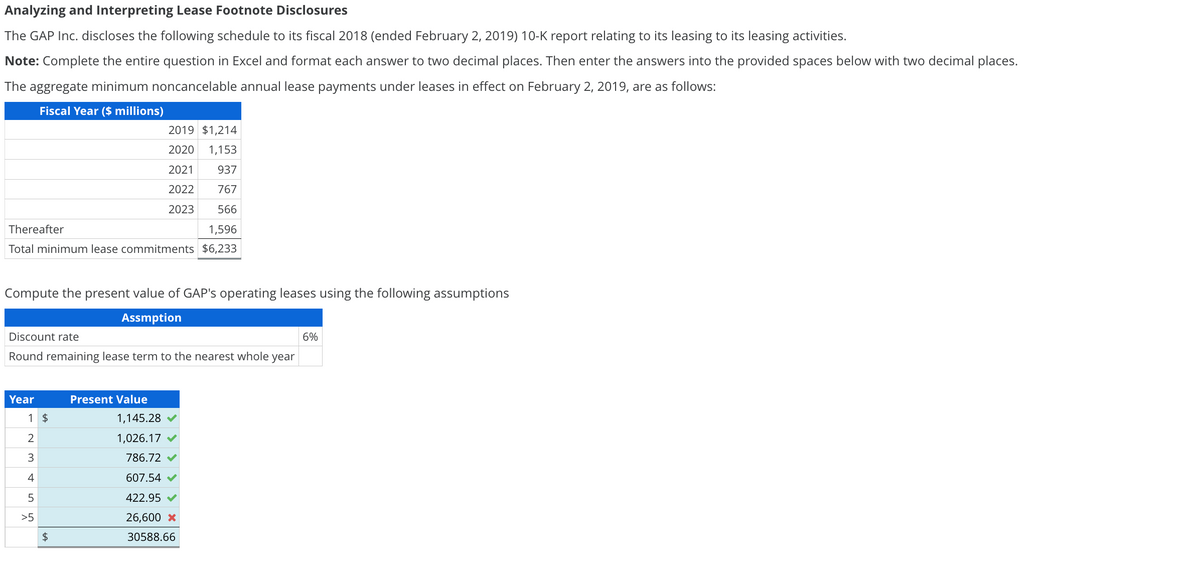

Analyzing and Interpreting Lease Footnote Disclosures The GAP Inc. discloses the following schedule to its fiscal 2018 (ended February 2, 2019) 10-K report relating to its leasing to its leasing activities. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. The aggregate minimum noncancelable annual lease payments under leases in effect on February 2, 2019, are as follows: Fiscal Year ($ millions) 2019 $1,214 2020 1,153 2021 937 2022 767 2023 566 Thereafter 1,596 Total minimum lease commitments $6,233 Compute the present value of GAP's operating leases using the following assumptions Assmption Discount rate Round remaining lease term to the nearest whole year 6%

Analyzing and Interpreting Lease Footnote Disclosures The GAP Inc. discloses the following schedule to its fiscal 2018 (ended February 2, 2019) 10-K report relating to its leasing to its leasing activities. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. The aggregate minimum noncancelable annual lease payments under leases in effect on February 2, 2019, are as follows: Fiscal Year ($ millions) 2019 $1,214 2020 1,153 2021 937 2022 767 2023 566 Thereafter 1,596 Total minimum lease commitments $6,233 Compute the present value of GAP's operating leases using the following assumptions Assmption Discount rate Round remaining lease term to the nearest whole year 6%

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 6E: Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on...

Related questions

Question

4

Transcribed Image Text:Analyzing and Interpreting Lease Footnote Disclosures

The GAP Inc. discloses the following schedule to its fiscal 2018 (ended February 2, 2019) 10-K report relating to its leasing to its leasing activities.

Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places.

The aggregate minimum noncancelable annual lease payments under leases in effect on February 2, 2019, are as follows:

Fiscal Year ($ millions)

Thereafter

1,596

Total minimum lease commitments $6,233

Compute the present value of GAP's operating leases using the following assumptions

Assmption

Discount rate

Round remaining lease term to the nearest whole year

Year

1 $

234

55

>5

2019 $1,214

2020 1,153

2021 937

2022

767

2023

566

$

AA

Present Value

1,145.28

1,026.17

786.72

607.54

422.95

26,600 *

30588.66

6%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

This is wrong.....>2023 is not 19870.07. Please try again. The rest is right.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning