

Total

Accumulated

Other

Comprehensive Noncontrolling share-owners'

Income (Loss) Interest

Equity

$ (718)

$ 731

844

(18)

(372)

(472)

216

$ 929

(18)

$ (736)

$3

$3

(a) Campbell Soup Company reports $20 million in its Common Stock account. Which of the following statements best describes the manner in which this number is computed?

OThe computation uses the number of issued shares multiplied by the par value of the stock.

OThe computation uses the number of outstanding shares multiplied by the par value of the stock.

OThe computation uses the number of outstanding shares multiplied by the market price of the stock.

OThe computation uses the number of issued shares multiplied by the market value of the stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Please answer G part with explanation. Answer was incoorect in previous solution

Solution

Follow-up Question

Please provide me the solution with explanation of d,e,f and G

Solution

Follow-up Question

Please provide the explanation of part a and Part b

Solution

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning