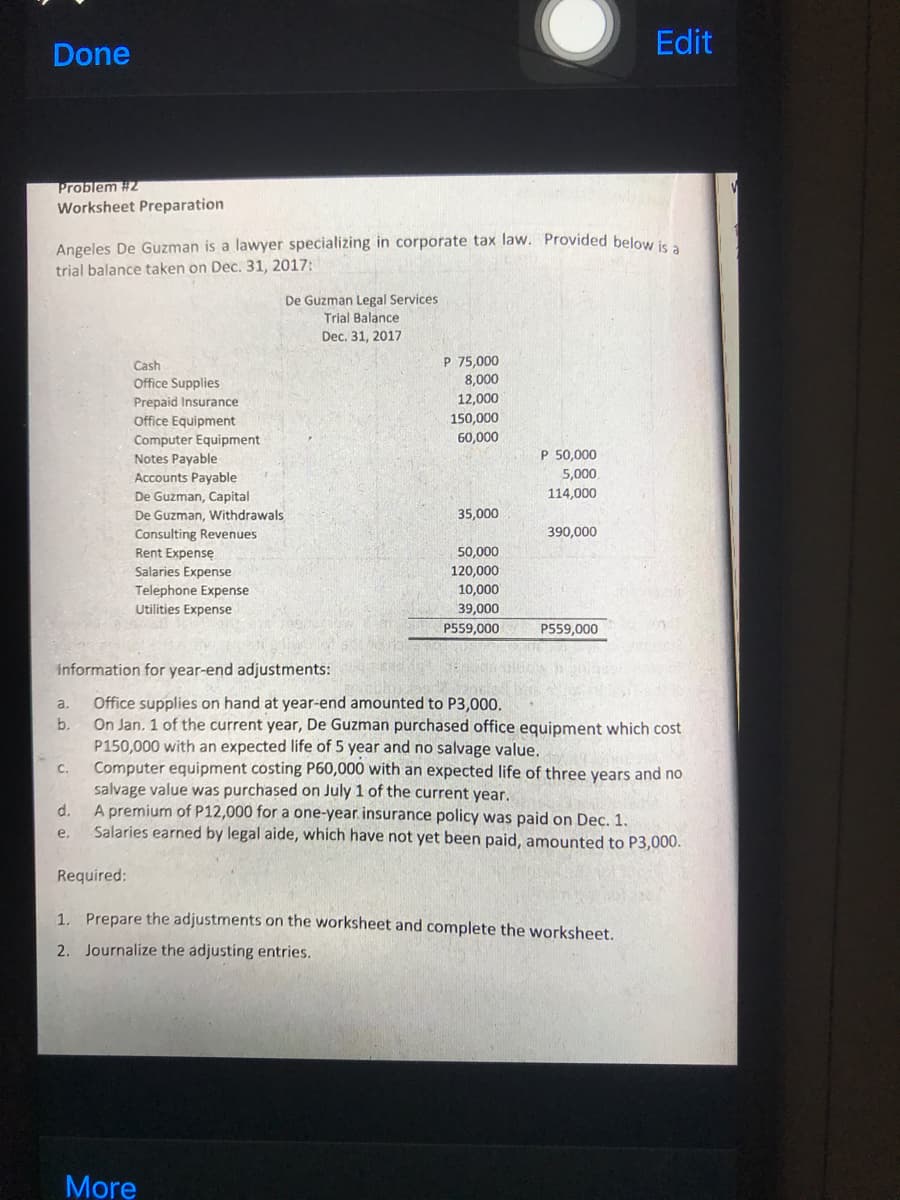

Angeles De Guzman is a lawyer specializing in corporate tax law. Provided below isa trial balance taken on Dec. 31, 2017: De Guzman Legal Services Trial Balance Dec. 31, 2017 P 75,000 8,000 Cash Office Supplies Prepaid Insurance Office Equipment 12,000 150,000 60,000 Computer Equipment Notes Payable Accounts Payable P 50,000 5,000 114,000 De Guzman, Capital De Guzman, Withdrawals 35,000 390,000 Consulting Revenues Rent Expensę Salaries Expense 50,000 120,000 Telephone Expense 10,000 Utilities Expense 39,000 P559,000 P559,000 information for year-end adjustments: Office supplies on hand at year-end amounted to P3,000. On Jan. 1 of the current year, De Guzman purchased office equipment which cost P150,000 with an expected life of 5 year and no salvage value. Computer equipment costing P60,000 with an expected life of three years and no salvage value was purchased on July 1 of the current year. A premium of P12,000 for a one-year. insurance policy was paid on Dec. 1. Salaries earned by legal aide, which have not yet been paid, amounted to P3,000. a. b. C. d. e. Required: 1. Prepare the adjustments on the worksheet and complete the worksheet. 2. Journalize the adjusting entries.

Angeles De Guzman is a lawyer specializing in corporate tax law. Provided below isa trial balance taken on Dec. 31, 2017: De Guzman Legal Services Trial Balance Dec. 31, 2017 P 75,000 8,000 Cash Office Supplies Prepaid Insurance Office Equipment 12,000 150,000 60,000 Computer Equipment Notes Payable Accounts Payable P 50,000 5,000 114,000 De Guzman, Capital De Guzman, Withdrawals 35,000 390,000 Consulting Revenues Rent Expensę Salaries Expense 50,000 120,000 Telephone Expense 10,000 Utilities Expense 39,000 P559,000 P559,000 information for year-end adjustments: Office supplies on hand at year-end amounted to P3,000. On Jan. 1 of the current year, De Guzman purchased office equipment which cost P150,000 with an expected life of 5 year and no salvage value. Computer equipment costing P60,000 with an expected life of three years and no salvage value was purchased on July 1 of the current year. A premium of P12,000 for a one-year. insurance policy was paid on Dec. 1. Salaries earned by legal aide, which have not yet been paid, amounted to P3,000. a. b. C. d. e. Required: 1. Prepare the adjustments on the worksheet and complete the worksheet. 2. Journalize the adjusting entries.

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 2RP

Related questions

Question

100%

Transcribed Image Text:Edit

Done

Problem #2

Worksheet Preparation

Angeles De Guzman is a lawyer specializing in corporate tax law. Provided below i

trial balance taken on Dec. 31, 2017:

De Guzman Legal Services

Trial Balance

Dec. 31, 2017

Cash

Office Supplies

P 75,000

8,000

12,000

Prepaid Insurance

Office Equipment

150,000

60,000

Computer Equipment

Notes Payable

Accounts Payable

P 50,000

5,000.

De Guzman, Capital

114,000

De Guzman, Withdrawals

Consulting Revenues

Rent Expense

35,000

390,000

50,000

Salaries Expense

Telephone Expense

120,000

10,000

39,000

Utilities Expense

P559,000

P559,000

information for year-end adjustments:

Office supplies on hand at year-end amounted to P3,000,

On Jan. 1 of the current year, De Guzman purchased office equipment which cost

P150,000 with an expected life of 5 year and no salvage value.

Computer equipment costing P60,000 with an expected life of three years and no

salvage value was purchased on July 1 of the current year.

A premium of P12,000 for a one-year insurance policy was paid on Dec. 1.

Salaries earned by legal aide, which have not yet been paid, amounted to P3,000.

a.

b.

C.

d.

е.

Required:

1.

Prepare the adjustments on the worksheet and complete the worksheet.

2. Journalize the adjusting entries.

More

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage